Question: Please solve 1-8 under the Required section. Please number each answer to the problem. And for number 7 please substitue $1.15 for $2.72 earnings per

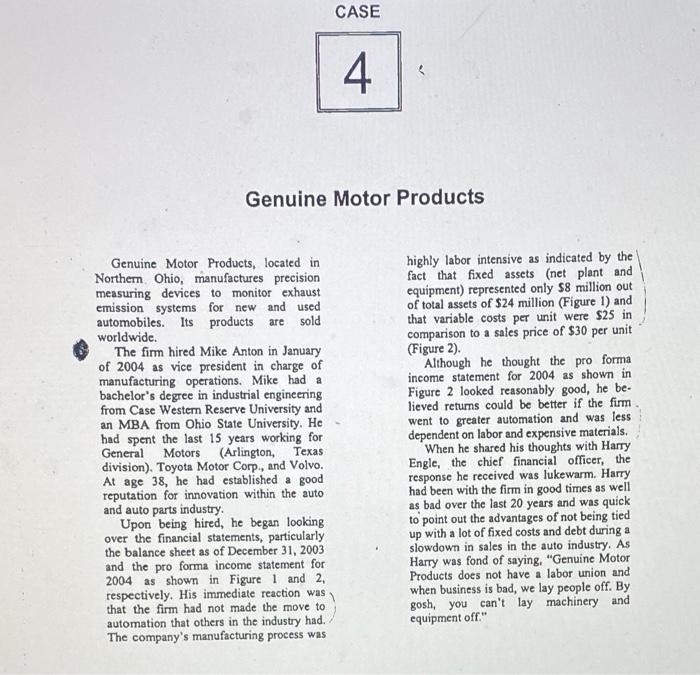

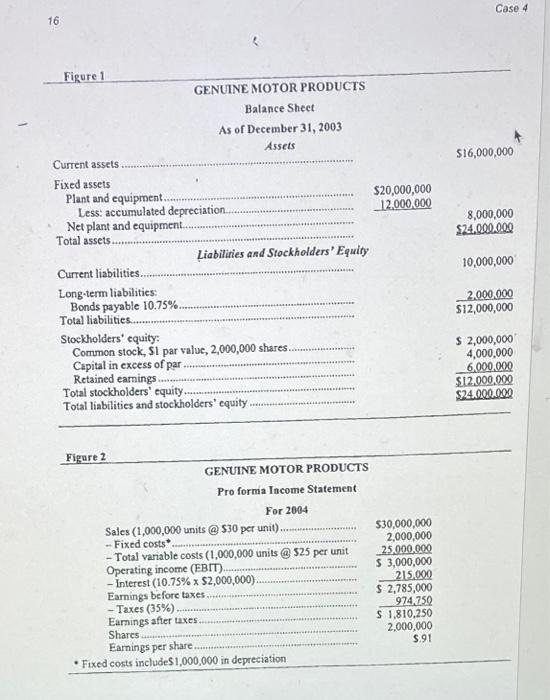

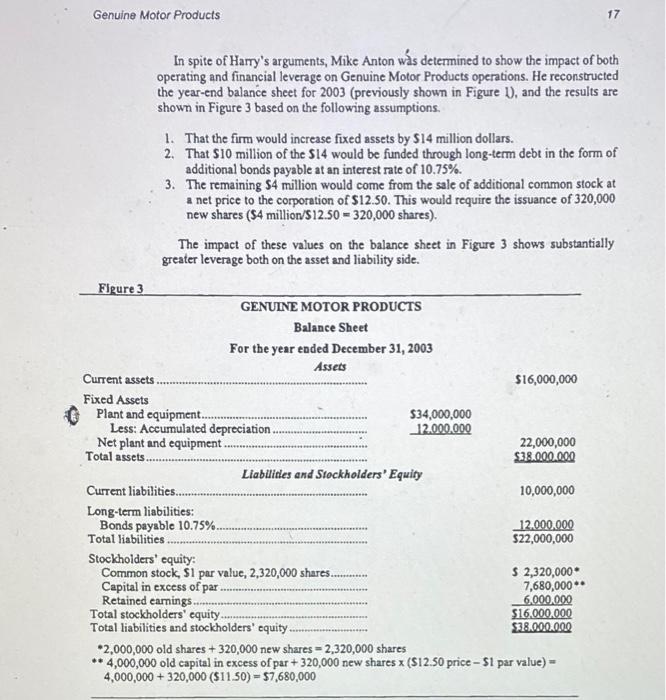

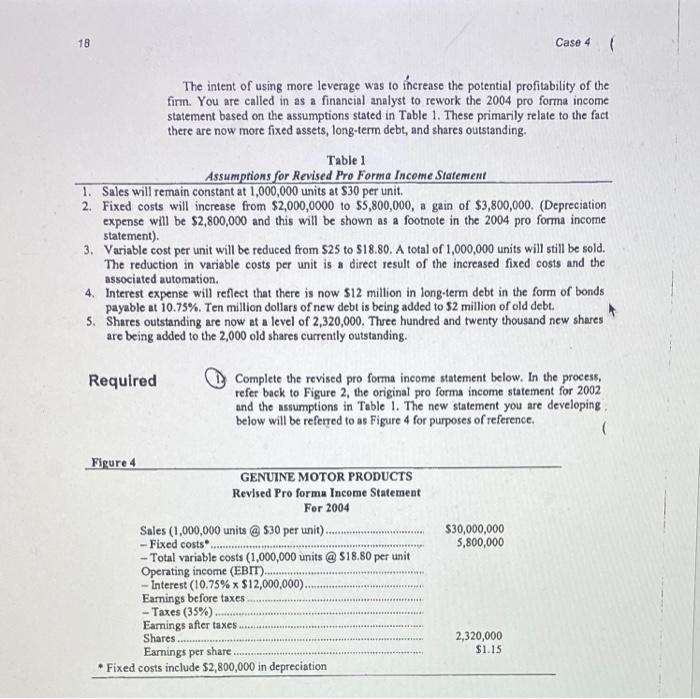

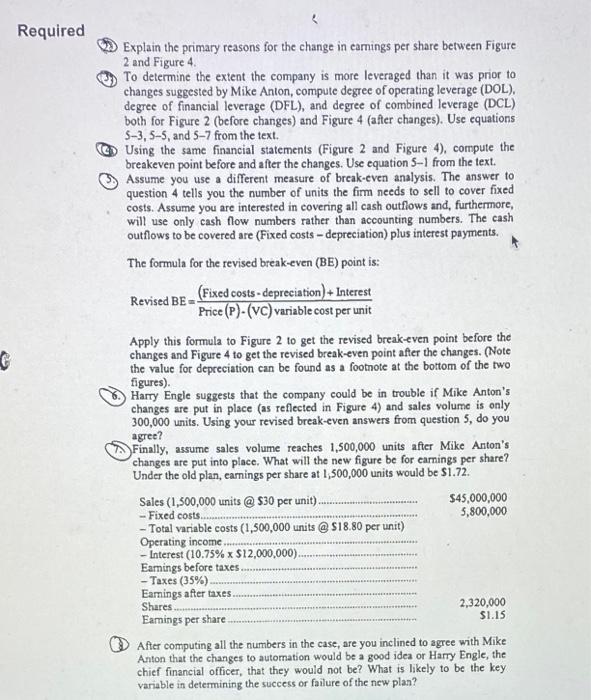

Genuine Motor Products Genuine Motor Products, located in Northern. Ohio, manufactures precision measuring devices to monitor exhaust emission systems for new and used automobiles. Its products are sold worldwide. highly labor intensive as indicated by the fact that fixed assets (net plant and equipment) represented only $8 million out of total assets of $24 million (Figure 1) and The firm hired Mike Anton in January that variable costs per unit were $25 in of 2004 as vice president in charge of comparison to a sales price of $30 per unit manufacturing operations. Mike had a (Figure 2). bachelor's degree in industrial engineering from Case Western Reserve University and an MBA from Ohio State University. He had spent the last 15 years working for General Motors (Arlington, Texas division). Toyota Motor Corp., and Volvo. At age 38, he had established a good Although he thought the pro forma reputation for innovation within the auto and auto parts industry. income statement for 2004 as shown in Figure 2 looked reasonably good, he be- Upon being hired, he began looking over the financial statements, particularly lieved returns could be better if the firm. the balance sheet as of December 31,2003 went to greater automation and was less and the pro forma income statement for 2004 as shown in Figure 1 and 2, dependent on labor and expensive materials. respectively. His immediate reaction was that the firm had not made the move to When he shared his thoughts with Harry automation that others in the industry had. received was lirkewarm in good times as well The company's manufacturing process was to point out the advantages of not being tied up with a lot of fixed costs and debt during a slowdown in sales in the auto industry. As Harry was fond of saying, "Genuine Motor Products does not have a labor union and when business is bad, we lay people off. By gosh, you can't lay machinery and equipment off." 16 Case 4 Figure 1 GENUINE MOTOR PRODUCTS Balance Shect Current assets As of December 31,2003 Assets Fixed assets Plant and equipment. Less: accumulated depreciation. Net plant and equipment. Total assets. Liabilities and Stockholders' Equity Current liabilities. $20,000,00012,000,000 Long-term liabilitics: Bonds payable 10.75% Total liabilities. Stockholders' cquity: Common stock, S1 par value, 2,000,000 shares. Cepital in excess of par Retained earnings. Total stockholders' equity Total liabilities and stockholders' equity. 516,000,000 Figare 2 GENUINE MOTOR PRODUCTS Pro forma Income Statement For 2004 Sales (1,000,000 units @$330 per unit). - Fixed costs*. 8,000,000$24,000000 Earnings before taxes 10,000,000 - Taxes (35\%). Earnings after taxes Shares. $12,000,0002,000,000 Earnings per share. $2,000,0004,000,0006,000,000$12,000,000$24,000.000 - Fixed costs include $1,000,000 in depreciation In spite of Harry's arguments, Mike Anton ws determined to show the impact of both operating and financial leverage on Genuine Motor Products operations. He reconstructed the year-end balance sheet for 2003 (previously shown in Figure 1), and the results are shown in Figure 3 based on the following assumptions. 1. That the firm would increase fixed assets by 514 million dollars. 2. That $10 million of the $14 would be funded through long-term debt in the form of additional bonds payable at an interest rate of 10.75%. 3. The remaining S4 million would come from the sale of additional common stock at a net price to the corporation of $12.50. This would require the issuance of 320,000 new shares ( S4 million /S12.50=320,000 shares). The impact of these values on the balance sheet in Figure 3 shows substantially greater leverage both on the asset and liability side. The intent of using more leverage was to increase the potential profitability of the firm. You are called in as a financial analyst to rework the 2004 pro forma income statement based on the assumptions stated in Table 1 . These primarily relate to the fact there are now more fixed assets, long-term debt, and shares outstanding. Table 1 Assumptions for Revised Pro Forma Income Statement 1. Sales will remain constant at 1,000,000 units at $30 per unit. 2. Fixed costs will increase from $2,000,0000 to $5,800,000, a gain of $3,800,000. (Depreciation expense will be $2,800,000 and this will be shown as a footnote in the 2004 pro forma income statement). 3. Variable cost per unit will be reduced from $25 to $18.80. A total of 1,000,000 units will still be sold. The reduction in variable costs per unit is a direct result of the increased fixed costs and the associated automation. 4. Interest expense will reflect that there is now 512 million in long-term debt in the form of bonds payable at 10.75%. Ten million dollars of new debt is being added to $2 million of old debt. 5. Shares outstanding are now at a level of 2,320,000. Three hundred and twenty thousand new shares are being added to the 2,000 old shares currently outstanding. Required Complete the revised pro forma income statement below. In the process, refer back to Figure 2, the original pro forma income statement for 2002 and the assumptions in Table 1. The new statement you are developing below will be referred to as Figure 4 for purposes of reference. Explain the primary reasons for the change in earnings per share between Figure 2 and Figure 4. To determine the extent the company is more leveraged than it was prior to changes suggested by Mike Anton, compute degree of operating leverage (DOL), degree of financial leverage (DFL), and degree of combined leverage (DCL) both for Figure 2 (before changes) and Figure 4 (after changes). Use equations 53,55, and 57 from the text. Using the same financial statements (Figure 2 and Figure 4), compute the breakeven point before and after the changes. Use equation 5-1 from the text. Assume you use a different measure of break-even analysis. The answer to question 4 tells you the number of units the firm needs to sell to cover fixed costs. Assume you are interested in covering all cash outflows and, furthermore, will use only cash flow numbers rather than accounting numbers. The cash outflows to be covered are (Fixed costs - depreciation) plus interest payments. The formula for the revised break-even (BE) point is: RevisedBE=Price(P)(VC)variablecostperunit(Fixedcosts-depreciation)+Interest Apply this formula to Figure 2 to get the revised break-even point before the changes and Figure 4 to get the revised break-even point after the changes. (Note the value for depreciation can be found as a footnote at the bottom of the two figures). 6. Harry Engle suggests that the company could be in trouble if Mike Anton's changes are put in place (as reflected in Figure 4) and sales volume is only 300,000 units. Using your revised break-even answers from question 5, do you agree? Finally, assume sales volume reaches 1,500,000 units after Mike Anton's changes are put into place. What will the new figure be for earnings per share? Under the old plan, earnings per share at 1,500,000 units would be $1.72. (3) After computing all the numbers in the case, are you inclined to agree with Mike Anton that the changes to autornation would be a good idea or Harry Engle, the chief financial officer, that they would not be? What is likely to be the key variable in determining the success or failure of the new plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts