Please solve a,b, c , d, and e

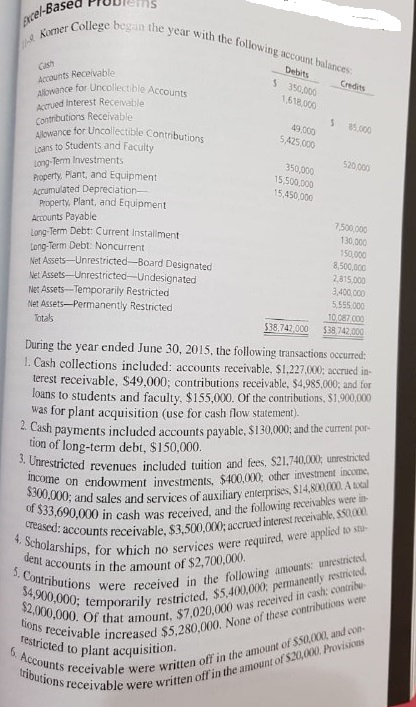

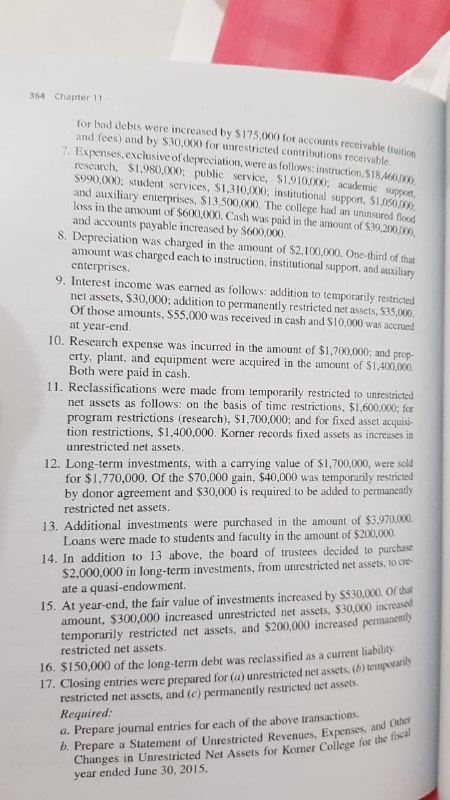

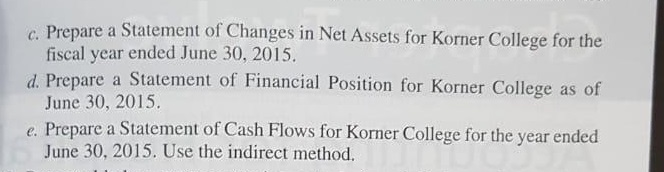

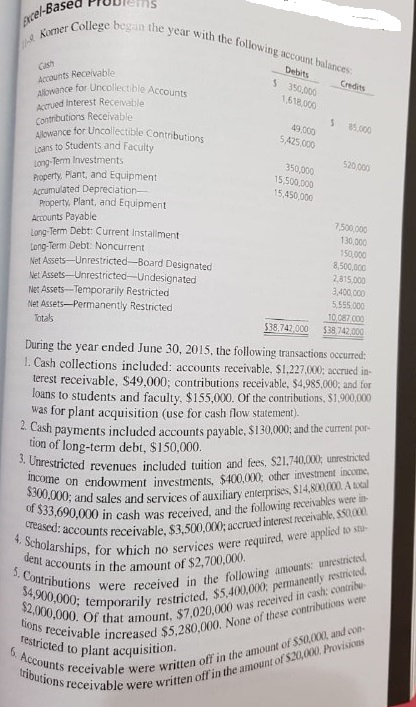

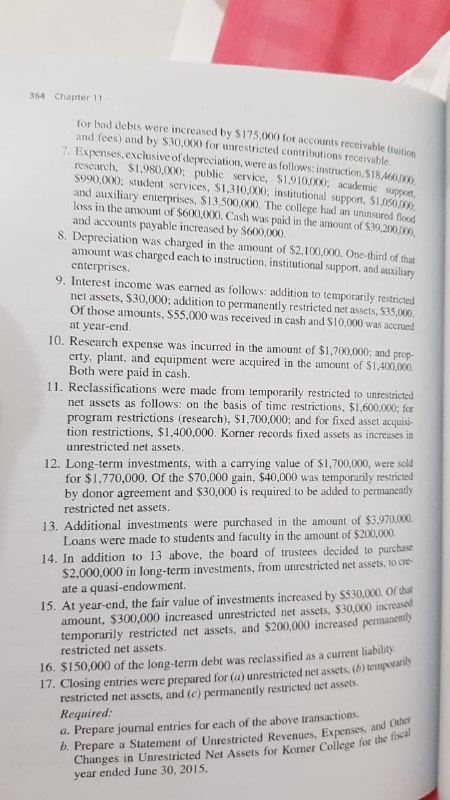

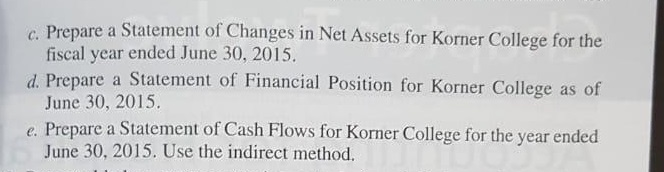

Basea Probems s Komer College t e began the year with the fo lowing account balances Accounts Receivable Allowance for Un Accrued Interest Recevable Contrbutions Receivable ce for Uncollectible Accounts 49.000 5425,000 wance for Uncollectible Contributions Lans to Students and Faculty uong-Term Investments Property. Plant, and Equipment Accumulated Depreciation 520,000 350,000 15,500,000 15,450,000 Property, Plant, and Equipment Accounts Payable Long Term Debt: Current Instalilment Long-Term Debt: Noncurrent Net Assets-Unrestricted-Board Designated Net Assets-Unrestricted-Undesignated e Assets-Temporarily Restricted Net Assets-Permanently Restricted otals 130,000 50,000 8,500,000 2,815,000 3,400 000 5,555,000 10.087 000 $38 742000 38.742000 During the year ended June 30, 2015, the following transactions occurred: l. Cash collections included: accounts receivable, $1,227.000: accrued in- terest receivable, $49,000; contributions receivable, $4,985,000; and for loans to students and faculty, $155,000. Of the contributions, $1 900,000 was for plant acquisition (use for cash flow statement . Cash payments included accounts payable, S13000; and the curent por- tion of long-term debt, $ 1 50,000. revenues included tuition and fees, $21.740,000, unrestricted on endowment investments, $400,000, other investment income, es of auxiliary enterprises, $14,800000 A al $300 in cash was received, and the following receivables were in- nts receivable, $3,500,000;accrued interest receivable $0000 ps, for which no services were required, were applied to stu and sales and servic creased: accounts 4. Scholarships, 5 eu accounts in the amount of $2.700.000. ount of $2,700,00 were received in the following amounts unrestric nts: unrestricted rily restricted, $5,400,000, pemanently restricted. reased $5,280,000. None of these contributions were e were written off in the amount of S50.000 and con 000; temporarily 000,000. Of that amount, $7,020 tions receivable Testricted to plant acquisiti e were written off in the amount of $20,000. Provisions 364 Chapter 11 for bad debts were increased by $175,000 for accounts receivable (tuition and fees) and by $30,000 for unrestricted contributions receivable Expenses, exclusive of depreciation, were as follows: instruction, $18,460000 research. S1,980.000: public service, $1,910000, academie suppon, $990,000: student services, $1.310,000: institutional support, S1,0s0x and auxiliary enterprises, $13,500.000. The college had an uninsured flood loss in the amount of $600,000. Cash was paid in the amount of $39,200,000 and accounts payable increased by S600,000. 8. Depreciation was charged in the amount of $2 100 00, one-third of that amount was charged each to instruction, institutional support, and auxiliary enterprises. 9. Interest income was earned as follows: addition to temporarily restricted net assets, $30,000; addition to permanently restricted net assets, $35,000 Of those amounts, $55,000 was received in cash and S10,000 was accrued at year-end. 10. Research expense was incurred in the amount of $1.700,000, and prop- erty, plant, and equipment were acquired in the amount of S1.400.000. Both were paid in cash. 11. Reclassifications were made from temporarily restricted to unrestricted net assets as follows: on the basis of time restrictions, S1.600000; for program restrictions (research), $1,700,000; and for fixed asset acquisi- tion restrictions, $1,400,000. Korner records fixed assets as increases in unrestricted net assets. 12. Long-term investments, with a carrying value of S1,700,000, were sold for $1,770,000. Of the $70,000 gain, $40,000 was temporarily restricted by donor agreement and $30,000 is required to be added to permanently restricted net assets. Additional investments were purchased in the amount of $3.970.000 Loans were made to students and faculty in the amount of $200,000. 14. In addition to 13 above, the board of trustees decided to purchase $2,000,000 in long-term investments, from unrestricted net assets, to cre- ate a quasi-endowment 15. At year-end, the fair value of investments increased by $530,000. Of that amount, $300,000 increased unrestricted net assets, $30,000 increase temporarily restricted net assets, and $200,000 increased permanently 16. $150,000 of the long-term debt was reclassified as a current liability 17. Closing entries were prepared for (a) unrestricted net assets, (b) temp restricted net assets restricted net assets, and (c) permanently restricted net assets Required a. Prepare journal entries for each of the above transactions.bet and Other Changes in Unrestricted Net Assets for Korner College for te year ended June 30, 2015 b. Prepare a Statement of Unrestricted Revenues, Expenses for the fisal pare a Statement of Changes in Net Assets for Korner College for the fiscal year ended June 30, 2015. c. Pre pare a Statement of Financial Position for Korner College as of June 30, 2015. d. Pre e. Prepare a Statement of Cash Flows for Korner College for the year ended June 30, 2015. Use the indirect method. Basea Probems s Komer College t e began the year with the fo lowing account balances Accounts Receivable Allowance for Un Accrued Interest Recevable Contrbutions Receivable ce for Uncollectible Accounts 49.000 5425,000 wance for Uncollectible Contributions Lans to Students and Faculty uong-Term Investments Property. Plant, and Equipment Accumulated Depreciation 520,000 350,000 15,500,000 15,450,000 Property, Plant, and Equipment Accounts Payable Long Term Debt: Current Instalilment Long-Term Debt: Noncurrent Net Assets-Unrestricted-Board Designated Net Assets-Unrestricted-Undesignated e Assets-Temporarily Restricted Net Assets-Permanently Restricted otals 130,000 50,000 8,500,000 2,815,000 3,400 000 5,555,000 10.087 000 $38 742000 38.742000 During the year ended June 30, 2015, the following transactions occurred: l. Cash collections included: accounts receivable, $1,227.000: accrued in- terest receivable, $49,000; contributions receivable, $4,985,000; and for loans to students and faculty, $155,000. Of the contributions, $1 900,000 was for plant acquisition (use for cash flow statement . Cash payments included accounts payable, S13000; and the curent por- tion of long-term debt, $ 1 50,000. revenues included tuition and fees, $21.740,000, unrestricted on endowment investments, $400,000, other investment income, es of auxiliary enterprises, $14,800000 A al $300 in cash was received, and the following receivables were in- nts receivable, $3,500,000;accrued interest receivable $0000 ps, for which no services were required, were applied to stu and sales and servic creased: accounts 4. Scholarships, 5 eu accounts in the amount of $2.700.000. ount of $2,700,00 were received in the following amounts unrestric nts: unrestricted rily restricted, $5,400,000, pemanently restricted. reased $5,280,000. None of these contributions were e were written off in the amount of S50.000 and con 000; temporarily 000,000. Of that amount, $7,020 tions receivable Testricted to plant acquisiti e were written off in the amount of $20,000. Provisions 364 Chapter 11 for bad debts were increased by $175,000 for accounts receivable (tuition and fees) and by $30,000 for unrestricted contributions receivable Expenses, exclusive of depreciation, were as follows: instruction, $18,460000 research. S1,980.000: public service, $1,910000, academie suppon, $990,000: student services, $1.310,000: institutional support, S1,0s0x and auxiliary enterprises, $13,500.000. The college had an uninsured flood loss in the amount of $600,000. Cash was paid in the amount of $39,200,000 and accounts payable increased by S600,000. 8. Depreciation was charged in the amount of $2 100 00, one-third of that amount was charged each to instruction, institutional support, and auxiliary enterprises. 9. Interest income was earned as follows: addition to temporarily restricted net assets, $30,000; addition to permanently restricted net assets, $35,000 Of those amounts, $55,000 was received in cash and S10,000 was accrued at year-end. 10. Research expense was incurred in the amount of $1.700,000, and prop- erty, plant, and equipment were acquired in the amount of S1.400.000. Both were paid in cash. 11. Reclassifications were made from temporarily restricted to unrestricted net assets as follows: on the basis of time restrictions, S1.600000; for program restrictions (research), $1,700,000; and for fixed asset acquisi- tion restrictions, $1,400,000. Korner records fixed assets as increases in unrestricted net assets. 12. Long-term investments, with a carrying value of S1,700,000, were sold for $1,770,000. Of the $70,000 gain, $40,000 was temporarily restricted by donor agreement and $30,000 is required to be added to permanently restricted net assets. Additional investments were purchased in the amount of $3.970.000 Loans were made to students and faculty in the amount of $200,000. 14. In addition to 13 above, the board of trustees decided to purchase $2,000,000 in long-term investments, from unrestricted net assets, to cre- ate a quasi-endowment 15. At year-end, the fair value of investments increased by $530,000. Of that amount, $300,000 increased unrestricted net assets, $30,000 increase temporarily restricted net assets, and $200,000 increased permanently 16. $150,000 of the long-term debt was reclassified as a current liability 17. Closing entries were prepared for (a) unrestricted net assets, (b) temp restricted net assets restricted net assets, and (c) permanently restricted net assets Required a. Prepare journal entries for each of the above transactions.bet and Other Changes in Unrestricted Net Assets for Korner College for te year ended June 30, 2015 b. Prepare a Statement of Unrestricted Revenues, Expenses for the fisal pare a Statement of Changes in Net Assets for Korner College for the fiscal year ended June 30, 2015. c. Pre pare a Statement of Financial Position for Korner College as of June 30, 2015. d. Pre e. Prepare a Statement of Cash Flows for Korner College for the year ended June 30, 2015. Use the indirect method