Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work step by step or when using the financial calculator Thanks in advance 0 0 2. A property is purchased for $15

Please show your work step by step or when using the financial calculator

Thanks in advance

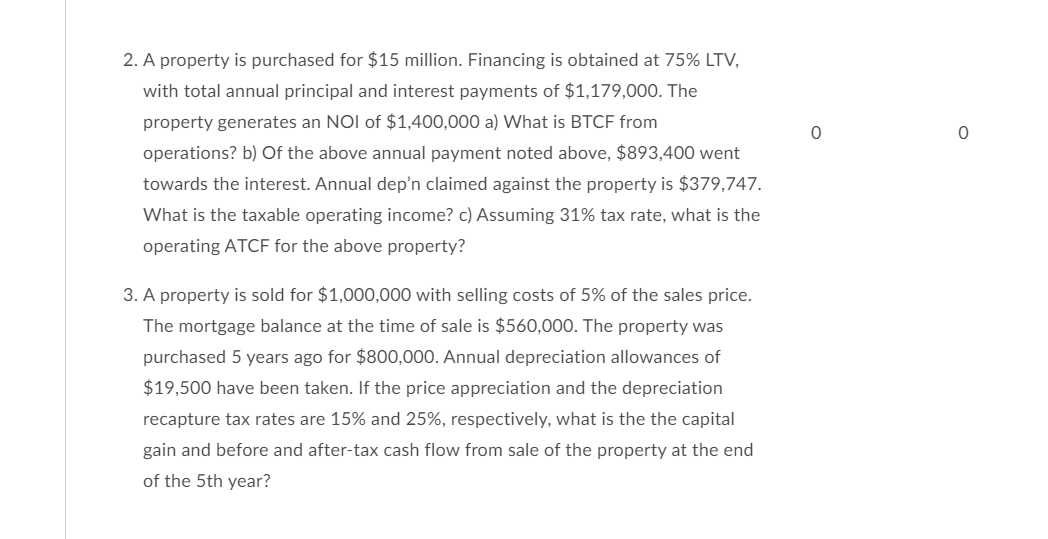

0 0 2. A property is purchased for $15 million. Financing is obtained at 75% LTV, with total annual principal and interest payments of $1,179,000. The property generates an NOI of $1,400,000 a) What is BTCF from operations? b) of the above annual payment noted above, $893,400 went towards the interest. Annual dep'n claimed against the property is $379,747. What is the taxable operating income? c) Assuming 31% tax rate, what is the operating ATCF for the above property? 3. A property is sold for $1,000,000 with selling costs of 5% of the sales price. The mortgage balance at the time of sale is $560,000. The property was purchased 5 years ago for $800,000. Annual depreciation allowances of $19,500 have been taken. If the price appreciation and the depreciation recapture tax rates are 15% and 25%, respectively, what is the the capital gain and before and after-tax cash flow from sale of the property at the end of the 5th year? 0 0 2. A property is purchased for $15 million. Financing is obtained at 75% LTV, with total annual principal and interest payments of $1,179,000. The property generates an NOI of $1,400,000 a) What is BTCF from operations? b) of the above annual payment noted above, $893,400 went towards the interest. Annual dep'n claimed against the property is $379,747. What is the taxable operating income? c) Assuming 31% tax rate, what is the operating ATCF for the above property? 3. A property is sold for $1,000,000 with selling costs of 5% of the sales price. The mortgage balance at the time of sale is $560,000. The property was purchased 5 years ago for $800,000. Annual depreciation allowances of $19,500 have been taken. If the price appreciation and the depreciation recapture tax rates are 15% and 25%, respectively, what is the the capital gain and before and after-tax cash flow from sale of the property at the end of the 5th yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started