Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all questions, will leave very good ratings. show work if need be 1. An ordinary annuity is best defined by which one of

please solve all questions, will leave very good ratings. show work if need be

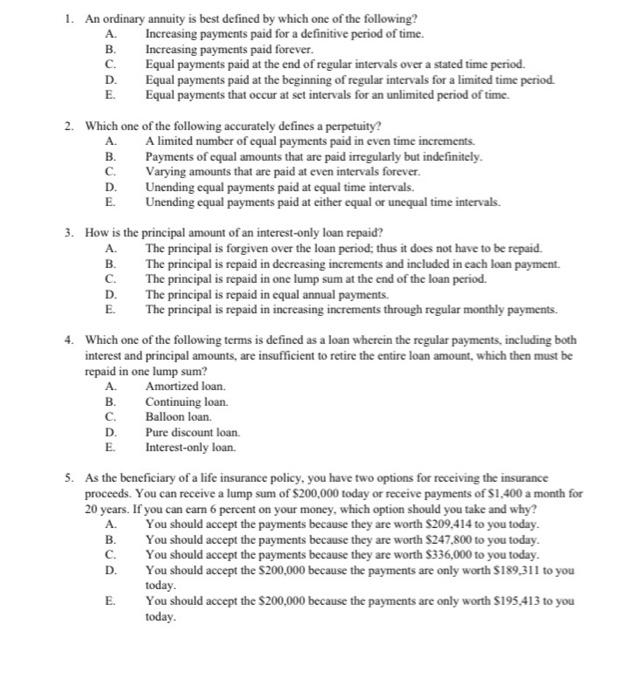

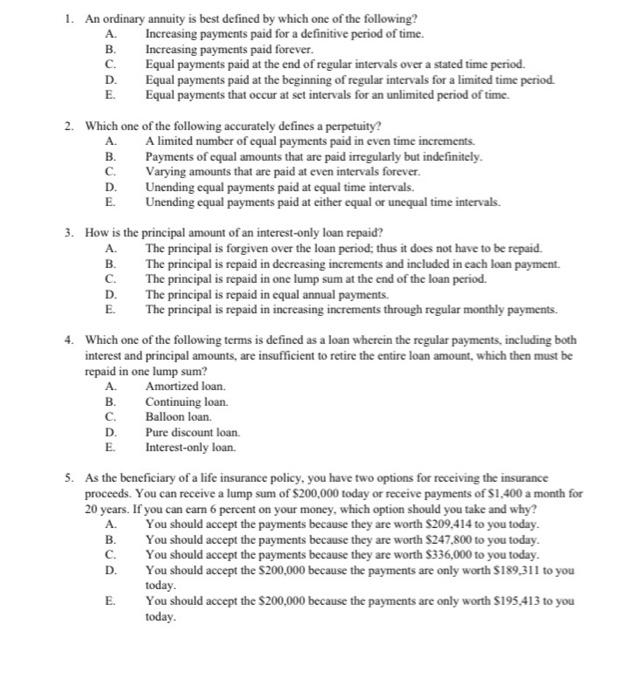

1. An ordinary annuity is best defined by which one of the following? A. Increasing payments paid for a definitive period of time. B. Increasing payments paid forever. c. Equal payments paid at the end of regular intervals over a stated time period. D. Equal payments paid at the beginning of regular intervals for a limited time period E. Equal payments that occur at set intervals for an unlimited period of time. 2. Which one of the following accurately defines a perpetuity? A A limited number of equal payments paid in even time increments. B. Payments of equal amounts that are paid irregularly but indefinitely c. Varying amounts that are paid at even intervals forever. D. Unending equal payments paid at equal time intervals. E Unending equal payments paid at either equal or unequal time intervals. 3. How is the principal amount of an interest-only loan repaid? A. The principal is forgiven over the loan period, thus it does not have to be repaid. B. The principal is repaid in decreasing increments and included in each loan payment. C. The principal is repaid in one lump sum at the end of the loan period. D. The principal is repaid in equal annual payments. E. The principal is repaid in increasing increments through regular monthly payments. 4. Which one of the following terms is defined as a loan wherein the regular payments, including both interest and principal amounts are insufficient to retire the entire loan amount which then must be repaid in one lump sum? A. Amortized loan B. Continuing loan. C. Balloon loan. D. Pure discount loan E. Interest-only loan 5. As the beneficiary of a life insurance policy, you have two options for receiving the insurance proceeds. You can receive a lump sum of $200,000 today or receive payments of S1,400 a month for 20 years. If you can earn 6 percent on your money, which option should you take and why? You should accept the payments because they are worth $209,414 to you today. y B. You should accept the payments because they are worth $247,800 to you today. C. You should accept the payments because they are worth $336,000 to you today. You should accept the $200.000 because the payments are only worth $189,311 to you today. E. You should accept the $200,000 because the payments are only worth $195.413 to you today. A D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started