Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show/explain how you got the answers. Calculating Profitability Ratios Toscano, Inc., has sales revenue of $12 million, total assets of $9.9 million, and total

Please show/explain how you got the answers.

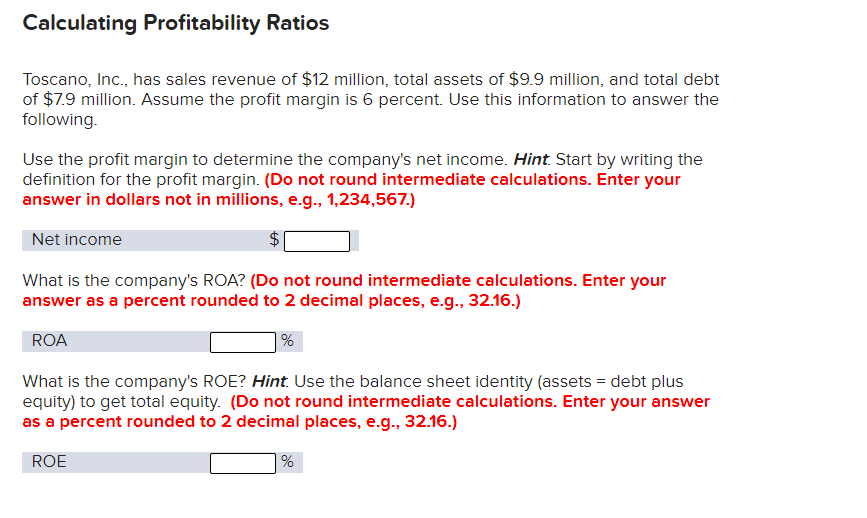

Calculating Profitability Ratios Toscano, Inc., has sales revenue of $12 million, total assets of $9.9 million, and total debt of $7.9 million. Assume the profit margin is 6 percent. Use this information to answer the following Use the profit margin to determine the company's net income. Hint. Start by writing the definition for the profit margin. (Do not round intermediate calculations. Enter your answer in dollars not in millions, e.g., 1,234,567.) Net income $ What is the company's ROA? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROA What is the company's ROE? Hint. Use the balance sheet identity (assets = debt plus equity) to get total equity. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started