Question: Please solve all 3 questions ! Consider the following two projects: The net present value (NPV) of project B is closest to: A. 22.7 B.

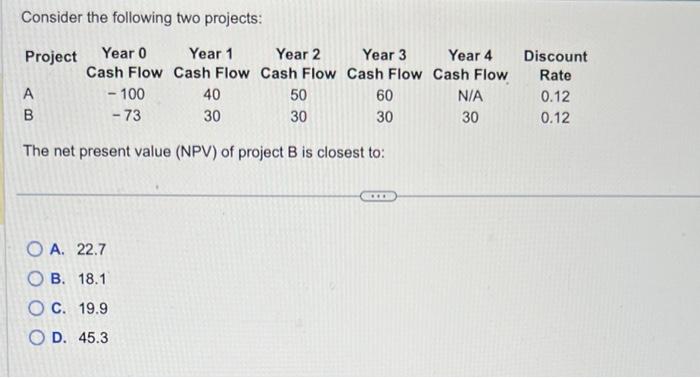

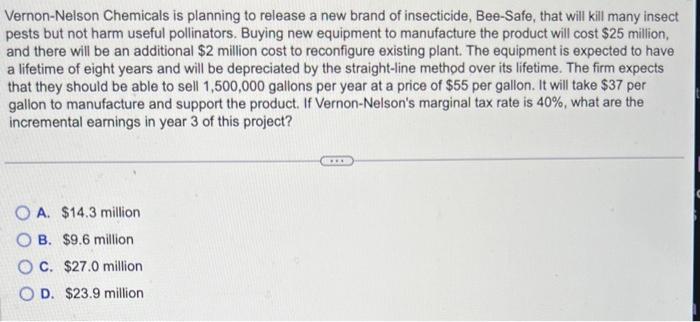

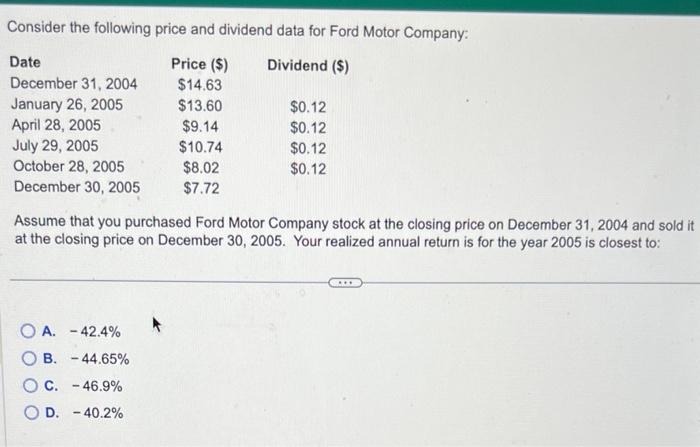

Consider the following two projects: The net present value (NPV) of project B is closest to: A. 22.7 B. 18.1 C. 19.9 D. 45.3 Vernon-Nelson Chemicals is planning to release a new brand of insecticide, Bee-Safe, that will kill many insect pests but not harm useful pollinators. Buying new equipment to manufacture the product will cost $25 million, and there will be an additional \$2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of eight years and will be depreciated by the straight-line method over its lifetime. The firm expects that they should be able to sell 1,500,000 gallons per year at a price of $55 per gallon. It will take $37 per gallon to manufacture and support the product. If Vernon-Nelson's marginal tax rate is 40%, what are the incremental earnings in year 3 of this project? A. $14.3 million B. $9.6 million C. $27.0 million D. $23.9 million Consider the following price and dividend data for Ford Motor Company: Assume that you purchased Ford Motor Company stock at the closing price on December 31, 2004 and sold it at the closing price on December 30, 2005. Your realized annual return is for the year 2005 is closest to: A. 42.4% B. 44.65% C. 46.9% D. 40.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts