Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all questions 10. The accounting for interest costs incurred during construction recommended under IFRS is to a. capitalize no interest charges during construction.

please solve all questions

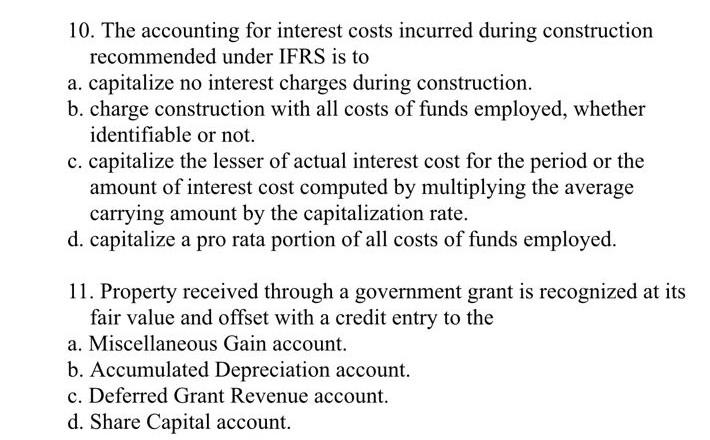

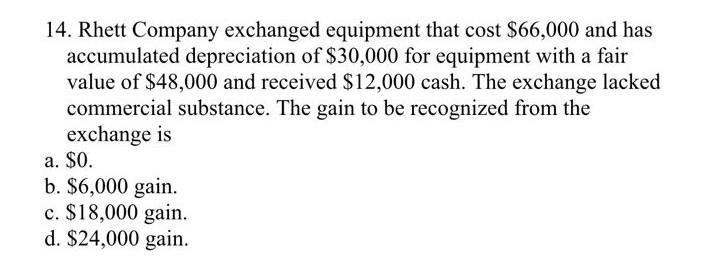

10. The accounting for interest costs incurred during construction recommended under IFRS is to a. capitalize no interest charges during construction. b. charge construction with all costs of funds employed, whether identifiable or not. c. capitalize the lesser of actual interest cost for the period or the amount of interest cost computed by multiplying the average carrying amount by the capitalization rate. d. capitalize a pro rata portion of all costs of funds employed. 11. Property received through a government grant is recognized at its fair value and offset with a credit entry to the 14. Rhett Company exchanged equipment that cost $66,000 and has accumulated depreciation of $30,000 for equipment with a fair value of $48,000 and received $12,000 cash. The exchange lacked commercial substance. The gain to be recognized from the exchange is a. $0. b. $6,000 gain. c. $18,000 gain. d. $24,000 gainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started