Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all questions FIN500: Exercises on Bonds Valuation (Chapter 6) Question 1: Les Company is about to issue a bond with semiannual coupon payments,

Please solve all questions

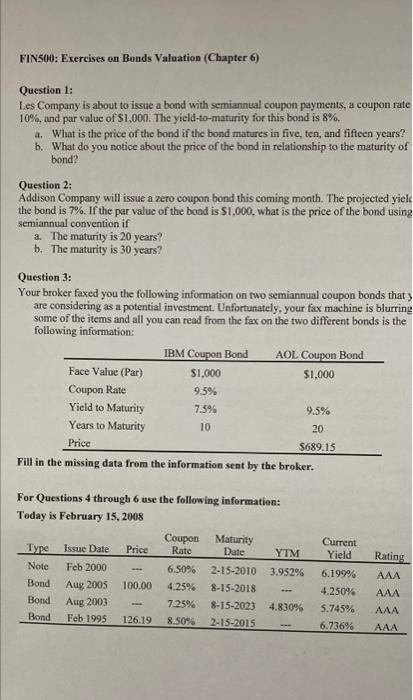

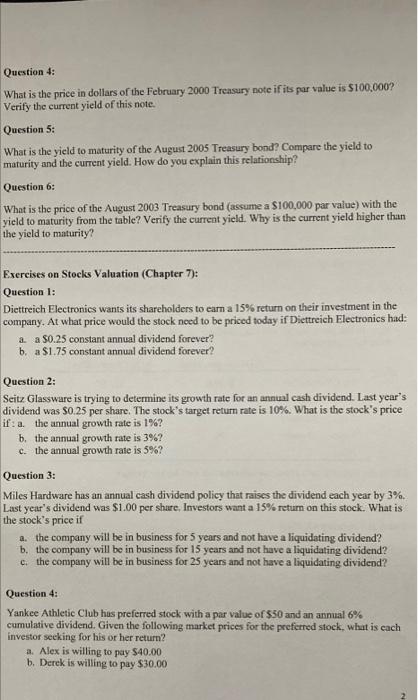

FIN500: Exercises on Bonds Valuation (Chapter 6) Question 1: Les Company is about to issue a bond with semiannual coupon payments, a coupon rate 10%, and par value of S1,000. The yield-to-maturity for this bond is 8%. a. What is the price of the bond if the bond matures in five, ten, and fifteen years? b. What do you notice about the price of the bond in relationship to the maturity of bond? Question 2: Addison Company will issue a zero coupon bond this coming month. The projected yiel the bond is 7%. If the par value of the bond is $1,000, what is the price of the bond using semiannual convention if a. The maturity is 20 years? b. The maturity is 30 years? Question 3: Your broker faxed you the following information on two semiannual coupon bonds that are considering as a potential investment. Unfortunately, your fax machine is blurring some of the items and all you can read from the fax on the two different bonds is the following information: IBM Coupon Bond AOL Coupon Bond Face Value (Par) $1.000 $1.000 Coupon Rate 9.5% Yield to Maturity 7.596 9.5% Years to Maturity 10 20 Price $689.15 Fill in the missing data from the information sent by the broker. For Questions 4 through 6 use the following information: Today is February 15, 2008 Coupon Maturity Type Issue Date Price Rate Date YTM Note Feb 2000 6.50% 2-15-2010 3.95296 Bond 100.00 4.25% 8-15-2018 Bond Aug 2003 7.25% 8-15-2023 4.830% Bond Feb 1995 126.19 8.50% 2-15-2015 Current Yield Rating AAA AAA Aug 2005 6.199% 4.250% 5.745% 6.736% AAA AAA Question 4: What is the price in dollars of the February 2000 Treasury note if its par value is $100,000? Verify the current yield of this note. Question 5: What is the yield to maturity of the August 2005 Treasury bond? Compare the yield to maturity and the current yield. How do you explain this relationship? Question 6: What is the price of the August 2003 Treasury bond (assume a $100,000 par value) with the yield to maturity from the table? Verify the current yield. Why is the current yield higher than the yield to maturity? Exercises on Stocks Valuation (Chapter 7): Question 1: Diettreich Electronics wants its shareholders to earn a 15% return on their investment in the company. At what price would the stock need to be priced today if Diettreich Electronics had: a. a $0.25 constant annual dividend forever? b. a $1.75 constant annual dividend forever? Question 2: Seitz Glassware is trying to determine its growth rate for an annual cash dividend. Last year's dividend was $0.25 per share. The stock's target return rate is 10%. What is the stock's price if:a. the annual growth rate is 1%? b. the annual growth rate is 3%? c. the annual growth rate is 5%? Question 3: Miles Hardware has an annual cash dividend policy that raises the dividend each year by 3% Last year's dividend was $1.00 per share. Investors want a 15% return on this stock. What is the stock's price if a. the company will be in business for 5 years and not have a liquidating dividend? b. the company will be in business for 15 years and not have a liquidating dividend? c. the company will be in business for 25 years and not have a liquidating dividend? Question 4: Yankee Athletic Club hus preferred stock with a par value of $50 and an annual 6% cumulative dividend. Given the following market prices for the preferred stock, what is cach investor seeking for his or her return? a. Alex is willing to pay $40.00 b. Derek is willing to pay $30.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started