Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please sir apas? Required: 1) Use this information to complete the following table. Depreciation Expense Book Value at End of Year Method 2018 2019 2020

please sir apas?

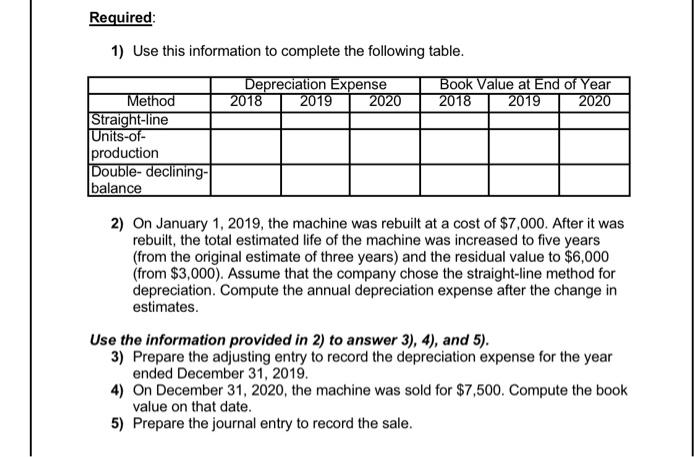

Required: 1) Use this information to complete the following table. Depreciation Expense Book Value at End of Year Method 2018 2019 2020 2018 2019 2020 Straight-line Units-of- production Double-declining- balance 2) On January 1, 2019, the machine was rebuilt at a cost of $7,000. After it was rebuilt, the total estimated life of the machine was increased to five years (from the original estimate of three years) and the residual value to $6,000 (from $3,000). Assume that the company chose the straight-line method for depreciation. Compute the annual depreciation expense after the change in estimates. Use the information provided in 2) to answer 3), 4), and 5). 3) Prepare the adjusting entry to record the depreciation expense for the year ended December 31, 2019. 4) On December 31, 2020, the machine was sold for $7,500. Compute the book value on that date. 5) Prepare the journal entry to record the sale. Required: 1) Use this information to complete the following table. Depreciation Expense Book Value at End of Year Method 2018 2019 2020 2018 2019 2020 Straight-line Units-of- production Double-declining- balance 2) On January 1, 2019, the machine was rebuilt at a cost of $7,000. After it was rebuilt, the total estimated life of the machine was increased to five years (from the original estimate of three years) and the residual value to $6,000 (from $3,000). Assume that the company chose the straight-line method for depreciation. Compute the annual depreciation expense after the change in estimates. Use the information provided in 2) to answer 3), 4), and 5). 3) Prepare the adjusting entry to record the depreciation expense for the year ended December 31, 2019. 4) On December 31, 2020, the machine was sold for $7,500. Compute the book value on that date. 5) Prepare the journal entry to record the sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started