Answered step by step

Verified Expert Solution

Question

1 Approved Answer

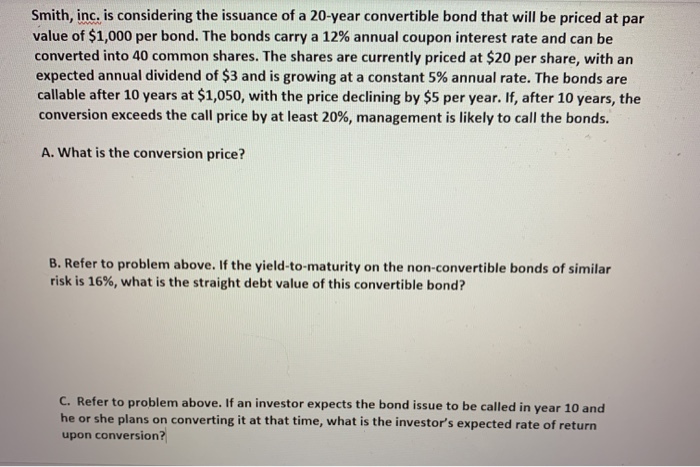

Please solve A, B, and C. Please show work. Smith, inc. is considering the issuance of a 20-year convertible bond that will be priced at

Please solve A, B, and C. Please show work.

Smith, inc. is considering the issuance of a 20-year convertible bond that will be priced at par value of $1,000 per bond. The bonds carry a 12% annual coupon interest rate and can be converted into 40 common shares. The shares are currently priced at $20 per share, with an expected annual dividend of $3 and is growing at a constant 5% annual rate. The bonds are callable after 10 years at $1,050, with the price declining by $5 per year. If, after 10 years, the conversion exceeds the call price by at least 20%, management is likely to call the bonds. A. What is the conversion price? B. Refer to problem above. If the yield-to-maturity on the non-convertible bonds of similar risk is 16%, what is the straight debt value of this convertible bond? C. Refer to problem above. If an investor expects the bond issue to be called in year 10 and he or she plans on converting it at that time, what is the investor's expected rate of return upon conversion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started