Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all parts with steps A professor recently received an unexpected $10. Being a savvy investor, the professor decided to invest the $10 into

please solve all parts with steps

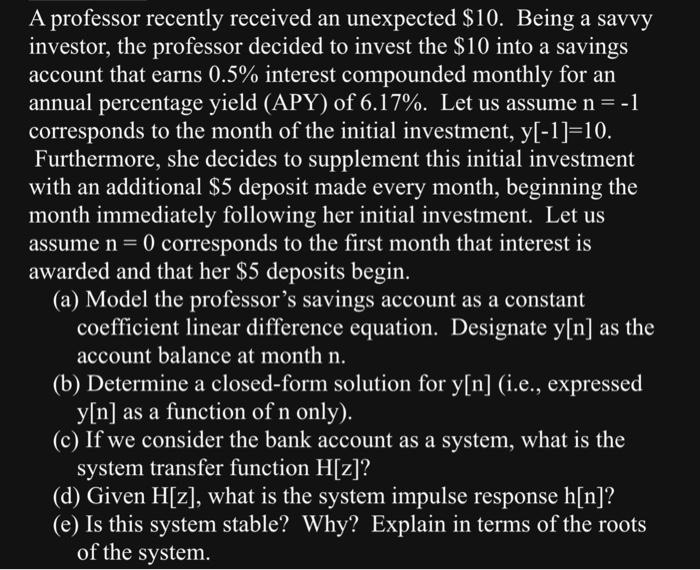

A professor recently received an unexpected $10. Being a savvy investor, the professor decided to invest the $10 into a savings account that earns 0.5% interest compounded monthly for an annual percentage yield (APY) of 6.17%. Let us assume n=1 corresponds to the month of the initial investment, y[1]=10. Furthermore, she decides to supplement this initial investment with an additional $5 deposit made every month, beginning the month immediately following her initial investment. Let us assume n=0 corresponds to the first month that interest is awarded and that her $5 deposits begin. (a) Model the professor's savings account as a constant coefficient linear difference equation. Designate y[n] as the account balance at month n. (b) Determine a closed-form solution for y[n] (i.e., expressed y[n] as a function of n only). (c) If we consider the bank account as a system, what is the system transfer function H[z] ? (d) Given H[z], what is the system impulse response h[n] ? (e) Is this system stable? Why? Explain in terms of the roots of the system

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started