Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all requirement. Thank you On January 3, 2020, Gagne Inc. paid $264,000 for a computer system. In addition to the basic purchase price,

Please solve all requirement. Thank you

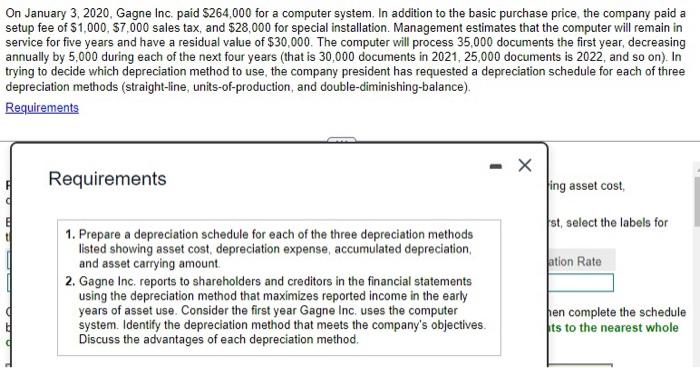

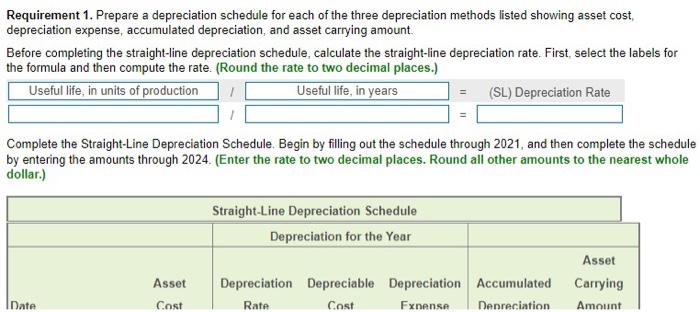

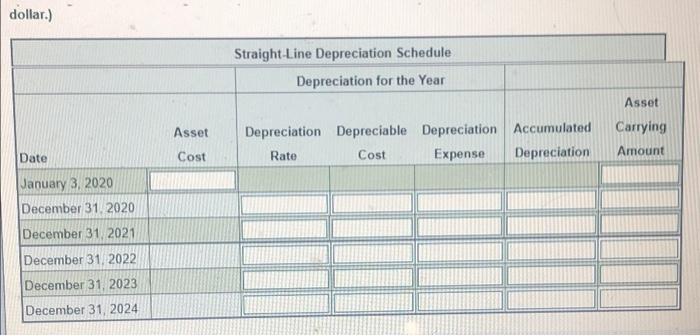

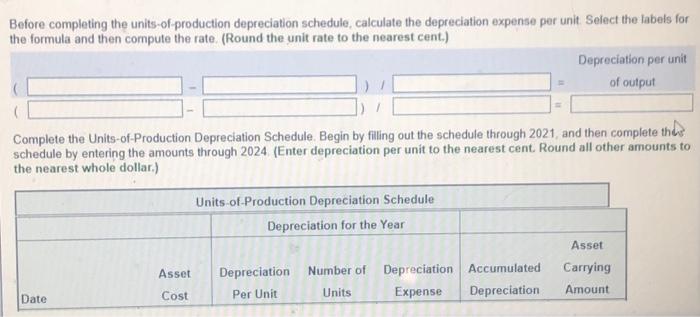

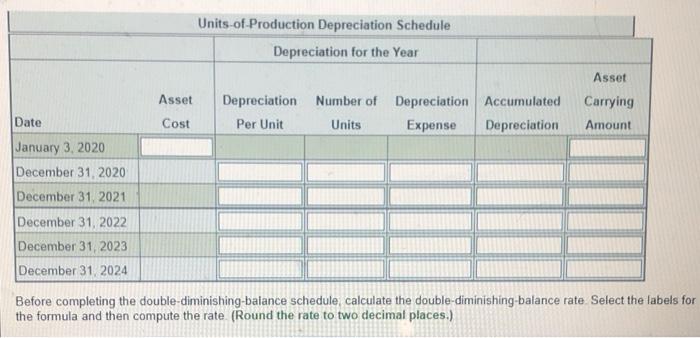

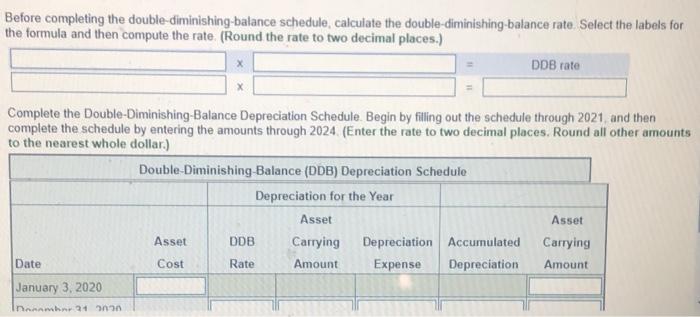

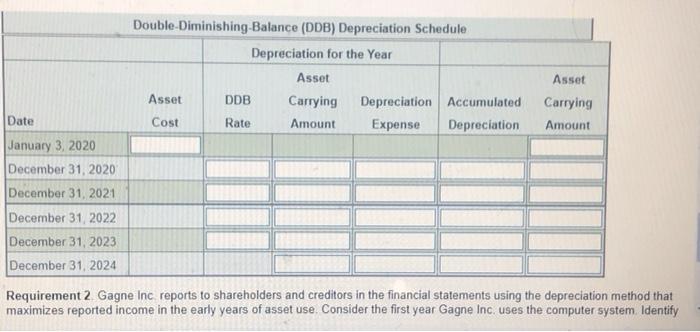

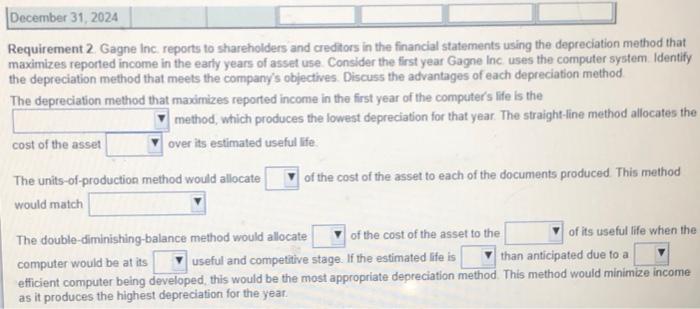

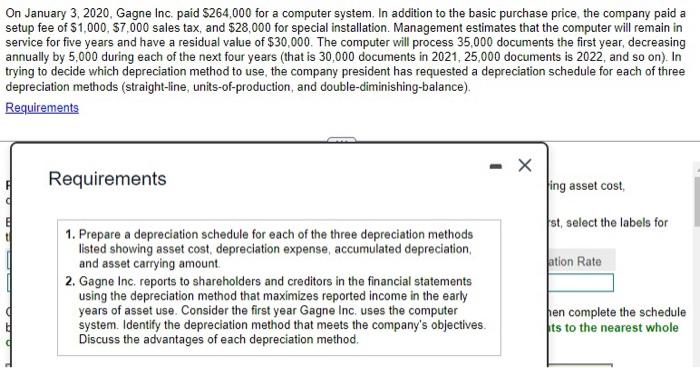

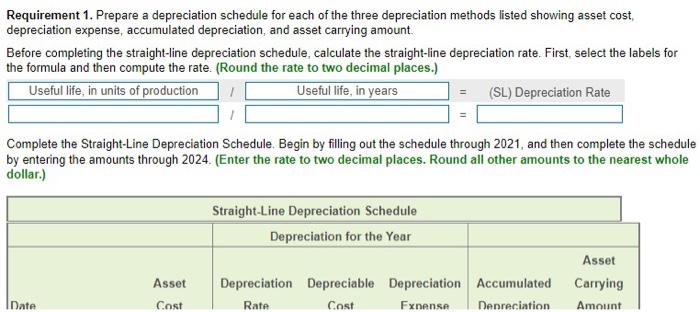

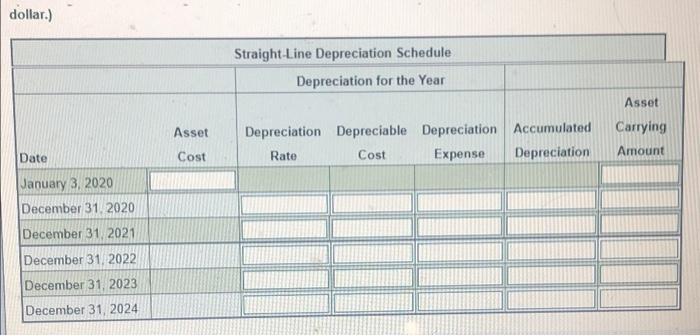

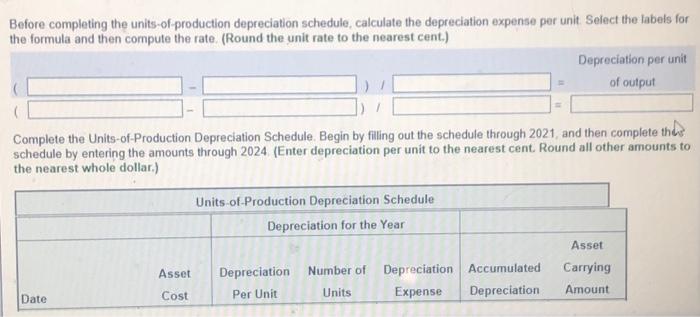

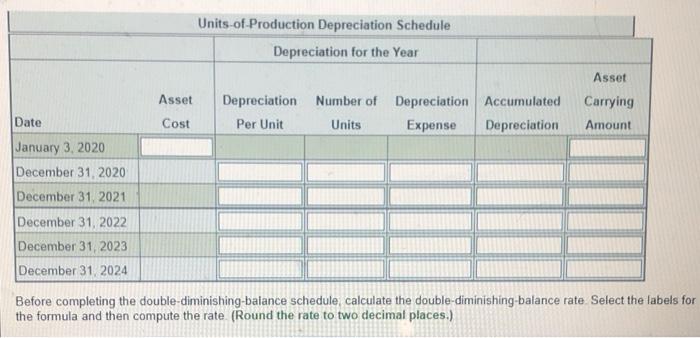

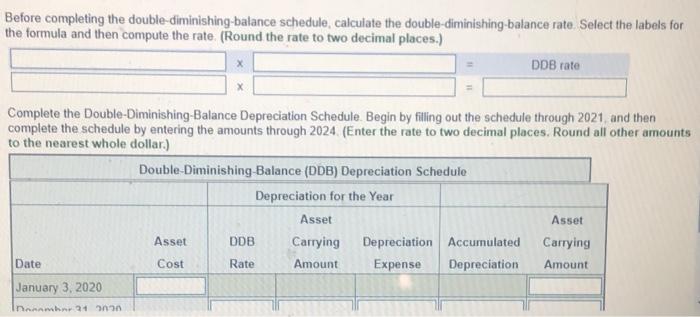

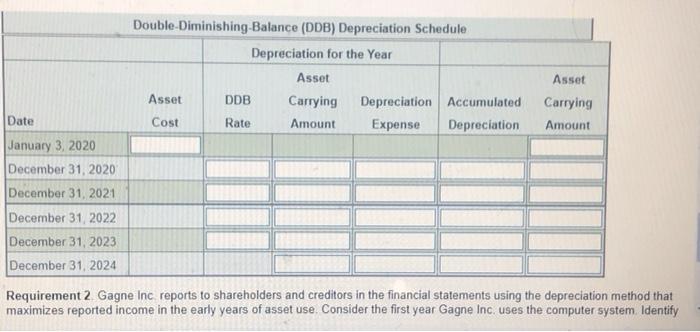

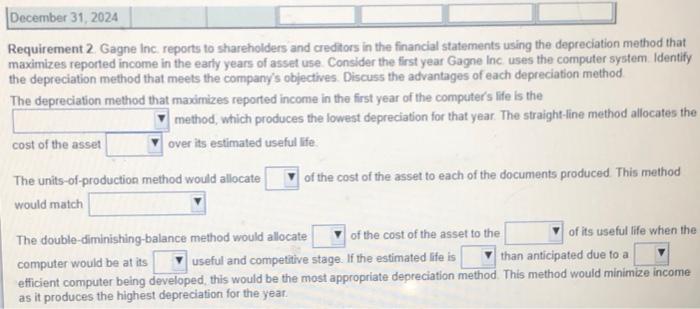

On January 3, 2020, Gagne Inc. paid $264,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,000, $7,000 sales tax, and $28,000 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $30,000. The computer will process 35,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 30,000 documents in 2021, 25,000 documents is 2022, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Requirements - X Requirements ing asset cost, st, select the labels for 1. Prepare a depreciation schedule for each of the three depreciation methods listed showing asset cost, depreciation expense, accumulated depreciation, and asset carrying amount. ation Rate 2. Gagne Inc. reports to shareholders and creditors in the financial statements using the depreciation method that maximizes reported income in the early years of asset use. Consider the first year Gagne Inc. uses the computer system. Identify the depreciation method that meets the company's objectives. Discuss the advantages of each depreciation method. hen complete the schedule ts to the nearest whole Requirement 1. Prepare a depreciation schedule for each of the three depreciation methods listed showing asset cost, depreciation expense, accumulated depreciation, and asset carrying amount. Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. First, select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) Useful life, in units of production Useful life, in years (SL) Depreciation Rate Complete the Straight-Line Depreciation Schedule. Begin by filling out the schedule through 2021, and then complete the schedule by entering the amounts through 2024. (Enter the rate to two decimal places. Round all other amounts to the nearest whole dollar.) Straight-Line Depreciation Schedule Depreciation for the Year Asset Carrying Asset Accumulated Depreciation Depreciable Depreciation Cost Date Cost Rate: Exnense Depreciation Amount dollar.) Date January 3, 2020 December 31, 2020 December 31, 2021 December 31, 2022 December 31, 2023 December 31, 2024 Straight-Line Depreciation Schedule. Depreciation for the Year Asset Depreciation Depreciable Depreciation Cost Rate Cost Expense Accumulated Depreciation Asset Carrying Amount Before completing the units-of-production depreciation schedule, calculate the depreciation expense per unit. Select the labels for the formula and then compute the rate. (Round the unit rate to the nearest cent.) Depreciation per unit of output Complete the Units-of-Production Depreciation Schedule. Begin by filling out the schedule through 2021, and then complete the schedule by entering the amounts through 2024. (Enter depreciation per unit to the nearest cent. Round all other amounts to the nearest whole dollar.) Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Carrying Date Per Unit Units Expense Depreciation Amount Asset Cost Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Carrying Number of Depreciation Accumulated Units Expense Depreciation Date Per Unit Amount January 3, 2020 December 31, 2020 December 31, 2021 December 31, 2022 December 31, 2023 December 31, 2024 Before completing the double-diminishing-balance schedule, calculate the double-diminishing-balance rate. Select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) Asset Cost Before completing the schedule, calculate the double-diminishing-balance rate. Select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) double-diminishing-balance DDB rate Complete the Double-Diminishing-Balance Depreciation Schedule. Begin by filling out the schedule through 2021, and then complete the schedule by entering the amounts through 2024. (Enter the rate to two decimal places. Round all other amounts to the nearest whole dollar.) Double-Diminishing-Balance (DDB) Depreciation Schedule Depreciation for the Year Asset Asset Asset Carrying Depreciation Accumulated Carrying Date Cost Amount Expense Depreciation Amount January 3, 2020 Donamber 31 2030 DDB Rate Double-Diminishing-Balance (DDB) Depreciation Schedule Depreciation for the Year Asset Asset Asset DDB Carrying Carrying Depreciation Accumulated Amount Expense Date Cost Rate Depreciation Amount January 3, 2020 December 31, 2020 December 31, 2021 December 31, 2022 December 31, 2023 December 31, 2024 Requirement 2. Gagne Inc. reports to shareholders and creditors in the financial statements using the depreciation method that maximizes reported income in the early years of asset use. Consider the first year Gagne Inc. uses the computer system. Identify December 31, 2024 Requirement 2. Gagne Inc. reports to shareholders and creditors in the financial statements using the depreciation method that maximizes reported income in the early years of asset use. Consider the first year Gagne Inc. uses the computer system. Identify the depreciation method that meets the company's objectives. Discuss the advantages of each depreciation method The depreciation method that maximizes reported income in the first year of the computer's life is the method, which produces the lowest depreciation for that year. The straight-line method allocates the cost of the asset over its estimated useful life. of the cost of the asset to each of the documents produced. This method The units-of-production method would allocate would match of the cost of the asset to the of its useful life when the The double-diminishing-balance method would allocate than anticipated due to a computer would be at its efficient computer being developed, this would be the most appropriate depreciation method. This method would minimize income as it produces the highest depreciation for the year. useful and competitive stage. If the estimated life is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started