****Please show your work in excel. I will upvote! Thank you!!!!********

****Please show your work in excel. I will upvote! Thank you!!!!********

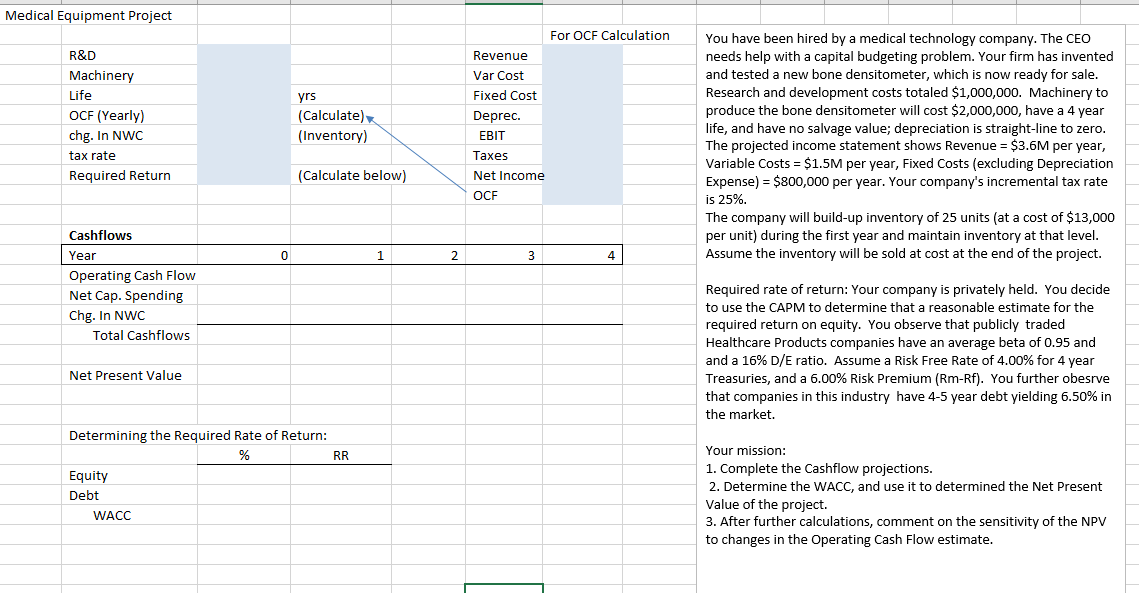

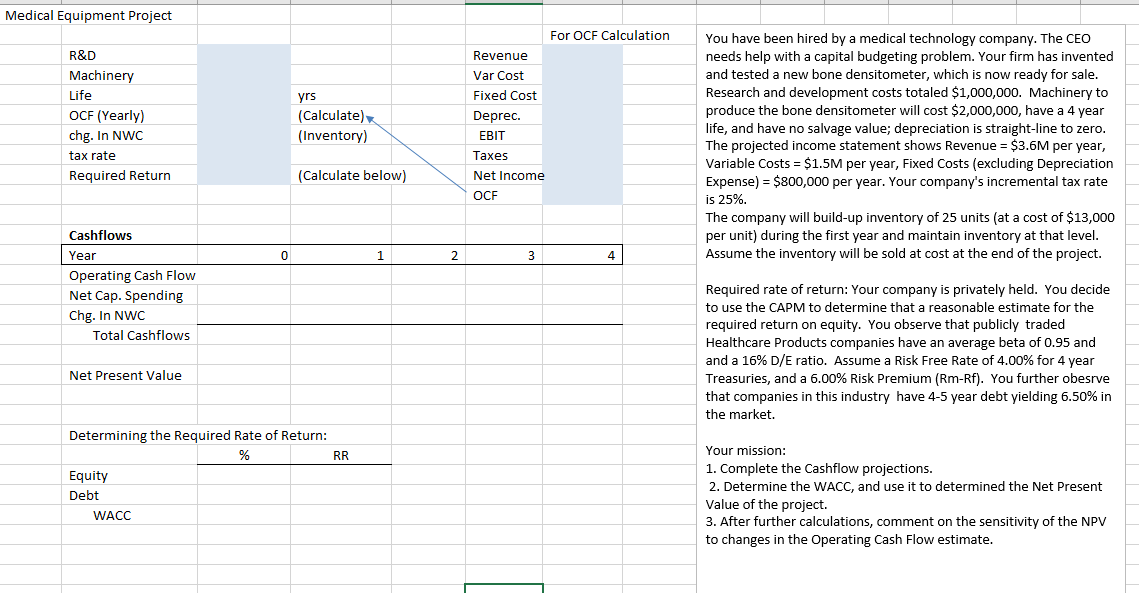

You have been hired by a medical technology company. The CEO needs help with a capital budgeting problem. Your firm has invented and tested a new bone densitometer, which is now ready for sale. Research and development costs totaled $1,000,000. Machinery to produce the bone densitometer will cost $2,000,000, have a 4 year life, and have no salvage value; depreciation is straight-line to zero. The projected income statement shows Revenue =$3.6M per year, Variable Costs =$1.5M per year, Fixed Costs (excluding Depreciation Expense )=$800,000 per year. Your company's incremental tax rate is 25%. The company will build-up inventory of 25 units (at a cost of $13,000 per unit) during the first year and maintain inventory at that level. Assume the inventory will be sold at cost at the end of the project. Required rate of return: Your company is privately held. You decide to use the CAPM to determine that a reasonable estimate for the required return on equity. You observe that publicly traded Healthcare Products companies have an average beta of 0.95 and and a 16% D/E ratio. Assume a Risk Free Rate of 4.00% for 4 year Treasuries, and a 6.00% Risk Premium (Rm-Rf). You further obesrve that companies in this industry have 4-5 year debt yielding 6.50% in the market. Your mission: 1. Complete the Cashflow projections. 2. Determine the WACC, and use it to determined the Net Present Value of the project. 3. After further calculations, comment on the sensitivity of the NPV to changes in the Operating Cash Flow estimate. You have been hired by a medical technology company. The CEO needs help with a capital budgeting problem. Your firm has invented and tested a new bone densitometer, which is now ready for sale. Research and development costs totaled $1,000,000. Machinery to produce the bone densitometer will cost $2,000,000, have a 4 year life, and have no salvage value; depreciation is straight-line to zero. The projected income statement shows Revenue =$3.6M per year, Variable Costs =$1.5M per year, Fixed Costs (excluding Depreciation Expense )=$800,000 per year. Your company's incremental tax rate is 25%. The company will build-up inventory of 25 units (at a cost of $13,000 per unit) during the first year and maintain inventory at that level. Assume the inventory will be sold at cost at the end of the project. Required rate of return: Your company is privately held. You decide to use the CAPM to determine that a reasonable estimate for the required return on equity. You observe that publicly traded Healthcare Products companies have an average beta of 0.95 and and a 16% D/E ratio. Assume a Risk Free Rate of 4.00% for 4 year Treasuries, and a 6.00% Risk Premium (Rm-Rf). You further obesrve that companies in this industry have 4-5 year debt yielding 6.50% in the market. Your mission: 1. Complete the Cashflow projections. 2. Determine the WACC, and use it to determined the Net Present Value of the project. 3. After further calculations, comment on the sensitivity of the NPV to changes in the Operating Cash Flow estimate

****Please show your work in excel. I will upvote! Thank you!!!!********

****Please show your work in excel. I will upvote! Thank you!!!!********