Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all questions, will leave very good ratings. show work if need be A C. 6. You need some money today and the only

please solve all questions, will leave very good ratings. show work if need be

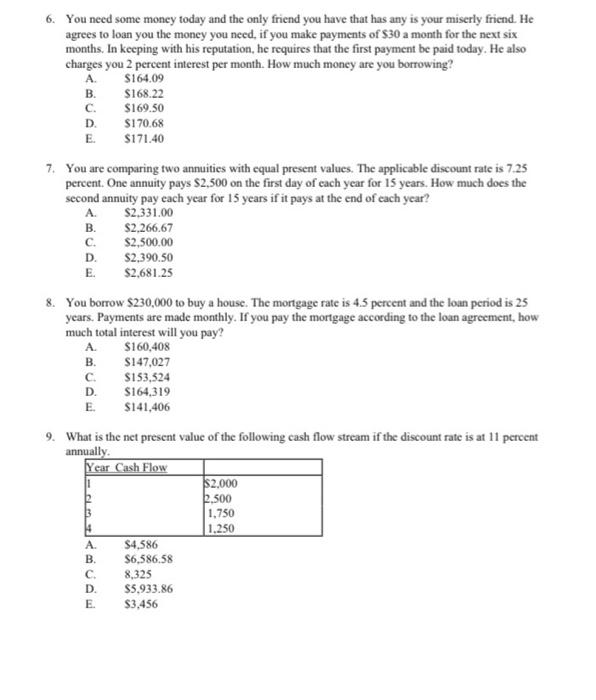

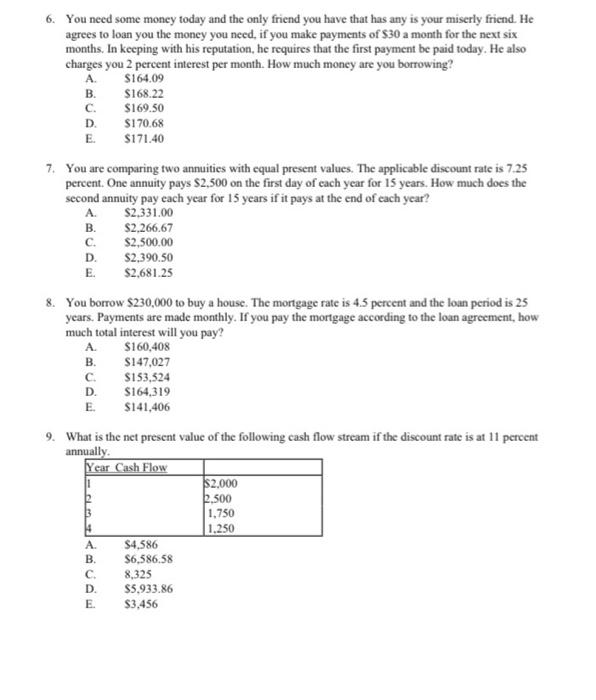

A C. 6. You need some money today and the only friend you have that has any is your miserly friend. He agrees to loan you the money you need, if you make payments of $30 a month for the next six months. In keeping with his reputation, he requires that the first payment be paid today. He also charges you 2 percent interest per month. How much money are you borrowing? A $164.09 B. $168.22 c. $169.50 D. $170.68 E $171.40 7. You are comparing two annuities with equal present values. The applicable discount rate is 7.25 percent. One annuity pays $2,500 on the first day of each year for 15 years. How much does the second annuity pay each year for 15 years if it pays at the end of each year? $2,331.00 B. $2,266.67 $2,500.00 D. $2,390.50 E $2,681.25 8. You borrow $230,000 to buy a house. The mortgage rate is 4.5 percent and the loan period is 25 years. Payments are made monthly. If you pay the mortgage according to the loan agreement, how much total interest will you pay? A $160,408 B. $147,027 c S153,524 D. $164,319 E $141,406 9. What is the net present value of the following cash flow stream if the discount rate is at 11 percent annually. Year Cash Flow $2,000 1.500 1.750 1.250 A $4,586 $6,586,58 c. 8,325 D. $5.933.86 E. $3,456 B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started