Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all. Check # doesnt matter in this The following must be prepared and submitted: 1. Prepare the Leumal Entries - Handwritten 2. T-Accounts

please solve all. Check # doesnt matter in this

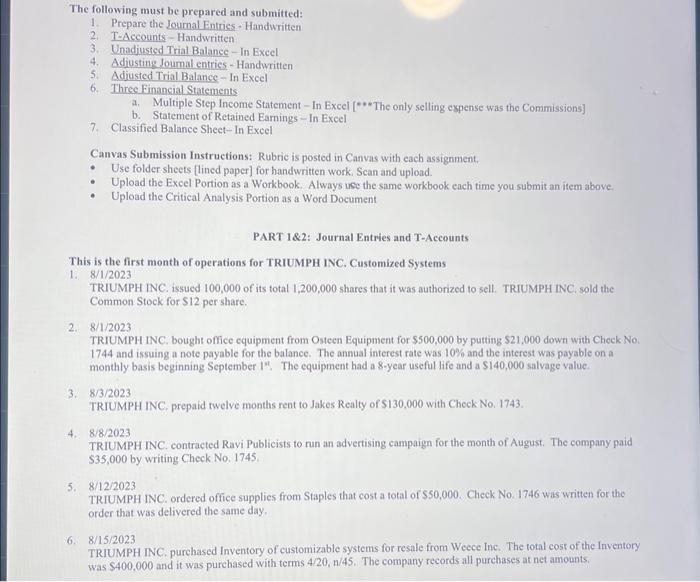

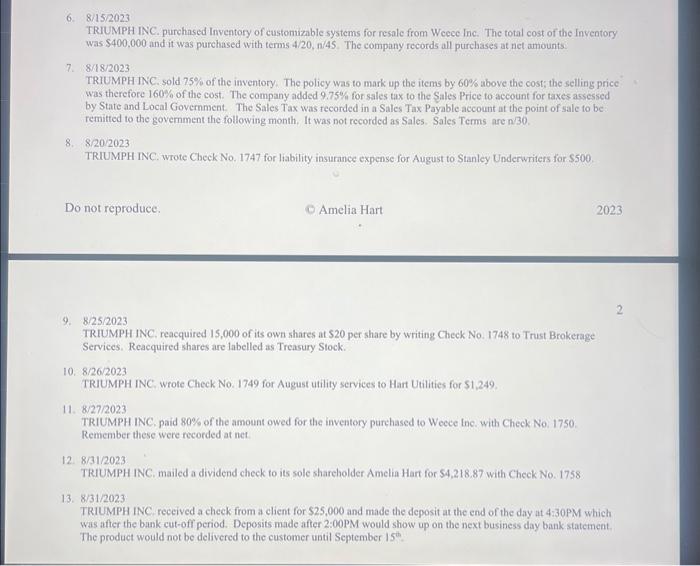

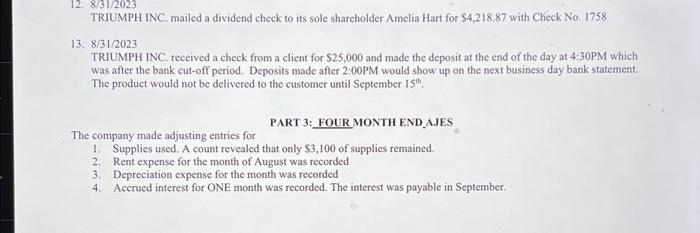

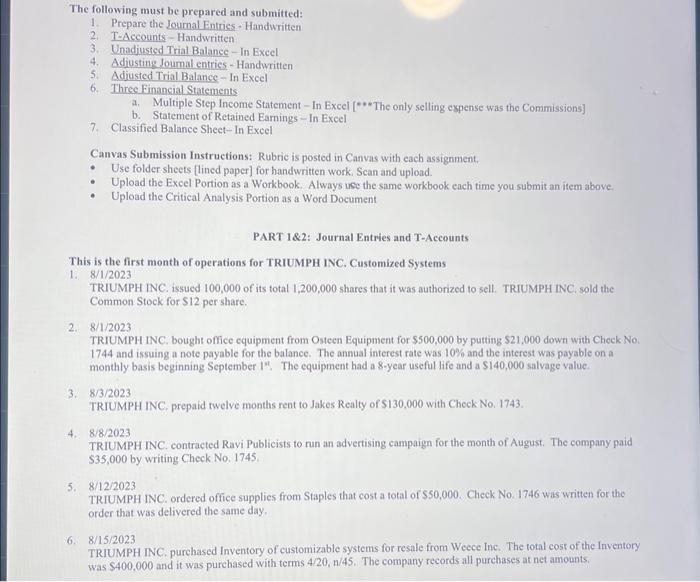

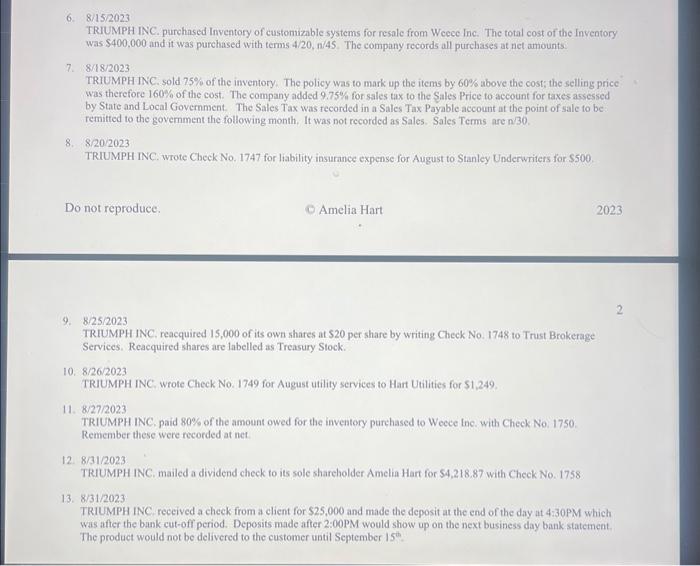

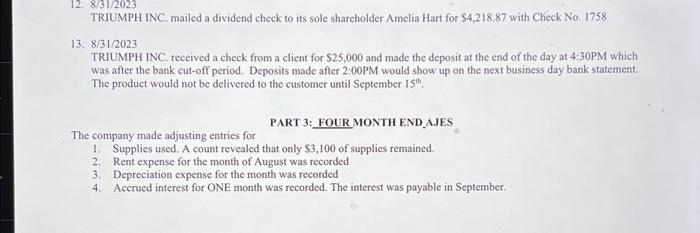

The following must be prepared and submitted: 1. Prepare the Leumal Entries - Handwritten 2. T-Accounts - Handwritten 3. Unadjusted Trial Balance - In Excel 4. Adiusting Joumal entries - Handwritten 5. Adiusted Trial Balance - In Excel 6. Three Financial Statements a. Multiple Step Income Statement - In Excel [** The only selling expense was the Commissions] b. Statement of Retained Earnings - In Excel 7. Classified Balance Sheet-In Excel Canvas Submission Instructions: Rubric is posted in Canvas with each assignment. - Use folder sheets [lined paper] for handwritten work. Scan and upload. - Upload the Excel Portion as a Workbook. Always use the same workbook each time you submit an item above. - Upload the Critical Analysis Portion as a Word Document PART 1\&2: Journal Entries and T-Accounts This is the first month of operations for TRIUMPH INC. Customized Systems 1. 8/1/2023 TRIUMPH INC. issued 100,000 of its total 1,200,000 shares that it was authorized to sell. TRIUMPH INC. sold the Common Stock for $12 per share. 2. 8/1/2023 TRIUMPH INC. bought office equipment from Osteen Equipment for $500,000 by putting $21,000 down with Check No. 1744 and issuing a note payable for the balance. The annual interest rate was 10% and the interest was payable on a monthly basis beginning September 1\%. The equipment had a 8 -year useful life and a $140,000 salvage value. 3. 8/3/2023 TRIUMPH INC. prepaid twelve months rent to Jakes Realty of $130,000 with Check No, 1743. 4. 8/8/2023 TRIUMPH INC. contracted Ravi Publicists to nu an advertising campaign for the month of August. The company paid $35,000 by writing Check No, 1745 . 5. 8/12/2023 TRIUMPH INC. ordered office supplies from Staples that cost a total of $50,000. Check No. 1746 was written for the order that was delivered the same day. 6. 8/15/2023 TRIUMPH INC. purchased Inventory of customizable systems for resale from Weece Inc. The total cost of the Inventory was $400,000 and it was purchased with terms 4/20,n/45. The company records all purchases at net amounts. 6. 8/15/2023 TRIUMPH INC. purchased Inventory of customizable systems for resale from Weeee Inc. The total cost of the Inventory was $400,000 and it was purchased with terms 4/20,n/45. The company records all purchases at net amounts 7. 8/18/2023 TRIUMPH INC. sold 75% of the inventory. The policy was to mark up the items by 60% above the cost; the selling price was therefore 160% of the cost. The company added 9.75% for sales tax to the Sales Price to account for taxes assessed by State and Local Government. The Sales Tax was recorded in a Sales Tax Payable account at the point of sale to be: remitted to the govemment the following month, It was not recorded as Sales. Sales Terms are N/30. 8. 8/20/2023 TRIUMPH INC. wrote Check No. 1747 for liability insurance expense for August to Stanley Underwriters for $500. Do not reproduce. Amelia Hart 2023 9. 8/25/2023 2 TRIUMPH INC, reacquired 15,000 of its own shares at $20 per share by writing Check No. 1748 to Trust Brokerage Services. Reacquired shares are labelled as Treasury Stock. 10. 8/26/2023 TRIUMPH INC, wrote Check No. 1749 for August utility services to Hart Utilities for $1,249. 11. 8/27/2023 TRIUMPH INC, paid 80% of the amount owed for the inventory purchased to Weece ine. with Check No. 1750. Remember these were recorded at net. 12. 8/31/2023 TRIUMPH INC. mailed a dividend check to its sole shareholder Amelia Hart for 54,218,87 with Check No. 1758 13. 8/31/2023 TRIUMPH INC. received a check from a client for $25,000 and made the deposit at the end of the day at 4:30PM which was after the bank cut-off period. Deposits made after 2:00PM would show up on the next business day bank statement. The product would not be delivered to the customer until September 15th.. 12. 8/31/2023 TRIUMPH INC, mailed a dividend check to its sole shareholder Amelia Hart for $4,218,87 with Check No. 1758 13. 8/31/2023 TRIUMPH INC. received a check from a client for $25,000 and made the deposit at the end of the day at 4:30PM which was after the bank cut-off period. Deposits made after 2:00PM would show up on the next business day bank statement. The product would not be delivered to the customer until September 15th. PART 3: FOUR MONTH END_A.JES The company made adjusting entries for 1. Supplies used. A count revealed that only $3,100 of supplies remained. 2. Rent expense for the month of August was recorded 3. Depreciation expense for the month was recorded 4. Accrued interest for ONE month was recorded. The interest was payable in September. The following must be prepared and submitted: 1. Prepare the Leumal Entries - Handwritten 2. T-Accounts - Handwritten 3. Unadjusted Trial Balance - In Excel 4. Adiusting Joumal entries - Handwritten 5. Adiusted Trial Balance - In Excel 6. Three Financial Statements a. Multiple Step Income Statement - In Excel [** The only selling expense was the Commissions] b. Statement of Retained Earnings - In Excel 7. Classified Balance Sheet-In Excel Canvas Submission Instructions: Rubric is posted in Canvas with each assignment. - Use folder sheets [lined paper] for handwritten work. Scan and upload. - Upload the Excel Portion as a Workbook. Always use the same workbook each time you submit an item above. - Upload the Critical Analysis Portion as a Word Document PART 1\&2: Journal Entries and T-Accounts This is the first month of operations for TRIUMPH INC. Customized Systems 1. 8/1/2023 TRIUMPH INC. issued 100,000 of its total 1,200,000 shares that it was authorized to sell. TRIUMPH INC. sold the Common Stock for $12 per share. 2. 8/1/2023 TRIUMPH INC. bought office equipment from Osteen Equipment for $500,000 by putting $21,000 down with Check No. 1744 and issuing a note payable for the balance. The annual interest rate was 10% and the interest was payable on a monthly basis beginning September 1\%. The equipment had a 8 -year useful life and a $140,000 salvage value. 3. 8/3/2023 TRIUMPH INC. prepaid twelve months rent to Jakes Realty of $130,000 with Check No, 1743. 4. 8/8/2023 TRIUMPH INC. contracted Ravi Publicists to nu an advertising campaign for the month of August. The company paid $35,000 by writing Check No, 1745 . 5. 8/12/2023 TRIUMPH INC. ordered office supplies from Staples that cost a total of $50,000. Check No. 1746 was written for the order that was delivered the same day. 6. 8/15/2023 TRIUMPH INC. purchased Inventory of customizable systems for resale from Weece Inc. The total cost of the Inventory was $400,000 and it was purchased with terms 4/20,n/45. The company records all purchases at net amounts. 6. 8/15/2023 TRIUMPH INC. purchased Inventory of customizable systems for resale from Weeee Inc. The total cost of the Inventory was $400,000 and it was purchased with terms 4/20,n/45. The company records all purchases at net amounts 7. 8/18/2023 TRIUMPH INC. sold 75% of the inventory. The policy was to mark up the items by 60% above the cost; the selling price was therefore 160% of the cost. The company added 9.75% for sales tax to the Sales Price to account for taxes assessed by State and Local Government. The Sales Tax was recorded in a Sales Tax Payable account at the point of sale to be: remitted to the govemment the following month, It was not recorded as Sales. Sales Terms are N/30. 8. 8/20/2023 TRIUMPH INC. wrote Check No. 1747 for liability insurance expense for August to Stanley Underwriters for $500. Do not reproduce. Amelia Hart 2023 9. 8/25/2023 2 TRIUMPH INC, reacquired 15,000 of its own shares at $20 per share by writing Check No. 1748 to Trust Brokerage Services. Reacquired shares are labelled as Treasury Stock. 10. 8/26/2023 TRIUMPH INC, wrote Check No. 1749 for August utility services to Hart Utilities for $1,249. 11. 8/27/2023 TRIUMPH INC, paid 80% of the amount owed for the inventory purchased to Weece ine. with Check No. 1750. Remember these were recorded at net. 12. 8/31/2023 TRIUMPH INC. mailed a dividend check to its sole shareholder Amelia Hart for 54,218,87 with Check No. 1758 13. 8/31/2023 TRIUMPH INC. received a check from a client for $25,000 and made the deposit at the end of the day at 4:30PM which was after the bank cut-off period. Deposits made after 2:00PM would show up on the next business day bank statement. The product would not be delivered to the customer until September 15th.. 12. 8/31/2023 TRIUMPH INC, mailed a dividend check to its sole shareholder Amelia Hart for $4,218,87 with Check No. 1758 13. 8/31/2023 TRIUMPH INC. received a check from a client for $25,000 and made the deposit at the end of the day at 4:30PM which was after the bank cut-off period. Deposits made after 2:00PM would show up on the next business day bank statement. The product would not be delivered to the customer until September 15th. PART 3: FOUR MONTH END_A.JES The company made adjusting entries for 1. Supplies used. A count revealed that only $3,100 of supplies remained. 2. Rent expense for the month of August was recorded 3. Depreciation expense for the month was recorded 4. Accrued interest for ONE month was recorded. The interest was payable in September

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started