Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work :) Homework 3 Ch 6,7,8 Problem 7-3 The Altoona Company issued a 25-year bond 5 years ago with a face value

Please show your work :)

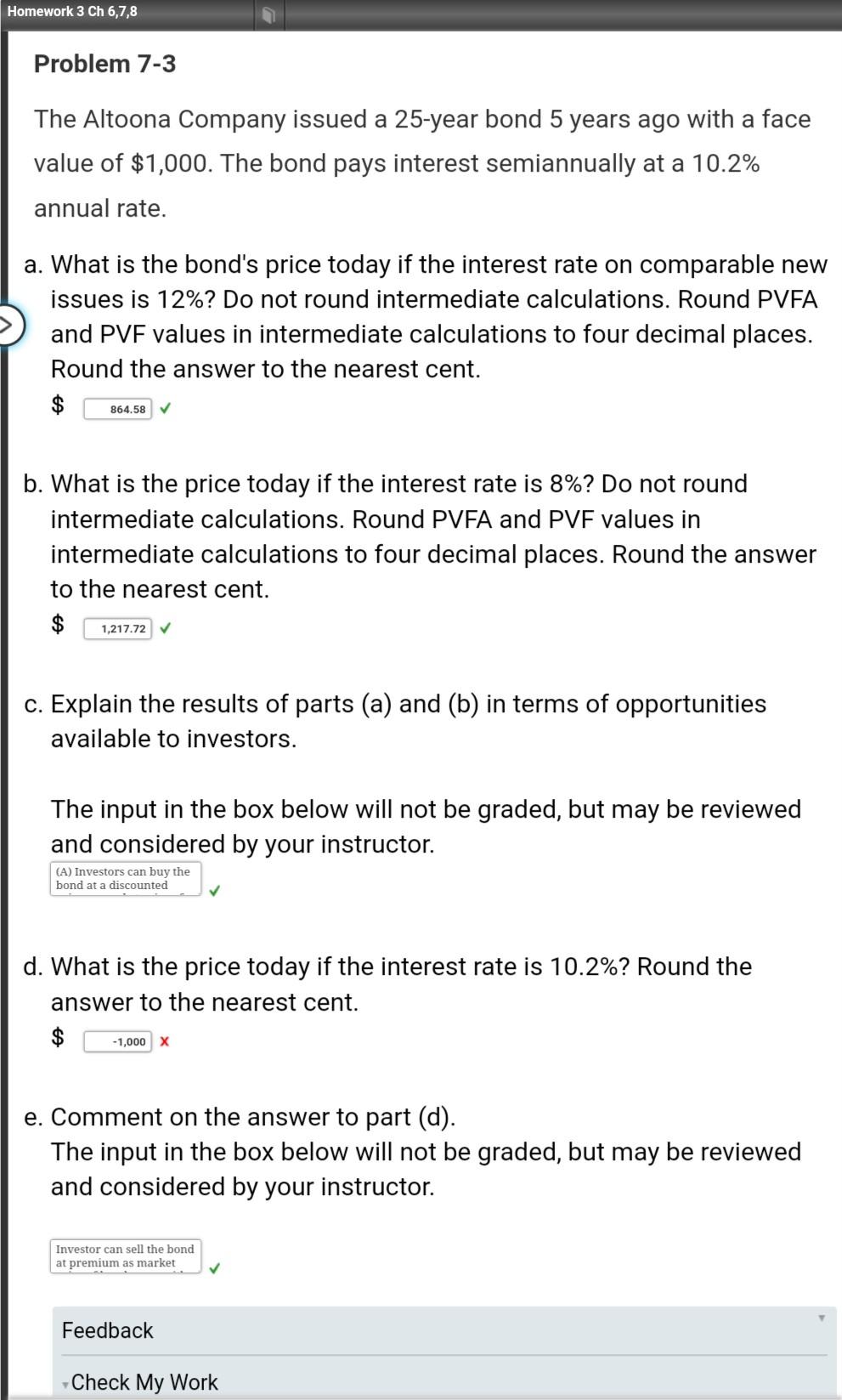

Homework 3 Ch 6,7,8 Problem 7-3 The Altoona Company issued a 25-year bond 5 years ago with a face value of $1,000. The bond pays interest semiannually at a 10.2% annual rate. a. What is the bond's price today if the interest rate on comparable new issues is 12%? Do not round intermediate calculations. Round PVFA and PVF values in intermediate calculations to four decimal places. Round the answer to the nearest cent. $ 864.58 b. What is the price today if the interest rate is 8%? Do not round intermediate calculations. Round PVFA and PVF values in intermediate calculations to four decimal places. Round the answer to the nearest cent. $ 1,217.72 c. Explain the results of parts (a) and (b) in terms of opportunities available to investors. The input in the box below will not be graded, but may be reviewed and considered by your instructor. (A) Investors can buy the bond at a discounted d. What is the price today if the interest rate is 10.2%? Round the answer to the nearest cent. -1,000 X e. Comment on the answer to part (d). The input in the box below will not be graded, but may be reviewed and considered by your instructor. Investor can sell the bond at premium as market Feedback Check My Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started