Answered step by step

Verified Expert Solution

Question

1 Approved Answer

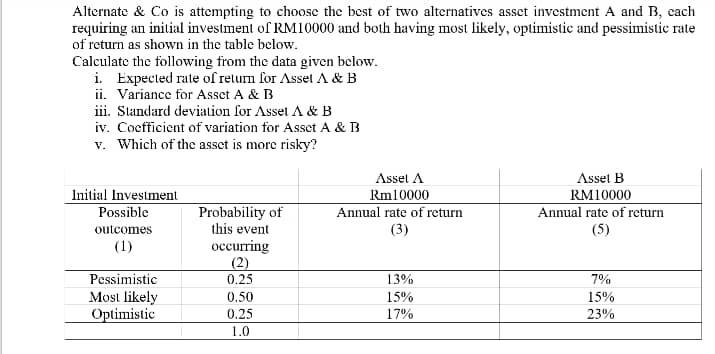

Please solve all parts. Sure, thumbs up :-) Thanks. Alternate & Co is attempting to choose the best of two alternatives asset investment A and

Please solve all parts. Sure, thumbs up :-)

Thanks.

Alternate & Co is attempting to choose the best of two alternatives asset investment A and B, cach requiring an initial investment of RM10000 and both having most likely, optimistic and pessimistic rate of return as shown in the table below. Calculate the following from the data given below. i. Expected rate of relum for Assel A&B ii. Variance for Asset A&B iii. Standard deviation for Asset A&B iv. Coefficient of variation for Asset A&B V. Which of the asset is more risky? Initial Investment Possible outcomes (1) Assel A Rm10000 Annual rate of return (3) Asset B RM10000 Annual rate of return (5) Probability of this event occurring (2) 0.25 0.50 0.25 1.0 Pessimistic Most likely Optimistic 13% 15% 17% 7% 15% 23%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started