please showball required solutions.

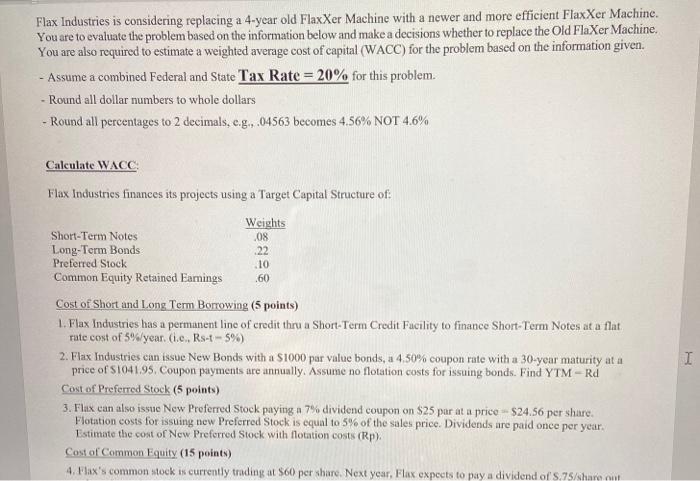

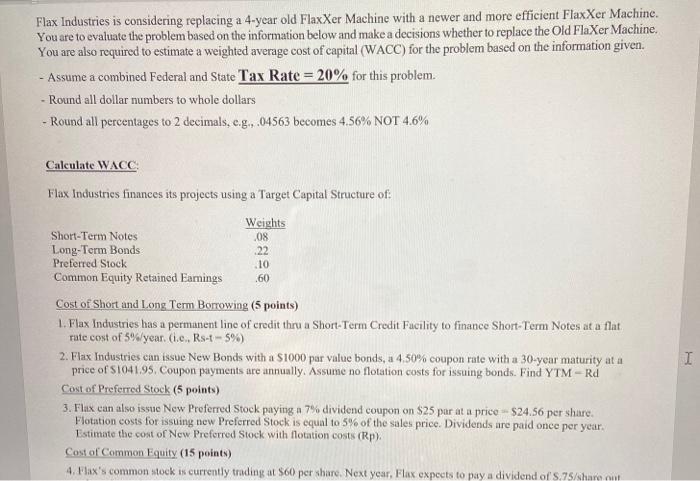

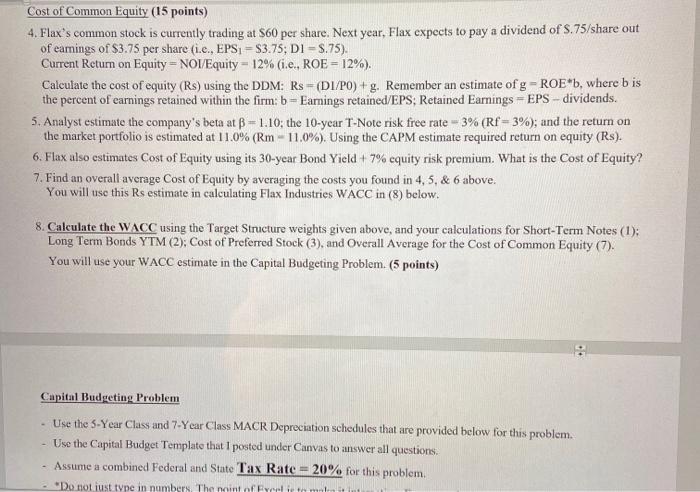

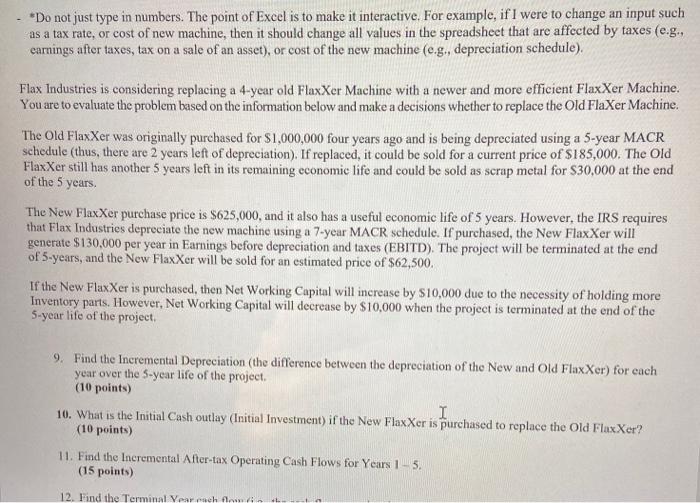

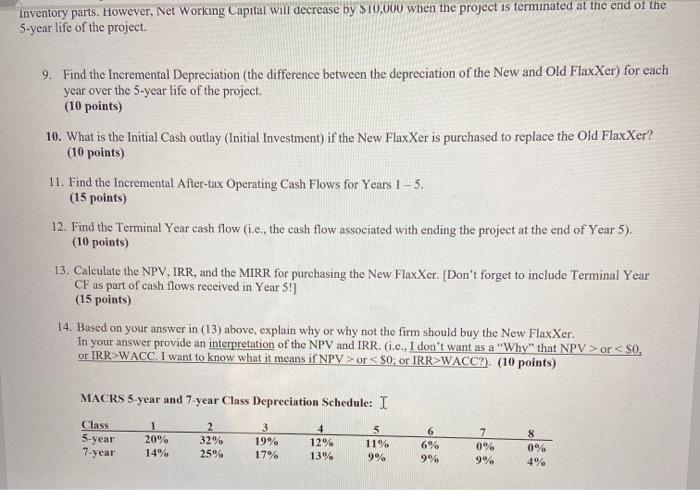

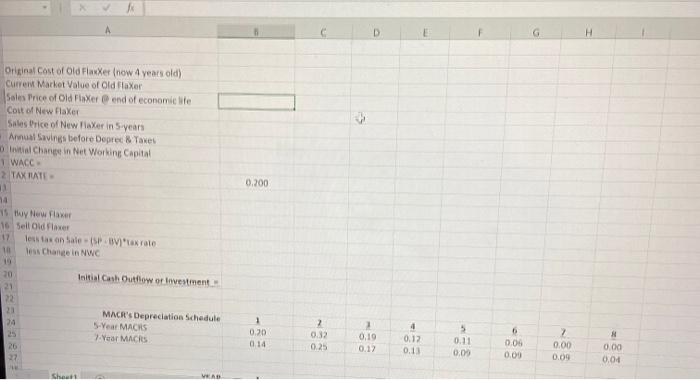

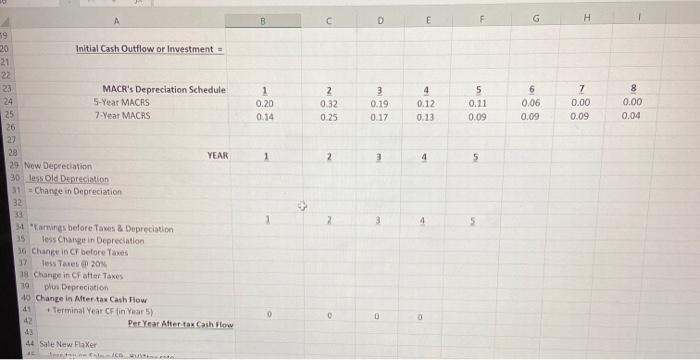

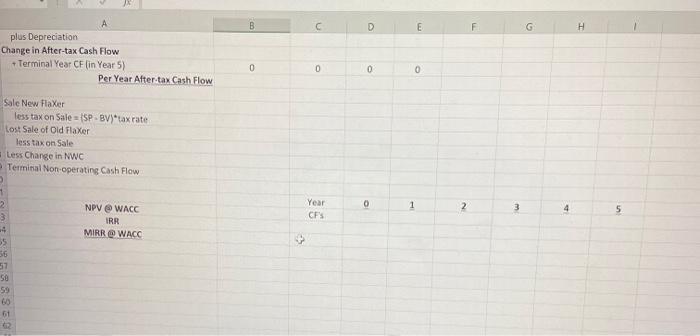

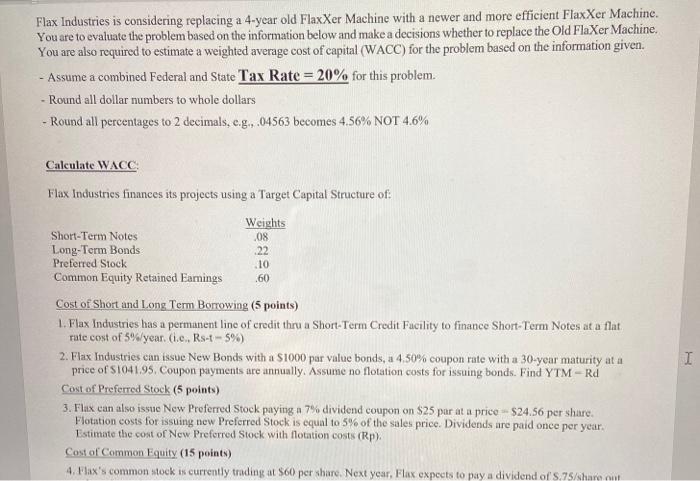

Flax Industries is considering replacing a 4-year old FlaxXer Machine with a newer and more efficient FlaxXer Machine. You are to evaluate the problem based on the information below and make a decisions whether to replace the Old FlaXer Machine You are also required to estimate a weighted average cost of capital (WACC) for the problem based on the information given. - Assume a combined Federal and State Tax Rate = 20% for this problem. - Round all dollar numbers to whole dollars - Round all percentages to 2 decimals, c.g., .04563 becomes 4.56% NOT 4.6% Calculate WACC Flax Industries finances its projects using a Target Capital Structure of Weights Short-Term Notes .08 Long-Term Bonds .22 Preferred Stock .10 Common Equity Retained Eamings .60 Cost of short and Long Term Borrowing (5 points) 1. Flax Industries has a permanent line of credit thru a Short-Term Credit Facility to finance Short-Term Notes at a flat rate cost of 5%/year. (1.c. RS-t - 5%) 2. Flax Industries can issue New Bonds with a $1000 par value bonds, a 4.50% coupon rate with a 30-year maturity at a price of S1041.95. Coupon payments are annually. Assume no flotation costs for issuing bonds. Find YTM - Rd Cost of Preferred Stock (5 points) 3. Flax can also issue New Preferred Stock paying a 7% dividend coupon on $25 par at a price $24.56 per share. Flotation costs for issuing new Preferred Stock is equal to 5% of the sales price. Dividends are paid once per year. Estimate the cost of New Preferred Stock with flotation costs (Rp). Cost of Common Equity (15 points) 4. Flax's common stock is currently trading at S60 per share. Next year, Flax expects to pay a dividend of 8.75/share I Cost of Common Equity (15 points) 4. Flax's common stock is currently trading at $60 per share. Next year, Flax expects to pay a dividend of S.75/share out of eamings of $3.75 per share (i.e., EPS1 = $3.75; DI = 5.75). Current Return on Equity = NOV/Equity = 12% (1.e., ROE = 12%). Calculate the cost of equity (Rs) using the DDM: Rs = (D1/PO) +g. Remember an estimate of g - ROE*b, where bis the percent of earnings retained within the firm: b - Earnings retained/EPS; Retained Earnings = EPS - dividends. 5. Analyst estimate the company's beta at B = 1.10; the 10-year T-Note risk free rate 3% (Rf = 3%); and the return on the market portfolio is estimated at 11.0% (Rm - 11.0%). Using the CAPM estimate required return on equity (Rs). 6. Flax ulso estimates Cost of Equity using its 30-year Bond Yield + 7% equity risk premium. What is the Cost of Equity? 7. Find an overall average Cost of Equity by averaging the costs you found in 4, 5. & 6 above. You will use this Rs estimate in calculating Flax Industries WACC in (8) below. 8. Calculate the WACC using the Target Structure weights given above, and your calculations for Short-Term Notes Long Term Bonds YTM (2): Cost of Preferred Stock (3), and Overall Average for the Cost of Common Equity (7). You will use your WACC estimate in the Capital Budgeting Problem. (5 points) Capital Budgeting Problem Use the 5-Year Class and 7-Year Class MACR Depreciation schedules that are provided below for this problem. Use the Capital Budget Template that I posted under Canvas to answer all questions. Assume a combined Federal and State Tax Rate - 20% for this problem. Do not iust type in numbers. The nint of Excel tema *Do not just type in numbers. The point of Excel is to make it interactive. For example, if I were to change an input such as a tax rate, or cost of new machine, then it should change all values in the spreadsheet that are affected by taxes (e.g., earnings after taxes, tax on a sale of an asset), or cost of the new machine (e.g., depreciation schedule). Flax Industries is considering replacing a 4-year old FlaxXer Machine with a newer and more efficient FlaxXer Machine. You are to evaluate the problem based on the information below and make a decisions whether to replace the Old FlaXer Machine. The Old FlaxXer was originally purchased for $1,000,000 four years ago and is being depreciated using a 5-year MACR schedule (thus, there are 2 years left of depreciation). If replaced, it could be sold for a current price of $185,000. The Old FlaxXer still has another 5 years left in its remaining economic life and could be sold as scrap metal for $30,000 at the end of the 5 years. The New Flax Xer purchase price is $625,000, and it also has a useful economic life of 5 years. However, the IRS requires that Flax Industries depreciate the new machine using a 7-year MACR schedule. If purchased, the New FlaxXer will generate $130.000 per year in Earnings before depreciation and taxes (EBITD). The project will be terminated at the end of 5-years, and the New FlaxXer will be sold for an estimated price of $62,500. If the New FlaxXer is purchased, then Net Working Capital will increase by S10,000 due to the necessity of holding mor Inventory parts. However, Net Working Capital will decrease by $10,000 when the project is terminated at the end of the 5-year life of the project. 9. Find the Incremental Depreciation (the difference between the depreciation of the New and Old FlaxXer) for each year over the 5-year life of the project. (10 points) I 10. What is the Initial Cash outlay (Initial Investment) if the New Flax Xer is purchased to replace the Old FlaxXer? (10 points) 11. Find the Incremental After-tax Operating Cash Flows for Years 1 - 5 (15 points) 12. Find the Terminal Year each Inventory parts. However, Net Working Capital will decrease by $10,000 when the project is terminated at the end of the 5-year life of the project. 9. Find the Incremental Depreciation (the difference between the depreciation of the New and Old FlaxXer) for each year over the 5-year life of the project. (10 points) 10. What is the Initial Cash outlay (Initial Investment) if the New FlaxXer is purchased to replace the Old FlaxXer? (10 points) 11. Find the Incremental After-tax Operating Cash Flows for Years 1 - 5. (15 points) 12. Find the Terminal Year cash flow (ie, the cash flow associated with ending the project at the end of Year 5). (10 points) 13. Calculate the NPV. IRR, and the MIRR for purchasing the New FlaxXer. [Don't forget to include Terminal Year CF as part of cash flows received in Year 5!] (15 points) 14. Based on your answer in (13) above, explain why or why not the firm should buy the New FlaxXer. In your answer provide an interpretation of the NPV and IRR.(i.e., I don't want as a "Why" that NPV > or WACC. I want to know what it means if NPV > or WACC?). (10 points) MACRS 5 year and 7 year Class Depreciation Schedule: I Class 5-year 7-year 1 20% 14% 2 32% 25% 3 19% 17% 4 12% 13% 5 11% 9% 6 6% 9% 7 0% 9% 8 0% 4% A D Original Cost of Old FlaxXer (now 4 years old) Current Market Value of Old Flaxer Sales Price of Old Fixer end of economice Cost of New Flaxer Sales Price of New Flaxer in 5 years Annual Savings before Depre & Taxes Initial Change in Net Working Capital 1 WACC 2 TAXTATE 0.200 14 15 thuy Now Flavor 16 Sell Old Flower less tax on Sale (PBV) tax rate less Change in NWC Initial Cash Outflow or investment 20 21 22 23 24 MACR'S Depreciation Schedule 5-Year MACRS 7.Year MARS 1 0.20 0.14 2 0.32 0.25 1 0,19 0.12 4 0.12 0.13 5 0.11 0,09 26 27 0.00 0.00 2 0.00 0.09 0.00 0.04 Chat VED B C D G E F H 1 0.20 0.14 2 0.32 0.25 3 0.19 0.17 4 0.12 0.13 5 0.11 0.09 0.06 0.09 7 0.00 0.09 8 0.00 0.04 1 2 3 4 5 19 20 Initial Cash Outflow or Investment 21 22 23 MACR's Depreciation Schedule 24 5-Year MACRS 25 7-Year MACRS 26 27 28 YEAR 29 New Depreciation 30 less Old Depreciation 31 - Change in Depreciation 32 39 34 arnings before Taxes & Depreciation 25 less Change in Depreciation 30 Change in CF before Taxes 17 less Teres 20% 18 Change in CF after Taxes 19 plus Depreciation 40 Change in Alter tax Cash Flow 1 Terminal Year CF in Year 5 42 Per Year Aftentax Cash flow 43 44 Sale New Flaxer w 1 2 0 D 0 B D E G plus Depreciation Change in After-tax Cash Flow + Terminal Year CF in Year 5) Per Year After-tax Cash Flow 0 0 0 0 Sale New Flaxer less tax on Sales (SP-BV)"tax rate Lost Sale of Old Flaxer less taxon Sale Less Change in NWC Terminal Non-operating Cash Flow 0 Year CFS 1 2 NPV WACC IRR MIRRWACC 5 4 3 4 35 56 57 SB 59 R Flax Industries is considering replacing a 4-year old FlaxXer Machine with a newer and more efficient FlaxXer Machine. You are to evaluate the problem based on the information below and make a decisions whether to replace the Old FlaXer Machine You are also required to estimate a weighted average cost of capital (WACC) for the problem based on the information given. - Assume a combined Federal and State Tax Rate = 20% for this problem. - Round all dollar numbers to whole dollars - Round all percentages to 2 decimals, c.g., .04563 becomes 4.56% NOT 4.6% Calculate WACC Flax Industries finances its projects using a Target Capital Structure of Weights Short-Term Notes .08 Long-Term Bonds .22 Preferred Stock .10 Common Equity Retained Eamings .60 Cost of short and Long Term Borrowing (5 points) 1. Flax Industries has a permanent line of credit thru a Short-Term Credit Facility to finance Short-Term Notes at a flat rate cost of 5%/year. (1.c. RS-t - 5%) 2. Flax Industries can issue New Bonds with a $1000 par value bonds, a 4.50% coupon rate with a 30-year maturity at a price of S1041.95. Coupon payments are annually. Assume no flotation costs for issuing bonds. Find YTM - Rd Cost of Preferred Stock (5 points) 3. Flax can also issue New Preferred Stock paying a 7% dividend coupon on $25 par at a price $24.56 per share. Flotation costs for issuing new Preferred Stock is equal to 5% of the sales price. Dividends are paid once per year. Estimate the cost of New Preferred Stock with flotation costs (Rp). Cost of Common Equity (15 points) 4. Flax's common stock is currently trading at S60 per share. Next year, Flax expects to pay a dividend of 8.75/share I Cost of Common Equity (15 points) 4. Flax's common stock is currently trading at $60 per share. Next year, Flax expects to pay a dividend of S.75/share out of eamings of $3.75 per share (i.e., EPS1 = $3.75; DI = 5.75). Current Return on Equity = NOV/Equity = 12% (1.e., ROE = 12%). Calculate the cost of equity (Rs) using the DDM: Rs = (D1/PO) +g. Remember an estimate of g - ROE*b, where bis the percent of earnings retained within the firm: b - Earnings retained/EPS; Retained Earnings = EPS - dividends. 5. Analyst estimate the company's beta at B = 1.10; the 10-year T-Note risk free rate 3% (Rf = 3%); and the return on the market portfolio is estimated at 11.0% (Rm - 11.0%). Using the CAPM estimate required return on equity (Rs). 6. Flax ulso estimates Cost of Equity using its 30-year Bond Yield + 7% equity risk premium. What is the Cost of Equity? 7. Find an overall average Cost of Equity by averaging the costs you found in 4, 5. & 6 above. You will use this Rs estimate in calculating Flax Industries WACC in (8) below. 8. Calculate the WACC using the Target Structure weights given above, and your calculations for Short-Term Notes Long Term Bonds YTM (2): Cost of Preferred Stock (3), and Overall Average for the Cost of Common Equity (7). You will use your WACC estimate in the Capital Budgeting Problem. (5 points) Capital Budgeting Problem Use the 5-Year Class and 7-Year Class MACR Depreciation schedules that are provided below for this problem. Use the Capital Budget Template that I posted under Canvas to answer all questions. Assume a combined Federal and State Tax Rate - 20% for this problem. Do not iust type in numbers. The nint of Excel tema *Do not just type in numbers. The point of Excel is to make it interactive. For example, if I were to change an input such as a tax rate, or cost of new machine, then it should change all values in the spreadsheet that are affected by taxes (e.g., earnings after taxes, tax on a sale of an asset), or cost of the new machine (e.g., depreciation schedule). Flax Industries is considering replacing a 4-year old FlaxXer Machine with a newer and more efficient FlaxXer Machine. You are to evaluate the problem based on the information below and make a decisions whether to replace the Old FlaXer Machine. The Old FlaxXer was originally purchased for $1,000,000 four years ago and is being depreciated using a 5-year MACR schedule (thus, there are 2 years left of depreciation). If replaced, it could be sold for a current price of $185,000. The Old FlaxXer still has another 5 years left in its remaining economic life and could be sold as scrap metal for $30,000 at the end of the 5 years. The New Flax Xer purchase price is $625,000, and it also has a useful economic life of 5 years. However, the IRS requires that Flax Industries depreciate the new machine using a 7-year MACR schedule. If purchased, the New FlaxXer will generate $130.000 per year in Earnings before depreciation and taxes (EBITD). The project will be terminated at the end of 5-years, and the New FlaxXer will be sold for an estimated price of $62,500. If the New FlaxXer is purchased, then Net Working Capital will increase by S10,000 due to the necessity of holding mor Inventory parts. However, Net Working Capital will decrease by $10,000 when the project is terminated at the end of the 5-year life of the project. 9. Find the Incremental Depreciation (the difference between the depreciation of the New and Old FlaxXer) for each year over the 5-year life of the project. (10 points) I 10. What is the Initial Cash outlay (Initial Investment) if the New Flax Xer is purchased to replace the Old FlaxXer? (10 points) 11. Find the Incremental After-tax Operating Cash Flows for Years 1 - 5 (15 points) 12. Find the Terminal Year each Inventory parts. However, Net Working Capital will decrease by $10,000 when the project is terminated at the end of the 5-year life of the project. 9. Find the Incremental Depreciation (the difference between the depreciation of the New and Old FlaxXer) for each year over the 5-year life of the project. (10 points) 10. What is the Initial Cash outlay (Initial Investment) if the New FlaxXer is purchased to replace the Old FlaxXer? (10 points) 11. Find the Incremental After-tax Operating Cash Flows for Years 1 - 5. (15 points) 12. Find the Terminal Year cash flow (ie, the cash flow associated with ending the project at the end of Year 5). (10 points) 13. Calculate the NPV. IRR, and the MIRR for purchasing the New FlaxXer. [Don't forget to include Terminal Year CF as part of cash flows received in Year 5!] (15 points) 14. Based on your answer in (13) above, explain why or why not the firm should buy the New FlaxXer. In your answer provide an interpretation of the NPV and IRR.(i.e., I don't want as a "Why" that NPV > or WACC. I want to know what it means if NPV > or WACC?). (10 points) MACRS 5 year and 7 year Class Depreciation Schedule: I Class 5-year 7-year 1 20% 14% 2 32% 25% 3 19% 17% 4 12% 13% 5 11% 9% 6 6% 9% 7 0% 9% 8 0% 4% A D Original Cost of Old FlaxXer (now 4 years old) Current Market Value of Old Flaxer Sales Price of Old Fixer end of economice Cost of New Flaxer Sales Price of New Flaxer in 5 years Annual Savings before Depre & Taxes Initial Change in Net Working Capital 1 WACC 2 TAXTATE 0.200 14 15 thuy Now Flavor 16 Sell Old Flower less tax on Sale (PBV) tax rate less Change in NWC Initial Cash Outflow or investment 20 21 22 23 24 MACR'S Depreciation Schedule 5-Year MACRS 7.Year MARS 1 0.20 0.14 2 0.32 0.25 1 0,19 0.12 4 0.12 0.13 5 0.11 0,09 26 27 0.00 0.00 2 0.00 0.09 0.00 0.04 Chat VED B C D G E F H 1 0.20 0.14 2 0.32 0.25 3 0.19 0.17 4 0.12 0.13 5 0.11 0.09 0.06 0.09 7 0.00 0.09 8 0.00 0.04 1 2 3 4 5 19 20 Initial Cash Outflow or Investment 21 22 23 MACR's Depreciation Schedule 24 5-Year MACRS 25 7-Year MACRS 26 27 28 YEAR 29 New Depreciation 30 less Old Depreciation 31 - Change in Depreciation 32 39 34 arnings before Taxes & Depreciation 25 less Change in Depreciation 30 Change in CF before Taxes 17 less Teres 20% 18 Change in CF after Taxes 19 plus Depreciation 40 Change in Alter tax Cash Flow 1 Terminal Year CF in Year 5 42 Per Year Aftentax Cash flow 43 44 Sale New Flaxer w 1 2 0 D 0 B D E G plus Depreciation Change in After-tax Cash Flow + Terminal Year CF in Year 5) Per Year After-tax Cash Flow 0 0 0 0 Sale New Flaxer less tax on Sales (SP-BV)"tax rate Lost Sale of Old Flaxer less taxon Sale Less Change in NWC Terminal Non-operating Cash Flow 0 Year CFS 1 2 NPV WACC IRR MIRRWACC 5 4 3 4 35 56 57 SB 59 R