Answered step by step

Verified Expert Solution

Question

1 Approved Answer

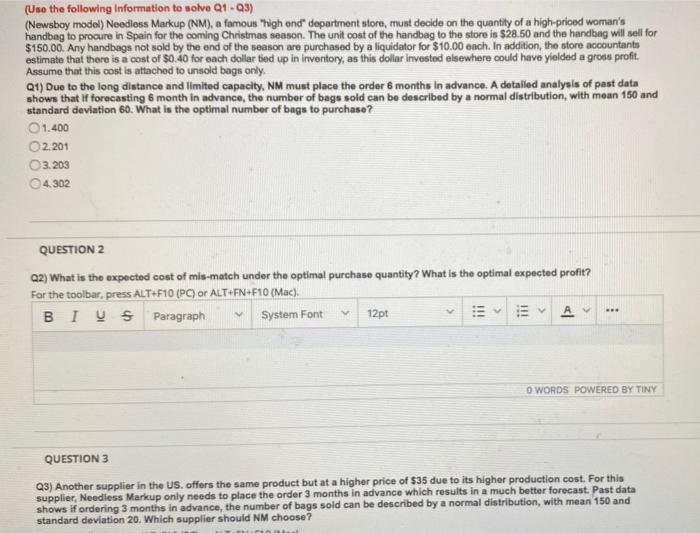

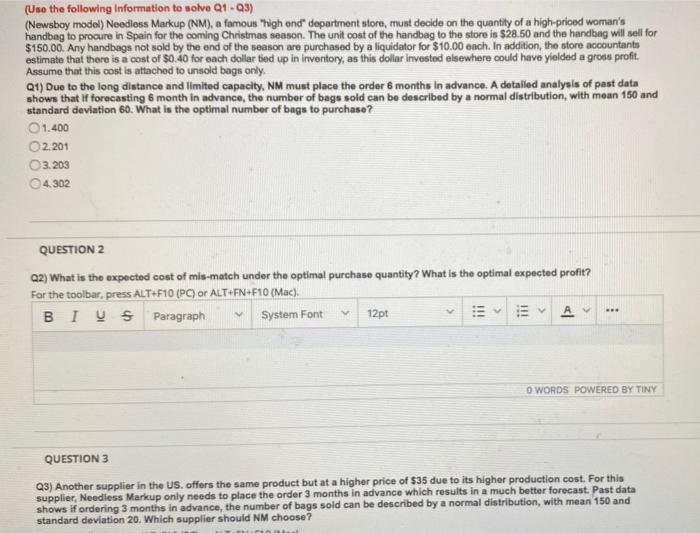

please solve all questions. thank you. (Use the following Information to solve Q1-Q3) (Newsboy model) Needless Markup (NM), a famous high end department store, must

please solve all questions. thank you.

(Use the following Information to solve Q1-Q3) (Newsboy model) Needless Markup (NM), a famous "high end" department store, must decide on the quantity of a high-priced woman's handbag to procure in Spain for the coming Christmas season. The unit cost of the handbag to the store is $28.50 and the handbag will sell for $150.00. Any handbags not sold by the end of the season are purchased by a liquidator for $10.00 each. In addition, the store accountants estimate that there is a cost of $0. 40 for each dollar tied up in inventory, as this dollar invested elsewhere could have yielded a gross profit. Assume that this cost is attached to unsold bags only. Q1) Due to the long distance and Ilmited capacity, NM must place the order 6 months In advance. A detalled analysis of past data shows that if forecasting 6 month in advance, the number of bags sold can be described by a normal distribution, with mean 150 and standard deviation 60 . What is the optimal number of bags to purchase? 1.400 2.201 3.203 4.302 QUESTION 2 Q2) What is the expected cost of mis-match under the optimal purchase quantity? What is the optimal expected profit? QUESTION 3 Q3) Another supplier in the US. offers the same product but at a higher price of $35 due to its higher production cost. For this supplier, Neediess Markup only needs to place the order 3 months in advance which results in a much better forecast. Past data shows if ordering 3 months in advance, the number of bags sold can be described by a normal distribution, with mean 150 and standard deviation 20 . Which supplier should NM choose? (Use the following Information to solve Q1-Q3) (Newsboy model) Needless Markup (NM), a famous "high end" department store, must decide on the quantity of a high-priced woman's handbag to procure in Spain for the coming Christmas season. The unit cost of the handbag to the store is $28.50 and the handbag will sell for $150.00. Any handbags not sold by the end of the season are purchased by a liquidator for $10.00 each. In addition, the store accountants estimate that there is a cost of $0. 40 for each dollar tied up in inventory, as this dollar invested elsewhere could have yielded a gross profit. Assume that this cost is attached to unsold bags only. Q1) Due to the long distance and Ilmited capacity, NM must place the order 6 months In advance. A detalled analysis of past data shows that if forecasting 6 month in advance, the number of bags sold can be described by a normal distribution, with mean 150 and standard deviation 60 . What is the optimal number of bags to purchase? 1.400 2.201 3.203 4.302 QUESTION 2 Q2) What is the expected cost of mis-match under the optimal purchase quantity? What is the optimal expected profit? QUESTION 3 Q3) Another supplier in the US. offers the same product but at a higher price of $35 due to its higher production cost. For this supplier, Neediess Markup only needs to place the order 3 months in advance which results in a much better forecast. Past data shows if ordering 3 months in advance, the number of bags sold can be described by a normal distribution, with mean 150 and standard deviation 20 . Which supplier should NM choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started