Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your works :> On May 1, 2020, Wilson Company signed an agreement to lease a piece of equipment for 7 years from Reid

Please show your works :>

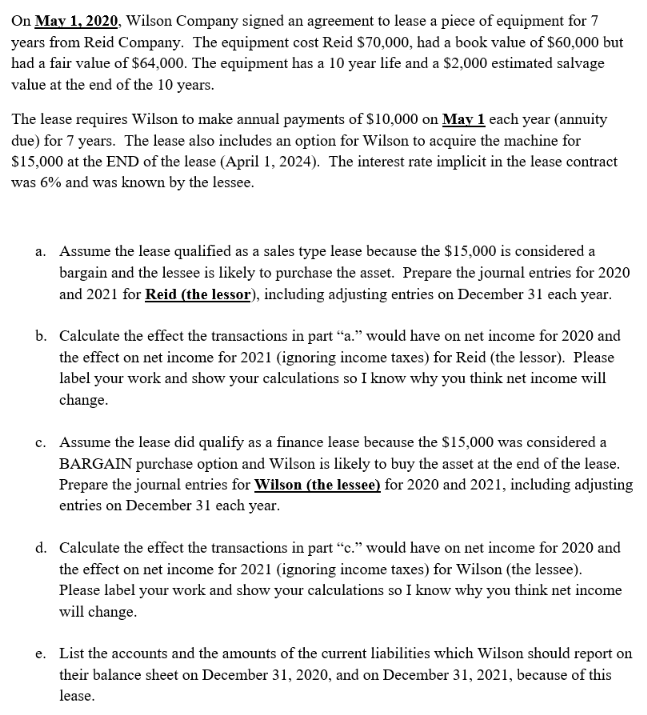

On May 1, 2020, Wilson Company signed an agreement to lease a piece of equipment for 7 years from Reid Company. The equipment cost Reid $70,000, had a book value of $60,000 but had a fair value of $64,000. The equipment has a 10 year life and a $2,000 estimated salvage value at the end of the 10 years. The lease requires Wilson to make annual payments of $10,000 on May 1 each year (annuity due) for 7 years. The lease also includes an option for Wilson to acquire the machine for $15,000 at the END of the lease (April 1, 2024). The interest rate implicit in the lease contract was 6% and was known by the lessee. a. Assume the lease qualified as a sales type lease because the $15,000 is considered a bargain and the lessee is likely to purchase the asset. Prepare the journal entries for 2020 and 2021 for Reid (the lessor), including adjusting entries on December 31 each year. b. Calculate the effect the transactions in part a. would have on net income for 2020 and the effect on net income for 2021 (ignoring income taxes) for Reid (the lessor). Please label your work and show your calculations so I know why you think net income will change. C. Assume the lease did qualify as a finance lease because the $15,000 was considered a BARGAIN purchase option and Wilson is likely to buy the asset at the end of the lease. Prepare the journal entries for Wilson (the lessee) for 2020 and 2021, including adjusting entries on December 31 each year. d. Calculate the effect the transactions in part c. would have on net income for 2020 and the effect on net income for 2021 (ignoring income taxes) for Wilson (the lessee). Please label your work and show your calculations so I know why you think net income will change. e. List the accounts and the amounts of the current liabilities which Wilson should report on their balance sheet on December 31, 2020, and on December 31, 2021, because of this lease. On May 1, 2020, Wilson Company signed an agreement to lease a piece of equipment for 7 years from Reid Company. The equipment cost Reid $70,000, had a book value of $60,000 but had a fair value of $64,000. The equipment has a 10 year life and a $2,000 estimated salvage value at the end of the 10 years. The lease requires Wilson to make annual payments of $10,000 on May 1 each year (annuity due) for 7 years. The lease also includes an option for Wilson to acquire the machine for $15,000 at the END of the lease (April 1, 2024). The interest rate implicit in the lease contract was 6% and was known by the lessee. a. Assume the lease qualified as a sales type lease because the $15,000 is considered a bargain and the lessee is likely to purchase the asset. Prepare the journal entries for 2020 and 2021 for Reid (the lessor), including adjusting entries on December 31 each year. b. Calculate the effect the transactions in part a. would have on net income for 2020 and the effect on net income for 2021 (ignoring income taxes) for Reid (the lessor). Please label your work and show your calculations so I know why you think net income will change. C. Assume the lease did qualify as a finance lease because the $15,000 was considered a BARGAIN purchase option and Wilson is likely to buy the asset at the end of the lease. Prepare the journal entries for Wilson (the lessee) for 2020 and 2021, including adjusting entries on December 31 each year. d. Calculate the effect the transactions in part c. would have on net income for 2020 and the effect on net income for 2021 (ignoring income taxes) for Wilson (the lessee). Please label your work and show your calculations so I know why you think net income will change. e. List the accounts and the amounts of the current liabilities which Wilson should report on their balance sheet on December 31, 2020, and on December 31, 2021, because of this leaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started