Please show/explain how to get the answers. Answers are provided in bold!

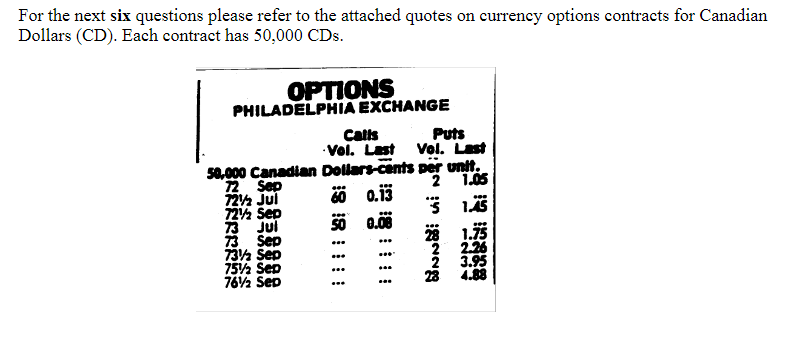

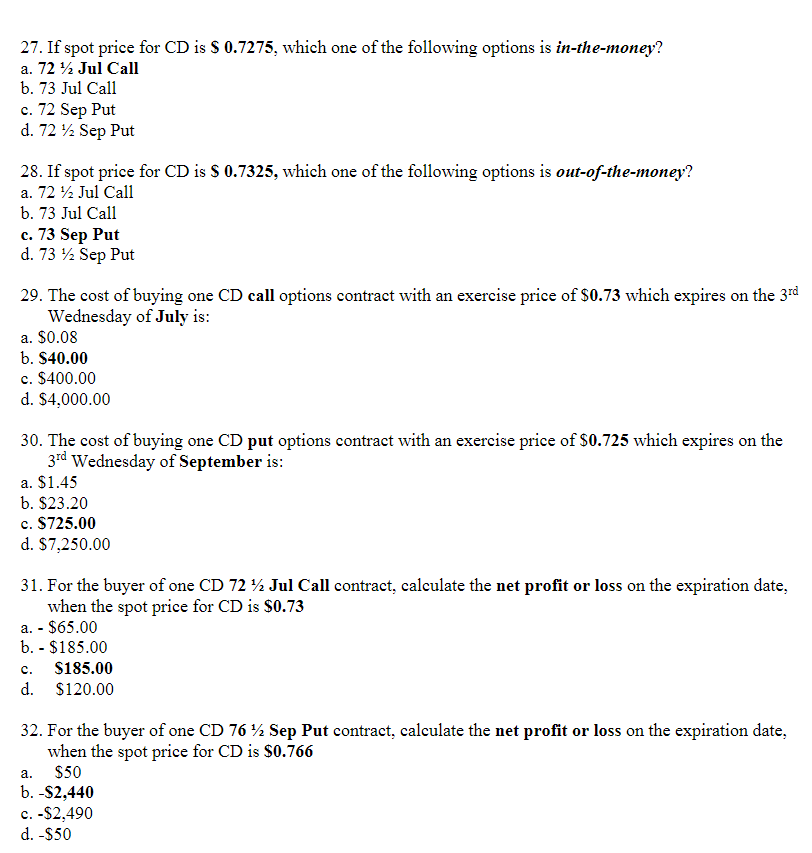

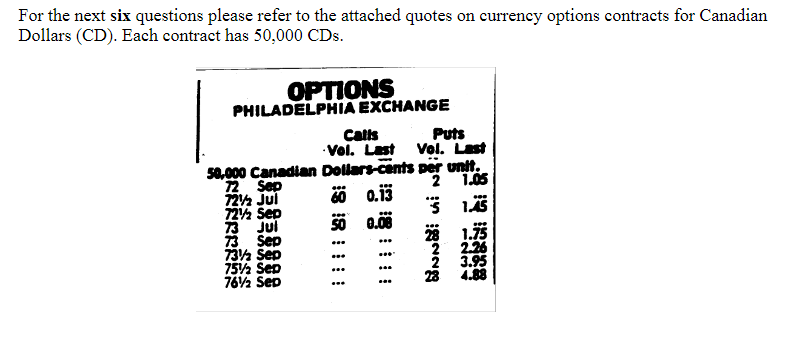

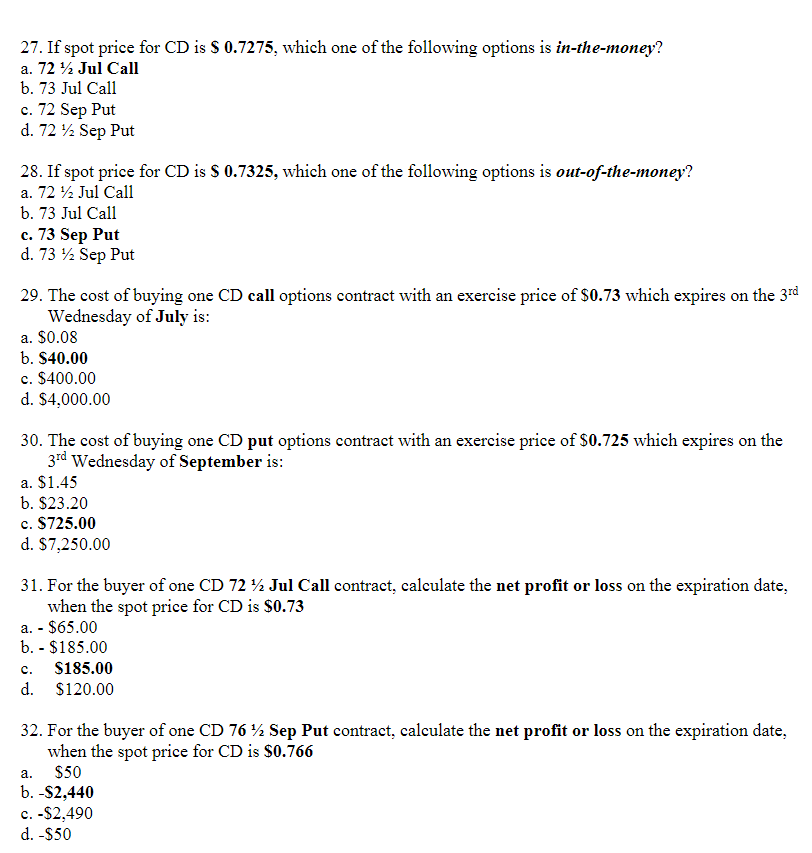

For the next six questions please refer to the attached quotes on currency options contracts for Canadian Dollars (CD). Each contract has 50,000 CDs OPTIONS PHILADELPHIA EXCHANGE Calls Puts Vel. Last Vel. Last 58,000 Canadian Doliars cents per untt. 2 1.05 2 Sep 7212 Jul 72 Sep 73 Jul T3 Seo 73 Sep 75% Sep 76 Sep 5 1A5 50 0.08 2 2.26 2 3.95 234.88 27. If spot price for CD is S 0.7275, which one of the following options is in-the-money? a. 72 1/% Jul Call b. 73 Jul Call c. 72 Sep Put d. 72 V/2 Sep Put 28. If spot price for CD is S 0.7325, which one of the following options is out-of-the-money? a. 72 2 Jul Call b. 73 Jul Call c. 73 Sep Put d. 73 V/2 Sep Put 29. The cost of buying one CD call options contract with an exercise price of S0.73 which expires on the 37d Wednesday of July is a. S0.08 b. S40.00 c. $400.00 d. S4,000.00 30. The cost of buying one CD put options contract with an exercise price of S0.725 which expires on the 3rd Wednesday of September is a. $1.45 b. $23.20 c. S725.00 d. S7,250.00 31. For the buyer of one CD 72 2 Jul Call contract, calculate the net profit or loss on the expiration date, when the spot price for CD is S0.73 a. - $65.00 b. - $185.00 c. S185.00 d. $120.00 32. For the buyer of one CD 76 /2 Sep Put contract, calculate the net profit or loss on the expiration date, when the spot price for CD is S0.766 a. S50 b. -S2,440 c. -S2,490 d. -S50 For the next six questions please refer to the attached quotes on currency options contracts for Canadian Dollars (CD). Each contract has 50,000 CDs OPTIONS PHILADELPHIA EXCHANGE Calls Puts Vel. Last Vel. Last 58,000 Canadian Doliars cents per untt. 2 1.05 2 Sep 7212 Jul 72 Sep 73 Jul T3 Seo 73 Sep 75% Sep 76 Sep 5 1A5 50 0.08 2 2.26 2 3.95 234.88 27. If spot price for CD is S 0.7275, which one of the following options is in-the-money? a. 72 1/% Jul Call b. 73 Jul Call c. 72 Sep Put d. 72 V/2 Sep Put 28. If spot price for CD is S 0.7325, which one of the following options is out-of-the-money? a. 72 2 Jul Call b. 73 Jul Call c. 73 Sep Put d. 73 V/2 Sep Put 29. The cost of buying one CD call options contract with an exercise price of S0.73 which expires on the 37d Wednesday of July is a. S0.08 b. S40.00 c. $400.00 d. S4,000.00 30. The cost of buying one CD put options contract with an exercise price of S0.725 which expires on the 3rd Wednesday of September is a. $1.45 b. $23.20 c. S725.00 d. S7,250.00 31. For the buyer of one CD 72 2 Jul Call contract, calculate the net profit or loss on the expiration date, when the spot price for CD is S0.73 a. - $65.00 b. - $185.00 c. S185.00 d. $120.00 32. For the buyer of one CD 76 /2 Sep Put contract, calculate the net profit or loss on the expiration date, when the spot price for CD is S0.766 a. S50 b. -S2,440 c. -S2,490 d. -S50