Answered step by step

Verified Expert Solution

Question

1 Approved Answer

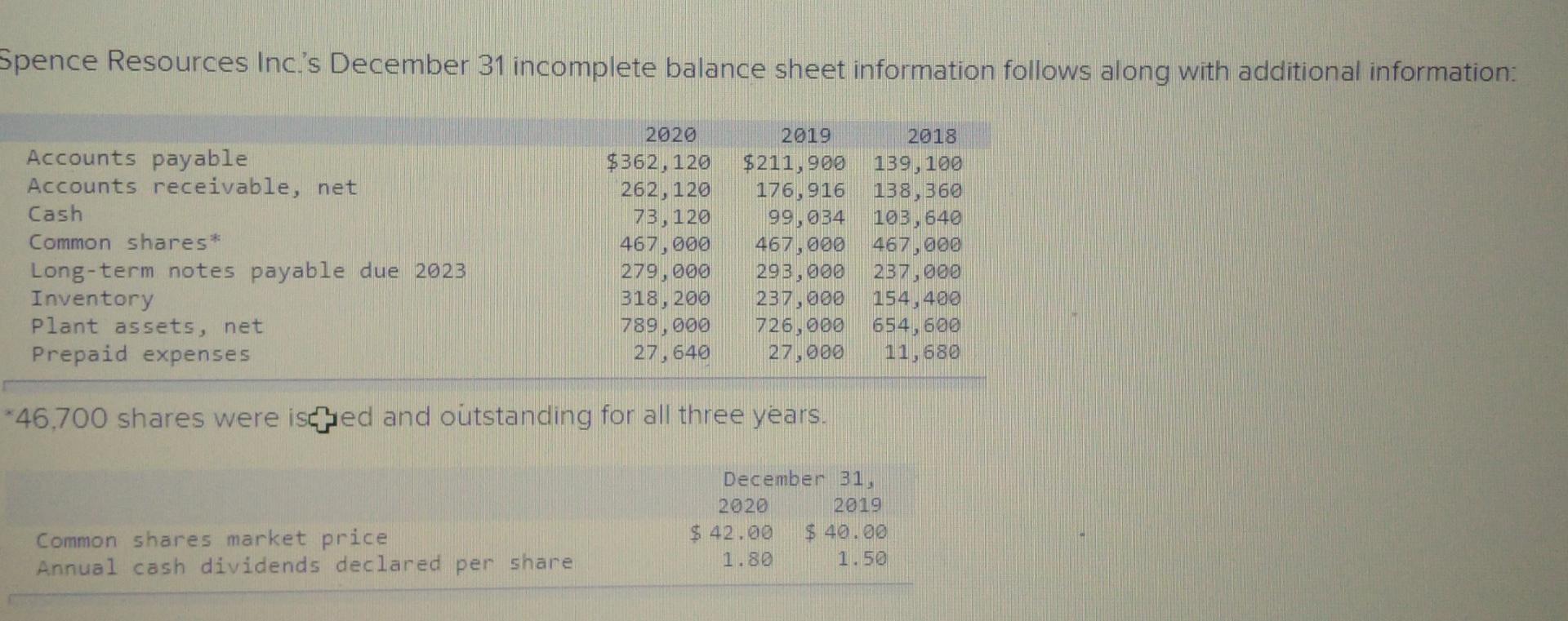

please solve 2 part . Spence Resources Inc.'s December 31 incomplete balance sheet information follows along with additional information: Accounts payable Accounts receivable, net Cash

please solve 2 part .

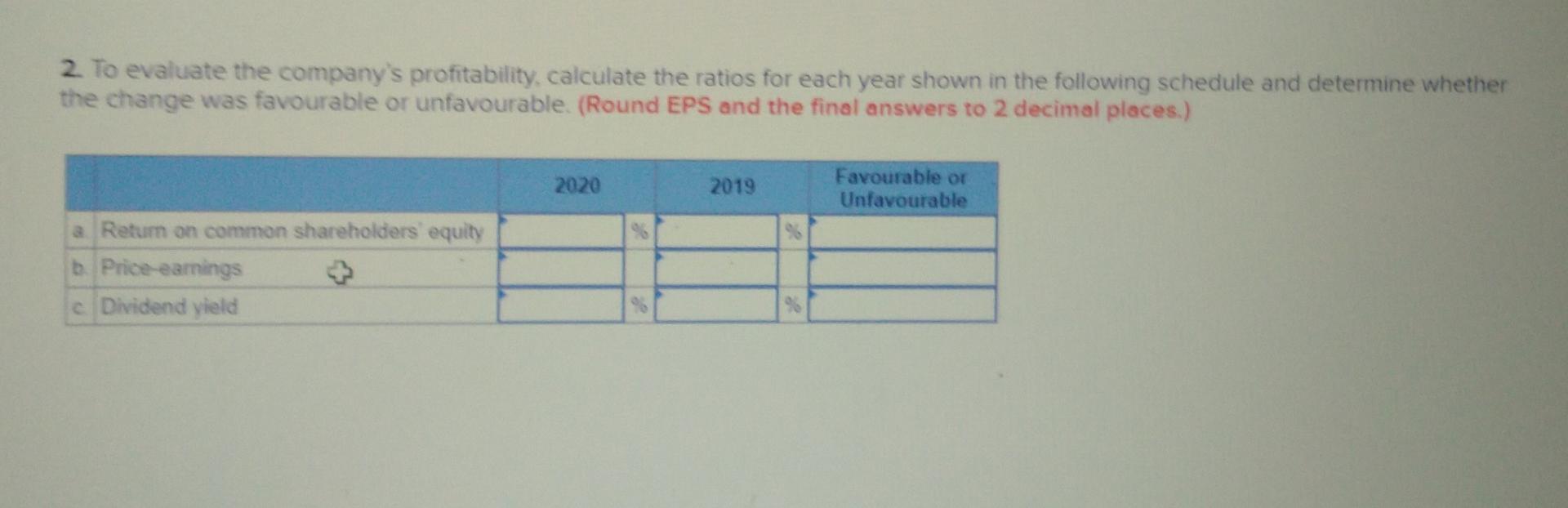

Spence Resources Inc.'s December 31 incomplete balance sheet information follows along with additional information: Accounts payable Accounts receivable, net Cash Common shares* Long-term notes payable due 2023 Inventory Plant assets, net Prepaid expenses 2020 $362, 120 262, 120 73, 120 467,000 279,000 318,200 789,000 27,640 2019 $211,900 176,916 99,034 467,000 293,000 237,000 726,000 27,000 2018 139,100 138,360 103,640 467,000 237,000 154,400 654,600 11,680 * 46,700 shares were isced and outstanding for all three years. December 31, 2020 2019 $ 42.00 $ 40.00 1.50 Common shares market price Annual cash dividends declared per share 2. To evaluate the company's profitability calculate the ratios for each year shown in the following schedule and determine whether the change was favourable or unfavourable (Round EPS and the final answers to 2 decimal places.) 2020 2019 Favourable or Unfavourable a Return on common shareholders' equity Price-eamings c Dividend yield Spence Resources Inc.'s December 31 incomplete balance sheet information follows along with additional information: Accounts payable Accounts receivable, net Cash Common shares* Long-term notes payable due 2023 Inventory Plant assets, net Prepaid expenses 2020 $362, 120 262, 120 73, 120 467,000 279,000 318,200 789,000 27,640 2019 $211,900 176,916 99,034 467,000 293,000 237,000 726,000 27,000 2018 139,100 138,360 103,640 467,000 237,000 154,400 654,600 11,680 * 46,700 shares were isced and outstanding for all three years. December 31, 2020 2019 $ 42.00 $ 40.00 1.50 Common shares market price Annual cash dividends declared per share 2. To evaluate the company's profitability calculate the ratios for each year shown in the following schedule and determine whether the change was favourable or unfavourable (Round EPS and the final answers to 2 decimal places.) 2020 2019 Favourable or Unfavourable a Return on common shareholders' equity Price-eamings c Dividend yieldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started