Please show your work in Microsoft Excel.

Below is a sample problem for reference.

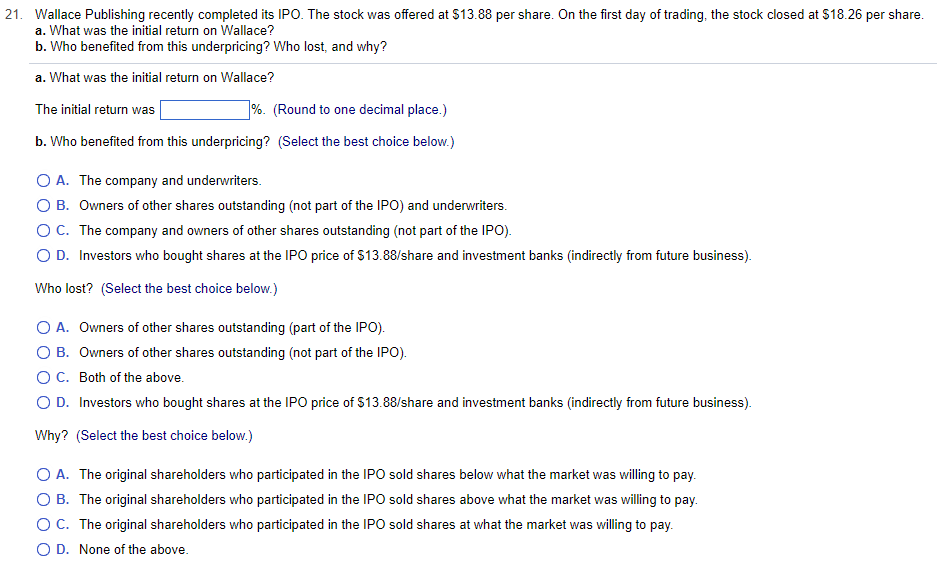

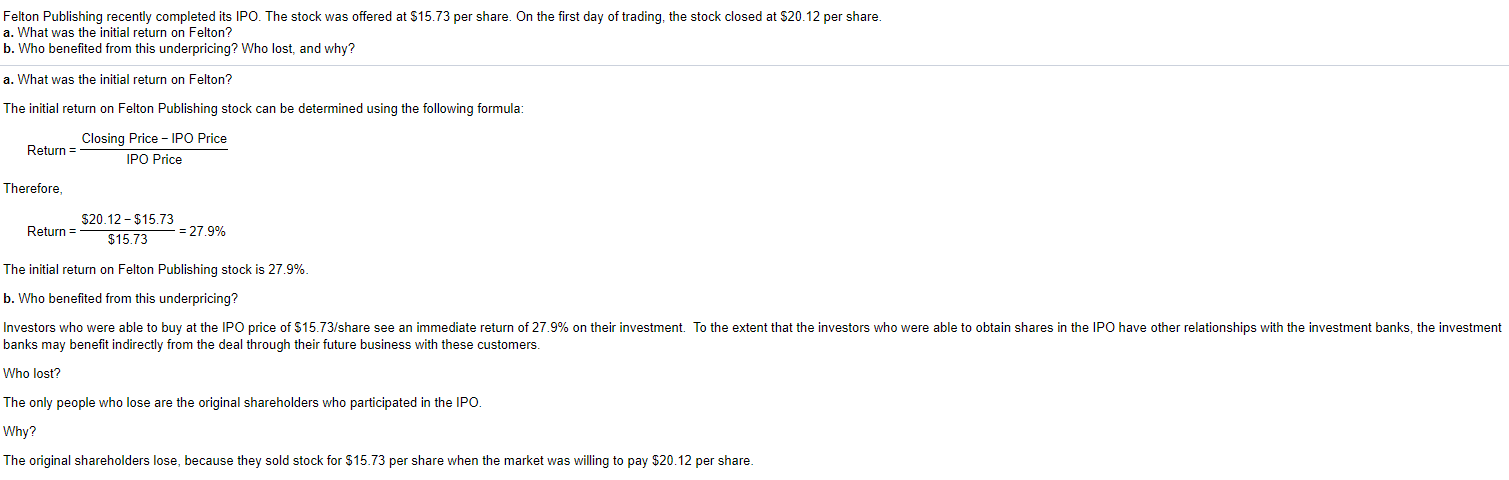

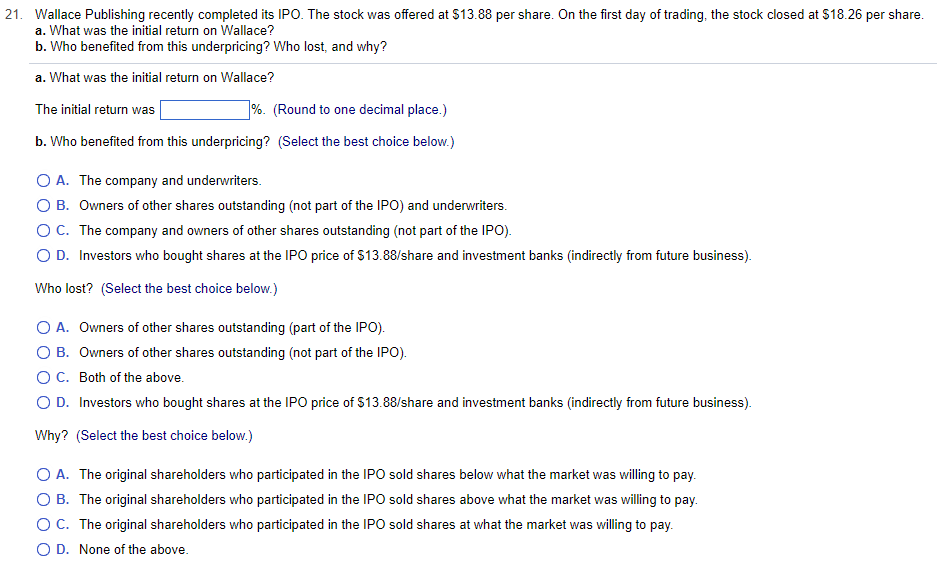

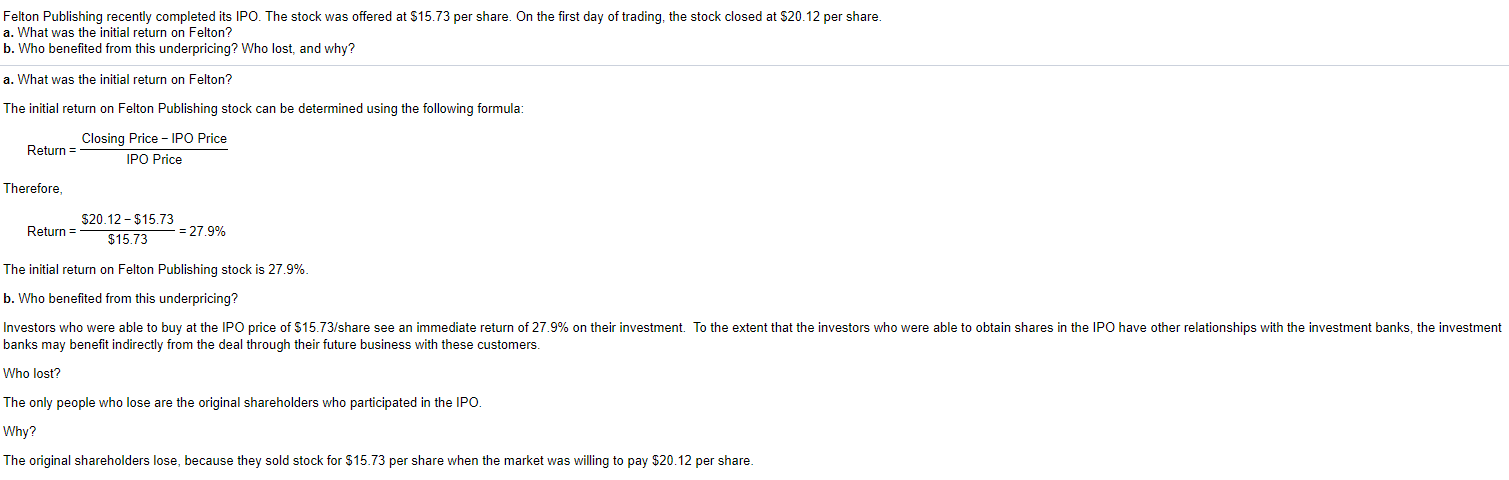

1. Wallace Publishing recently completed its IPO. The stock was offered at $13.88 per share. On the first day of trading, the stock closed at $18.26 per share. a. What was the initial return on Wallace? b. Who benefited from this underpricing? Who lost, and why? a. What was the initial return on Wallace? The initial return was \%. (Round to one decimal place.) b. Who benefited from this underpricing? (Select the best choice below.) A. The company and underwriters. B. Owners of other shares outstanding (not part of the IPO) and underwriters. C. The company and owners of other shares outstanding (not part of the IPO). D. Investors who bought shares at the IPO price of $13.88 /share and investment banks (indirectly from future business). Who lost? (Select the best choice below.) A. Owners of other shares outstanding (part of the IPO). B. Owners of other shares outstanding (not part of the IPO). C. Both of the above. D. Investors who bought shares at the IPO price of $13.88 /share and investment banks (indirectly from future business). Why? (Select the best choice below.) A. The original shareholders who participated in the IPO sold shares below what the market was willing to pay. B. The original shareholders who participated in the IPO sold shares above what the market was willing to pay. C. The original shareholders who participated in the IPO sold shares at what the market was willing to pay. D. None of the above. Felton Publishing recently completed its IPO. The stock was offered at $15.73 per share. On the first day of trading, the stock closed at $20.12 per share. a. What was the initial return on Felton? b. Who benefited from this underpricing? Who lost, and why? a. What was the initial return on Felton? The initial return on Felton Publishing stock can be determined using the following formula: Return=IPOPriceClosingPriceIPOPrice Therefore, Return=$15.73$20.12$15.73=27.9% The initial return on Felton Publishing stock is 27.9%. b. Who benefited from this underpricing? banks may benefit indirectly from the deal through their future business with these customers. Who lost? The only people who lose are the original shareholders who participated in the IPO. Why? The original shareholders lose, because they sold stock for $15.73 per share when the market was willing to pay $20.12 per share