Answered step by step

Verified Expert Solution

Question

1 Approved Answer

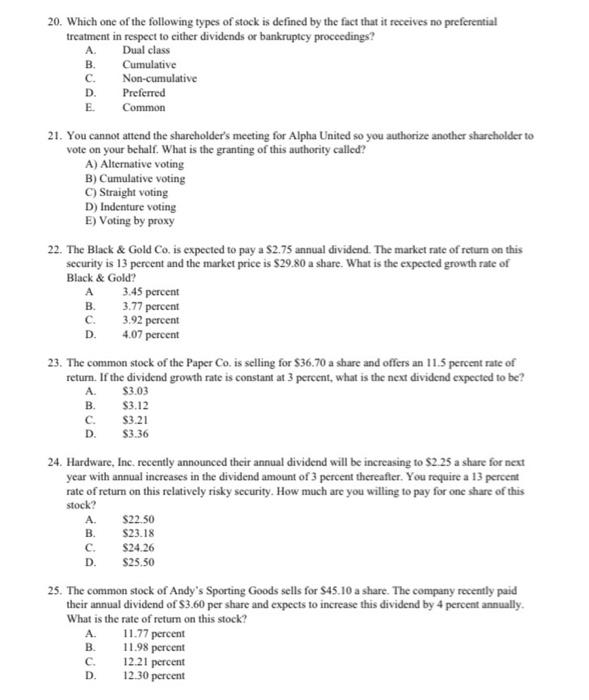

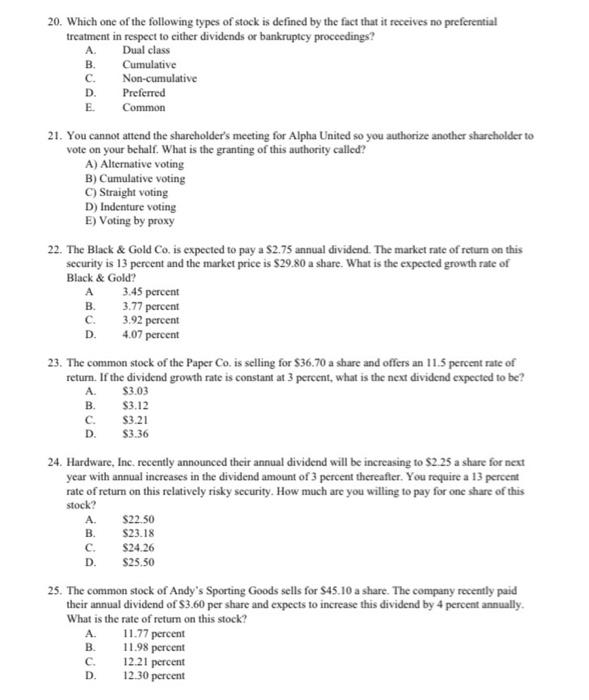

please solve all questions, will leave very good ratings. show work if need be A B 20. Which one of the following types of stock

please solve all questions, will leave very good ratings. show work if need be

A B 20. Which one of the following types of stock is defined by the fact that it receives no preferential treatment in respect to cither dividends or bankruptcy proceedings? Dual class Cumulative C. Non-cumulative D. Preferred E. Common 21. You cannot attend the shareholder's meeting for Alpha United so you authorize another sharcholder to vote on your behalf. What is the granting of this authority called? A) Alternative voting B) Cumulative voting C) Straight voting D) Indenture voting E) Voting by proxy 22. The Black & Gold Co. is expected to pay a $2.75 annual dividend. The market rate of return on this security is 13 percent and the market price is $29.80 a share. What is the expected growth rate of Black & Gold? A 3.45 percent B. 3.77 percent C. 3.92 percent D. 4.07 percent 23. The common stock of the Paper Co. is selling for $36.70 a share and offers an 11.5 percent rate of return. If the dividend growth rate is constant at 3 percent, what is the next dividend expected to be? A $3.03 B. $3.12 $3.21 $3.36 24. Hardware, Inc. recently announced their annual dividend will be increasing to $2.25 a share for next year with annual increases in the dividend amount of 3 percent thereafter. You require a 13 percent rate of retum on this relatively risky security. How much are you willing to pay for one share of this stock? $22.50 $23.18 C. $24.26 D. $25.50 C D. A B 25. The common stock of Andy's Sporting Goods sells for $45.10 a share. The company recently paid their annual dividend of 83.60 per share and expects to increase this dividend by 4 percent annually. What is the rate of return on this stock? A. 11.77 percent 11.98 percent 12.21 percent 12.30 percent : B C D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started