Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all of then Exercise C-9 (Algo) Calculate the present value of a single amount (LO C-3) Lights, Camera, and More sells filmmaking equipment.

please solve all of then

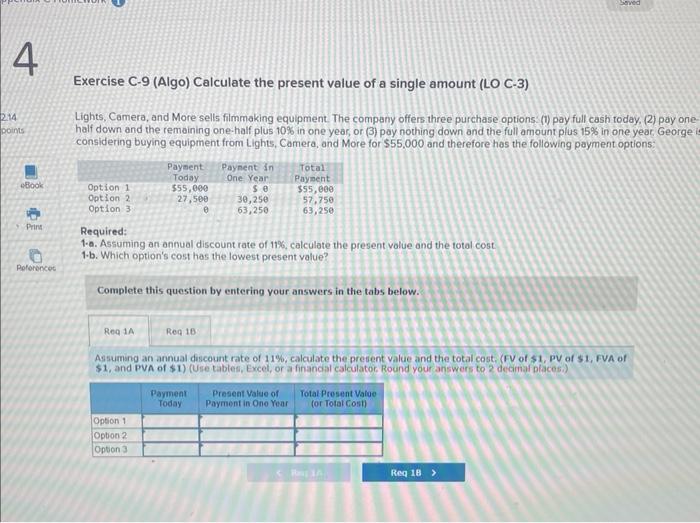

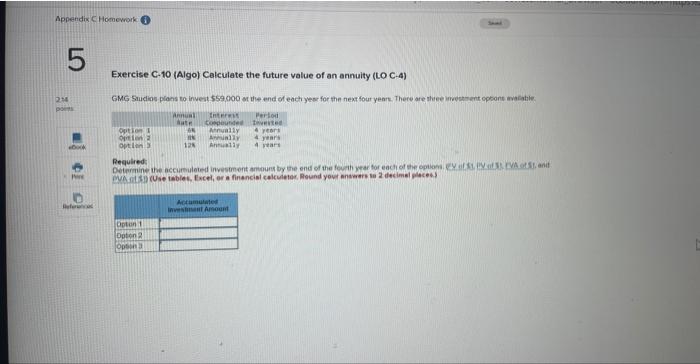

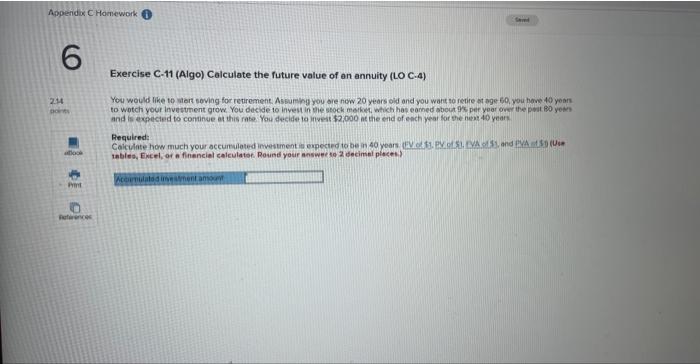

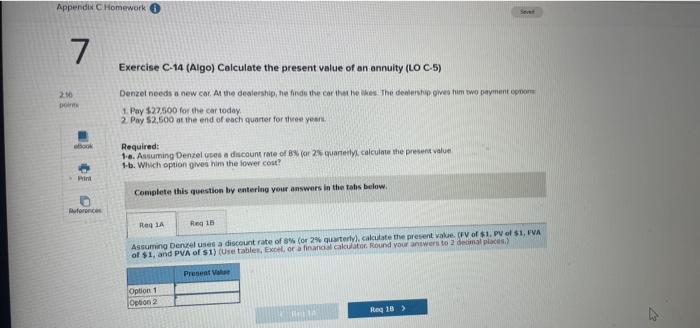

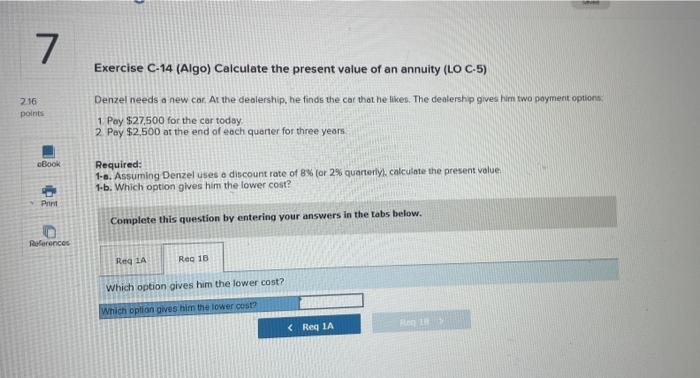

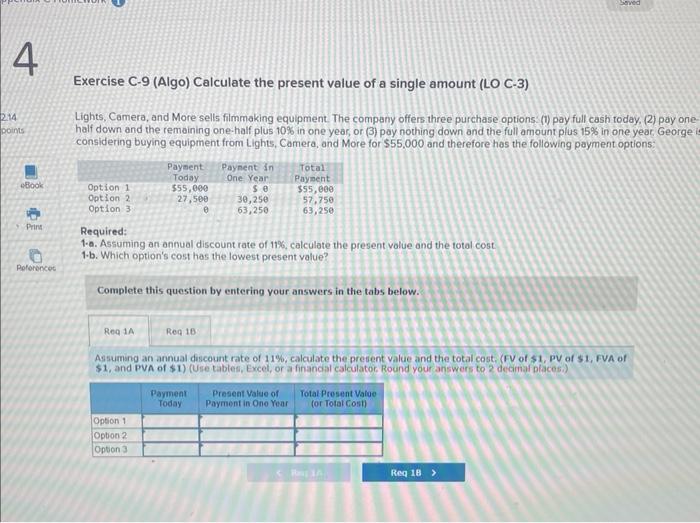

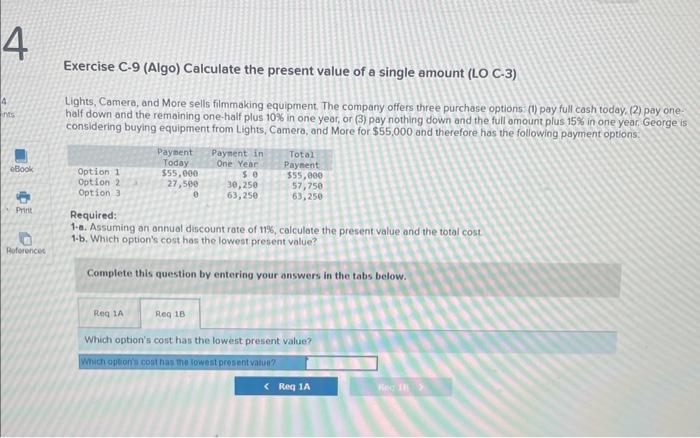

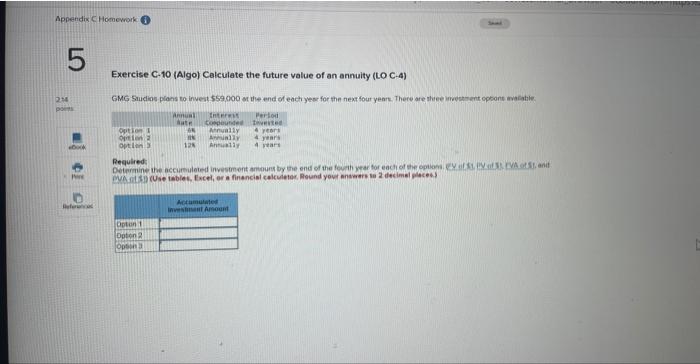

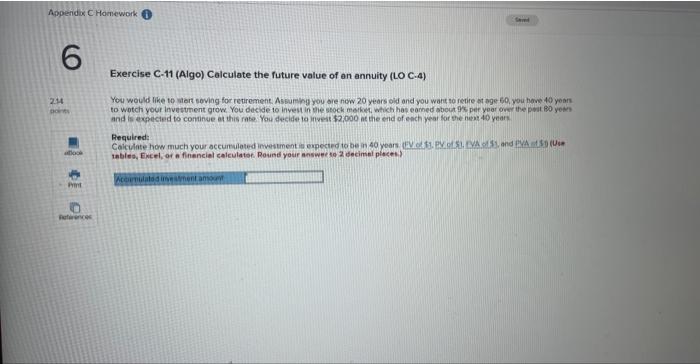

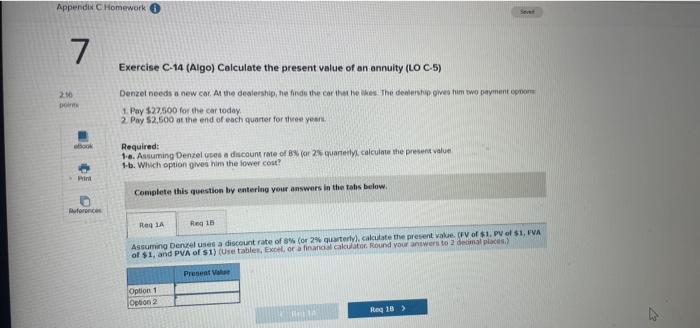

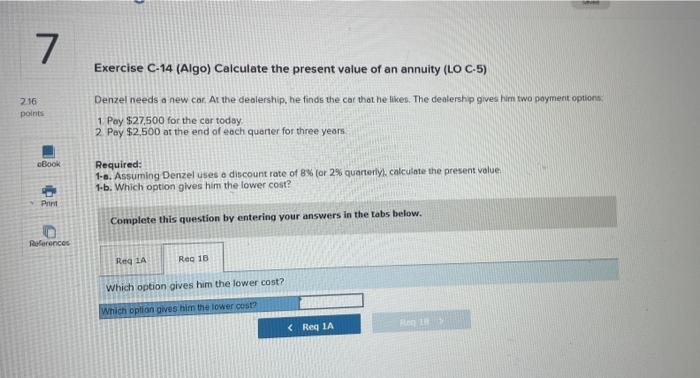

Exercise C-9 (Algo) Calculate the present value of a single amount (LO C-3) Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1) pay full cash today, (2) pay one half down and the remaining one-half plus 10% in one year, or (3) pay nothing down and the full amount plus 15% in one year. George considering buying equipment from Lights, Camera, and More for $55,000 and therefore has the following payment options: Required: 1. a. Assuming an aninual discount rate of 11%, calculate the present volue and the total cost 1.b. Which option's cost has the lowest present value? Complete this question by entering your answers in the tabs below. Assuming an annual discount rate of 11%, calculate the present value and the total cost, (FV of \$1, PV of \$1, FVA of $1, and pVA of \$1) (Use tables, Excel, or a financal calculator, Round your answers to 2 decimaf places.) Exercise C-9 (Algo) Calculate the present value of a single amount (LO C-3) Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1) pay full cash today, (2) pay onehalf down and the remaining one-half plus 10% in one year, or (3) pay nothing down and the full amount plus 15% in one year. George is considering buying equipment from Lights, Camera, and More for $55,000 and therefore has the following payment options: Required: 1.a. Assuming an annual discount rate of 11\%6, calculate the present value and the total cost 1.b. Which option's cost has the lowest present value? Complete this question by entering your answers in the tabs below. Which option's cost has the lowest present value? Exercise C10 (Algo) Calculate the future value of an annuity (LO C-4) GMG Sudias plans to invest 559,000 st the end of each yesc for the next four yente. There are thiee invertictent opsont avalithle. Regulied: Exercise C-11 (Algo) Calculate the future value of an annuity ( LO C.-4) You would like to atort soving foc retirement. Assuming you aie nen 20 years old and you wakt to retire of age 60 you heve 40 yoars to wotch your investrnent grow. You decide to inyelt in the stock molket, which has eamed about 9% per yoar ower the poit po yest Required: tables, Excel, of a finenciel calculater. Round your answee to 2 decimel piscen.) Exercise C.14 (Algo) Calculate the present value of an annuity (LO C.S) Denzef needs a new car. At the dealership, he finde the cat itat tie hhes. The denlership gives him two payment conorrim 1. Pay 427,500 for the car today. 2. Poy 52,500 at the end of each quarter for thees yesen. Required: 1.b. Whinch option gives him the iower cost? Comslete this gemstion by entering your answars in the tahs below, Assuming Derwel uses a discount rate of 3% (or 2% qiastertyl, calculate the present vake, (FY of $1, PU of $1, FVA Exercise C-14 (Algo) Calculate the present value of an annuity (LO C.5) Denzel needs a new cor, At the dealership, he finds the cat that he likes. The dealership gives him two payment options: 1. Pay $27,500 for the car today: 2. Pay $2,500 at the end of each quarter for three year Required: 1.a. Assuming Denzel uses a discount rate of 8% (or 2% quarterly. calculate the present velue 1.b. Which option gives him the lower cost? Complete this question by entering your answers in the tabs below. Which option gives him the lower cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started