Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work so I can understand how you got the answer and give you a thumbs up! Thank you. 9 Dinklage Corp. has

Please show your work so I can understand how you got the answer and give you a thumbs up! Thank you.

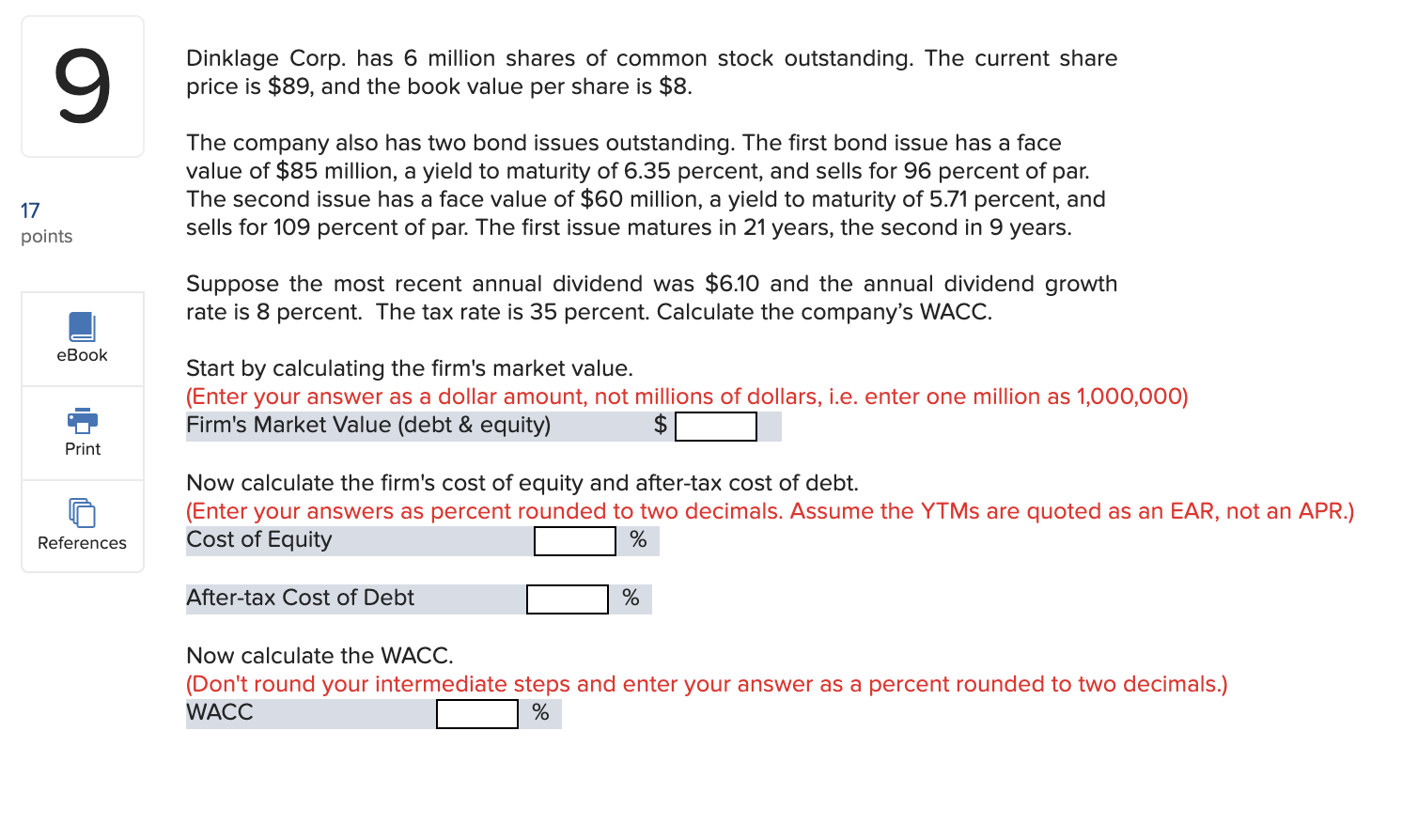

9 Dinklage Corp. has 6 million shares of common stock outstanding. The current share price is $89, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $85 million, a yield to maturity of 6.35 percent, and sells for 96 percent of par. The second issue has a face value of $60 million, a yield to maturity of 5.71 percent, and sells for 109 percent of par. The first issue matures in 21 years, the second in 9 years. 17 points Suppose the most recent annual dividend was $6.10 and the annual dividend growth rate is 8 percent. The tax rate is 35 percent. Calculate the company's WACC. eBook Start by calculating the firm's market value. (Enter your answer as a dollar amount, not millions of dollars, i.e. enter one million as 1,000,000) Firm's Market Value (debt & equity) $ Print Now calculate the firm's cost of equity and after-tax cost of debt. (Enter your answers as percent rounded to two decimals. Assume the YTMs are quoted as an EAR, not an APR.) Cost of Equity % References After-tax Cost of Debt % Now calculate the WACC. (Don't round your intermediate steps and enter your answer as a percent rounded to two decimals.) WACC %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started