please solve all of the questions

please solve all of the questions

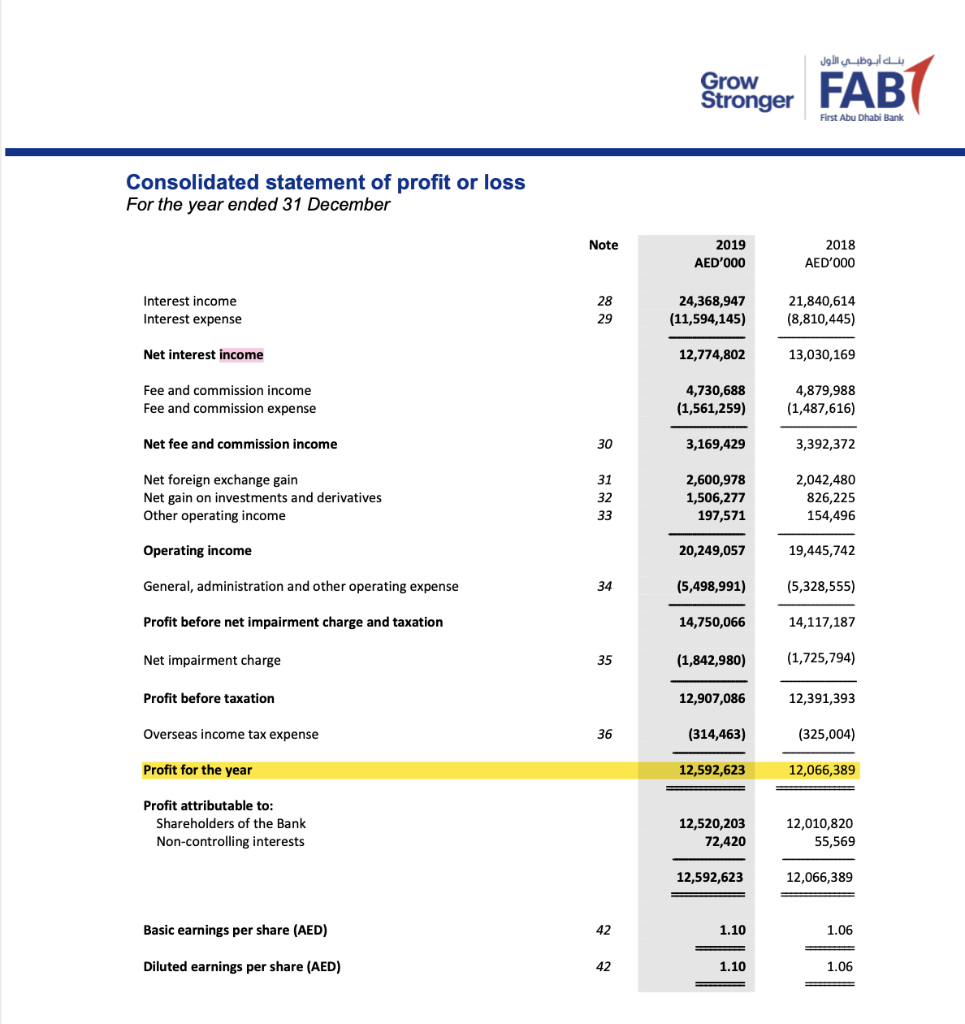

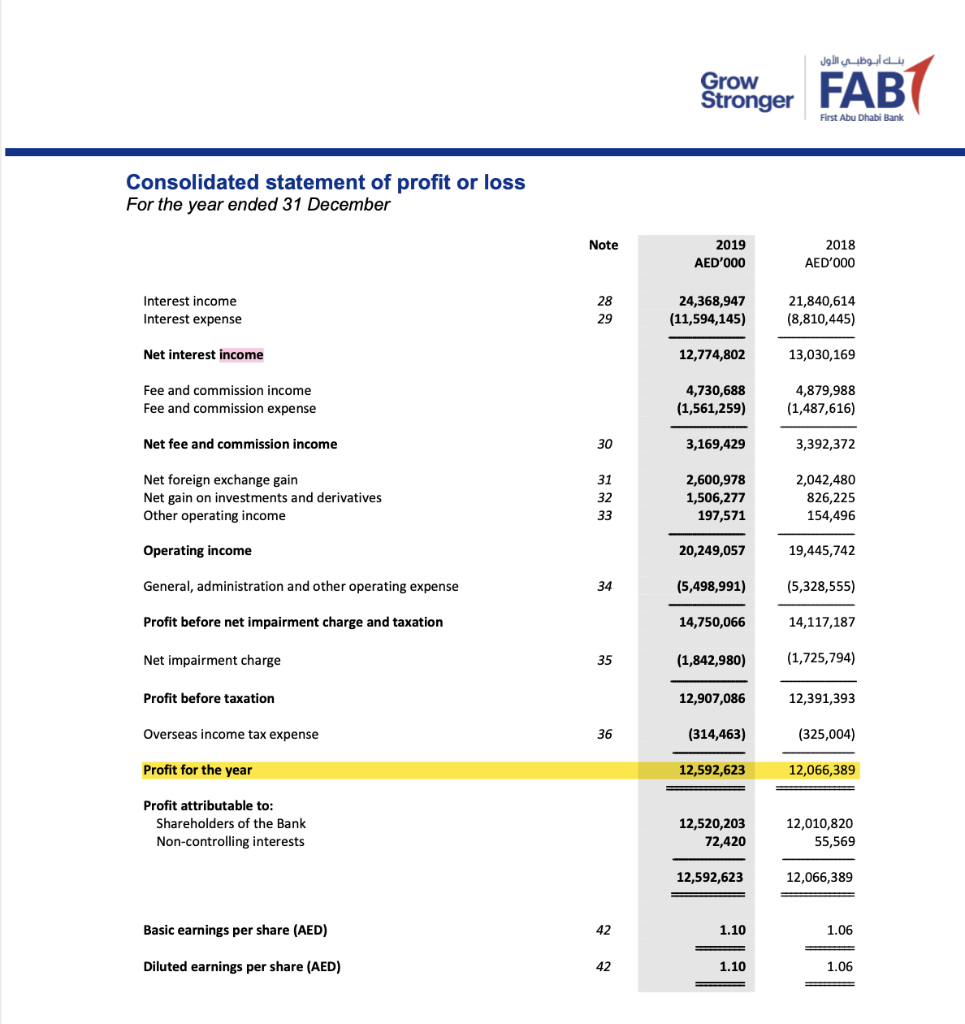

Grow Stronger FAB First Abu Dhabi Bank Consolidated statement of profit or loss For the year ended 31 December Note 2019 AED'000 2018 AED'000 Interest income Interest expense 28 29 24,368,947 (11,594,145) 21,840,614 (8,810,445) Net interest income 12,774,802 13,030,169 Fee and commission income Fee and commission expense 4,730,688 (1,561,259) 4,879,988 (1,487,616) Net fee and commission income 30 3,169,429 3,392,372 Net foreign exchange gain Net gain on investments and derivatives Other operating income 31 32 33 2,600,978 1,506,277 197,571 2,042,480 826,225 154,496 Operating income 20,249,057 19,445,742 General, administration and other operating expense 34 (5,498,991) (5,328,555) Profit before net impairment charge and taxation 14,750,066 14,117,187 Net impairment charge 35 (1,842,980) (1,725,794) Profit before taxation 12,907,086 12,391,393 Overseas income tax expense 36 (314,463) (325,004) Profit for the year 12,592,623 12,066,389 Profit attributable to: Shareholders of the Bank Non-controlling interests 12,520,203 72,420 12,010,820 55,569 12,592,623 12,066,389 Basic earnings per share (AED) 42 1.10 1.06 1: Diluted earnings per share (AED) 42 1.10 1.06 Use Balance Sheet an income statement of the FAB for the year 2019 to answer Questions 6-18 6. Using the information from income statement and balance sheet of FAB, what will be its ROE? 7. Using the information from income statement and balance sheet of FAB, calculate ROA. 8. Using the information from income statement and balance sheet of FAB, what will be the equity multiplier for FAB? 9. Using the information from income statement and balance sheet of FAB, calculate net interest margin for FAB. 10. Using the information from income statement and balance sheet of FAB, what will be the earning base for FAB? 11. Using the information from income statement and balance sheet of FAB, what will be the burden for FAB? 12. Using the information from income statement and balance sheet of FAB, calculate efficiency ratio for FAB. 13. Using the information from income statement and balance sheet of FAB, what will be total revenue for FAB? 14. Using the information from income statement and balance sheet of FAB, asset utilization ratio of for FAB. 15. Using the information from income statement and balance sheet of FAB, expense ratio for FAB. 16. Using the information from income statement and balance sheet of FAB, what will be interest expense ratio for FAB? 17. Using the information from income statement and balance sheet of FAB, what will be noninterest expense ratio for FAB? 18. Using the information from income statement and balance sheet of FAB, what will be PLL ratio for FAB? Grow Stronger FAB First Abu Dhabi Bank Consolidated statement of profit or loss For the year ended 31 December Note 2019 AED'000 2018 AED'000 Interest income Interest expense 28 29 24,368,947 (11,594,145) 21,840,614 (8,810,445) Net interest income 12,774,802 13,030,169 Fee and commission income Fee and commission expense 4,730,688 (1,561,259) 4,879,988 (1,487,616) Net fee and commission income 30 3,169,429 3,392,372 Net foreign exchange gain Net gain on investments and derivatives Other operating income 31 32 33 2,600,978 1,506,277 197,571 2,042,480 826,225 154,496 Operating income 20,249,057 19,445,742 General, administration and other operating expense 34 (5,498,991) (5,328,555) Profit before net impairment charge and taxation 14,750,066 14,117,187 Net impairment charge 35 (1,842,980) (1,725,794) Profit before taxation 12,907,086 12,391,393 Overseas income tax expense 36 (314,463) (325,004) Profit for the year 12,592,623 12,066,389 Profit attributable to: Shareholders of the Bank Non-controlling interests 12,520,203 72,420 12,010,820 55,569 12,592,623 12,066,389 Basic earnings per share (AED) 42 1.10 1.06 1: Diluted earnings per share (AED) 42 1.10 1.06 Use Balance Sheet an income statement of the FAB for the year 2019 to answer Questions 6-18 6. Using the information from income statement and balance sheet of FAB, what will be its ROE? 7. Using the information from income statement and balance sheet of FAB, calculate ROA. 8. Using the information from income statement and balance sheet of FAB, what will be the equity multiplier for FAB? 9. Using the information from income statement and balance sheet of FAB, calculate net interest margin for FAB. 10. Using the information from income statement and balance sheet of FAB, what will be the earning base for FAB? 11. Using the information from income statement and balance sheet of FAB, what will be the burden for FAB? 12. Using the information from income statement and balance sheet of FAB, calculate efficiency ratio for FAB. 13. Using the information from income statement and balance sheet of FAB, what will be total revenue for FAB? 14. Using the information from income statement and balance sheet of FAB, asset utilization ratio of for FAB. 15. Using the information from income statement and balance sheet of FAB, expense ratio for FAB. 16. Using the information from income statement and balance sheet of FAB, what will be interest expense ratio for FAB? 17. Using the information from income statement and balance sheet of FAB, what will be noninterest expense ratio for FAB? 18. Using the information from income statement and balance sheet of FAB, what will be PLL ratio for FAB

please solve all of the questions

please solve all of the questions