Answered step by step

Verified Expert Solution

Question

1 Approved Answer

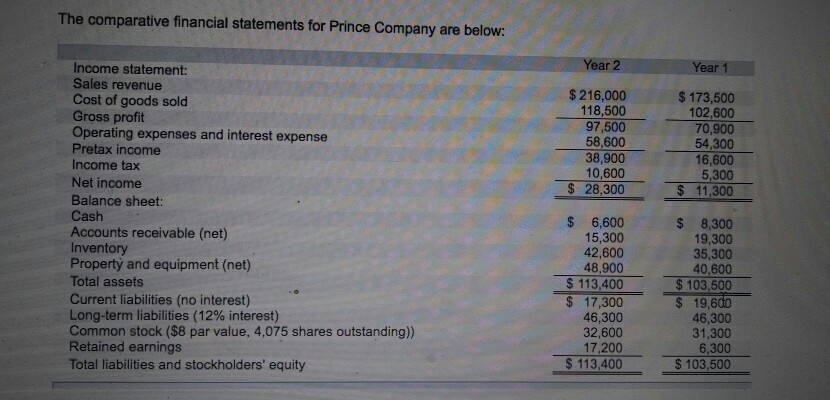

please show your workings The comparative financial statements for Prince Company are below: ear 2 Year 1 Income statement Sales revenue Cost of goods sold

please show your workings

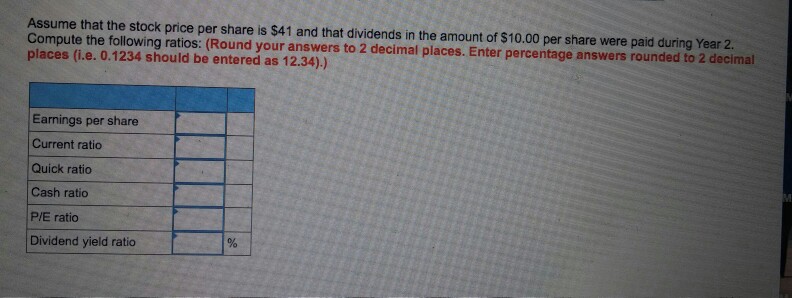

The comparative financial statements for Prince Company are below: ear 2 Year 1 Income statement Sales revenue Cost of goods sold Gross profit Operating expenses and interest expense Pretax income Income tax Net income Balance sheet Cash Accounts receivable (net) Inventory Propert and equipment (net) Total assets Current liabilities (no interest) Long-term liabilities (12% interest) Common stock ($8 par value, 4,075 shares outstanding)) Retained earnings Total liabilities and stockholders' equity $216,000 118,500 97,500 58,600 38,900 10,600 $ 173,500 102,600 70,900 54,300 16,600 5,300 20.900 S 11,300 $ 6,600 15,300 42,600 48,900 $ 8,300 19,300 35,300 40,600 $ 17,300 46,300 32,600 17 200 S 19,600 46,300 31,300 6,300 $ 113,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started