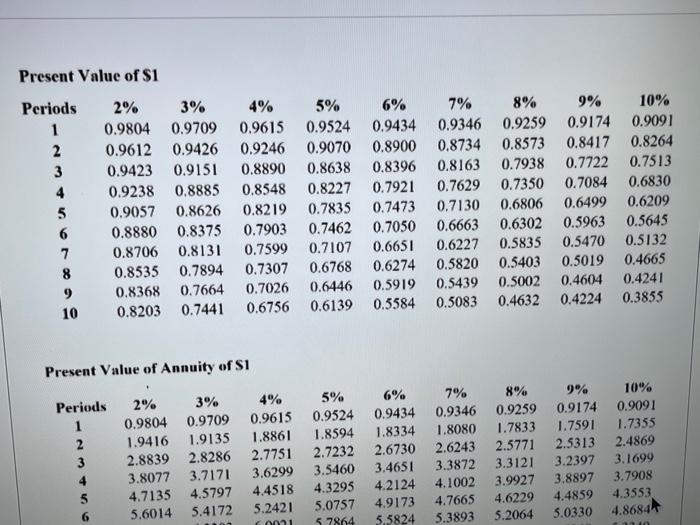

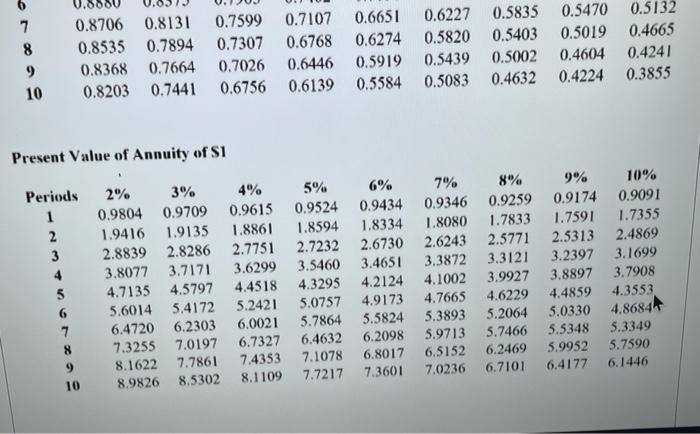

On January 1, 2020, ABC Company issued bonds with a face value of $1,000 and a coupon rate of 8 percent. The bonds mature in 2 years and pay interest on June 30 and December 31 each year. The market rate is 12% annually. The present value of $1 table and the present value of annuity of $1 table are provided at the end of this quiz. Round your final answers to the nearest whole dollar. What is the issue price of the bonds? Tohle Were the bonds issued at a discount, at par, or at a premium? Suppose ABC uses straight-line amortization method, what is the interest expense to be recorded on June 30, 2020? Round your final answers to the nearest whole dollar. Present Value of $1 Periods 2% 3% 4% 5% 6% 7% 8% 9% 1 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 2 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 3 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 4 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 5 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 6 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 7 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 8 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 9 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 10 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 Present Value of Annuity of S1 Periods 2% 3% 0.9804 0.9709 1.9416 1.9135 2.8839 2.8286 3.8077 3.7171 4.7135 4.5797 5.6014 5.4172 4% 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 (0021 5% 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 57864 3 4 6% 0.9434 1.8334 2.6730 3.4651 4.2124 4.9173 5.5824 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 7% 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 9% 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 10% 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 7 8 9 10 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 Present Value of Annuity of S1 Periods 1 2 3 4 5 6 7 8 2% 3% 4% 5% 0.9804 0.9709 0.9615 0.9524 1.9416 1.9135 1.8861 1.8594 2.8839 2.8286 2.7751 2.7232 3.8077 3.7171 3.6299 3.5460 4.7135 4.5797 4.4518 4.3295 5.6014 5.4172 5.2421 5.0757 6.4720 6.2303 6.0021 5.7864 7.3255 7.0197 6.7327 6.4632 8.1622 7.7861 7.4353 7.1078 8.9826 8.5302 8.1109 7.7217 6% 7% 0.9434 0.9346 1.8334 1.8080 2.6730 2.6243 3.4651 3.3872 4.2124 4.1002 4.9173 4.7665 5.5824 5.3893 6.2098 5.9713 6.8017 6.5152 7.3601 7.0236 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 9% 10% 0.9174 0.9091 1.7591 1.7355 2.5313 2.4869 3.2397 3.1699 3.8897 3.7908 4.4859 4.3553 5.0330 4.8684 5.5348 5.3349 5.9952 5.7590 6.4177 6.1446 9 10