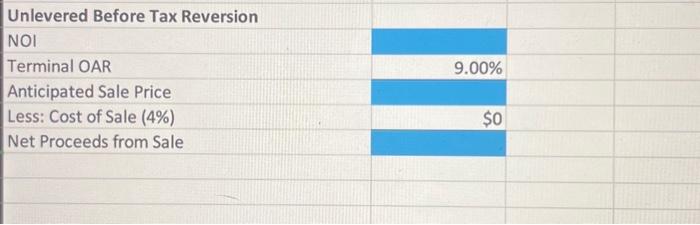

please solve all the ones in blue. Thank you!

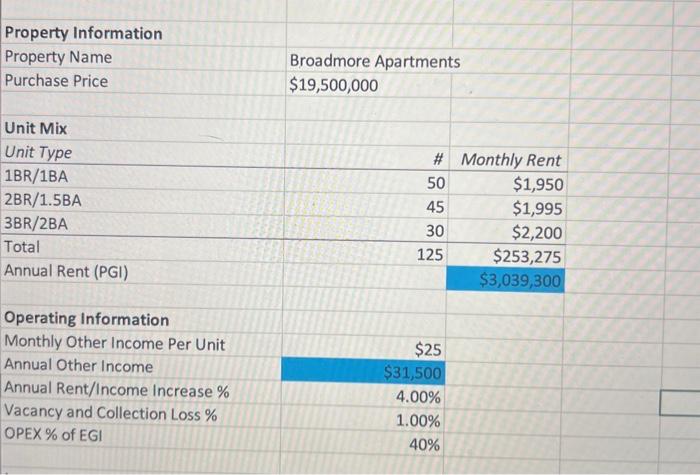

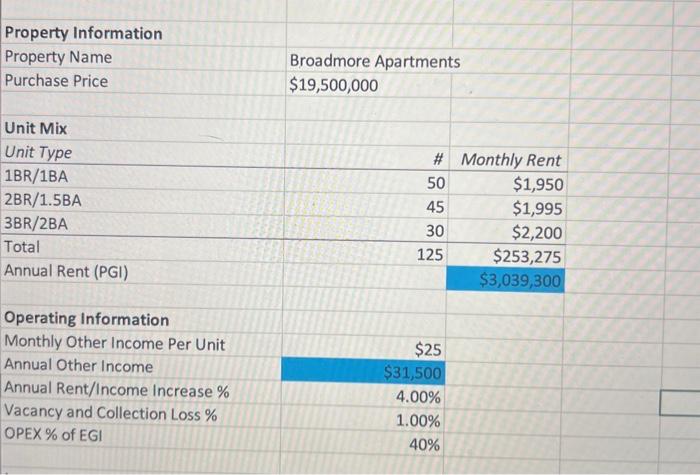

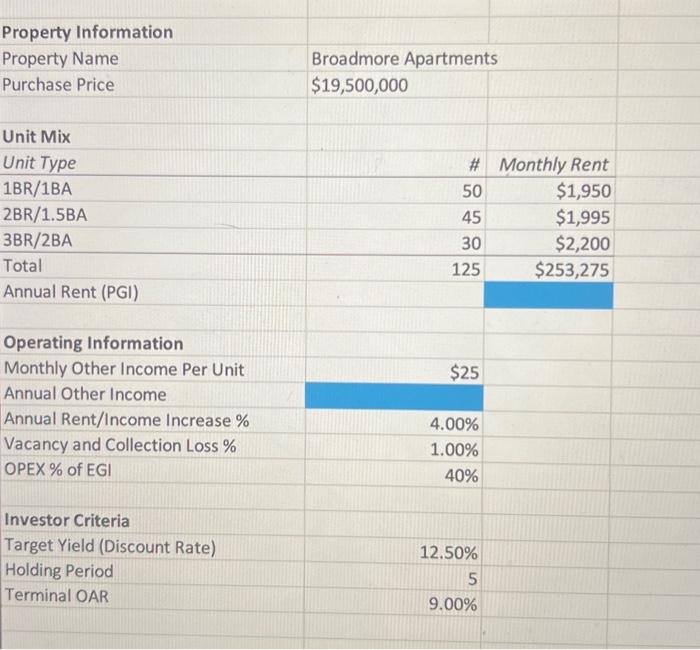

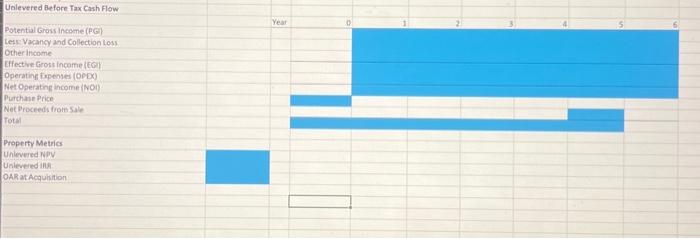

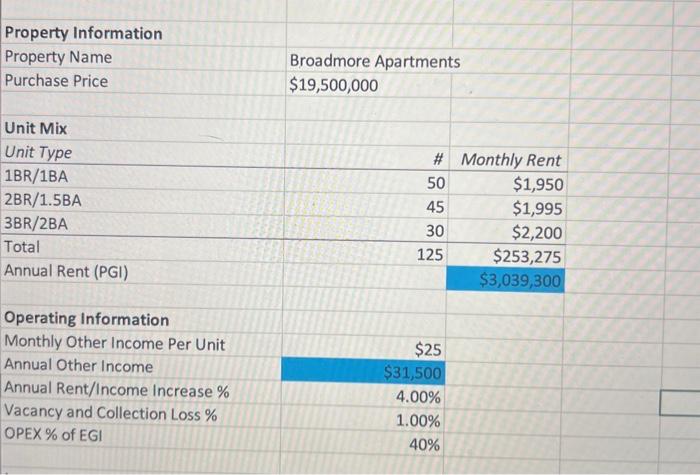

\begin{tabular}{l|r|r|} \hline \begin{tabular}{l} Property Information \\ Property Name \end{tabular} & Broadmore Apartments \\ \hline Purchase Price & $19,500,000 & \\ \hline & & \\ \hline Unit Mix & & \\ \hline Unit Type & 50 & $1,950 \\ \hline 1BR/1BA & 45 & $1,995 \\ \hline 2BR/1.5BA & 30 & $2,200 \\ \hline 3BR/2BA & 125 & $253,275 \\ \hline Total & & $3,039,300 \\ \hline Annual Rent (PGI) & & \\ \hline Operating Information & & \\ \hline Monthly Other Income Per Unit & $25 & \\ \hline Annual Other Income & $31,500 & \\ \hline Annual Rent/Income Increase \% & 4.00% & \\ \hline Vacancy and Collection Loss \% & 1.00% & \\ \hline OPEX\% of EGI & 40% & \\ \hline \end{tabular} Unlevered Before Tax Cash Flow Potential Gross Income (PG) Less Vacancy and Collection Loss Other income Operating fapenses (OPDX) Net Operating income (NOI) Purchane Price Wot Procedofrohisite Fotyl Property Metrics Unlevered NDV Ontereredilit OAR atAcqubition: Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4\%) \begin{tabular}{r} \hline \\ \hline 9.00% \\ \hline$0 \\ \hline \end{tabular} Net Proceeds from Sale \begin{tabular}{l|r|r|} \hline \begin{tabular}{l} Property Information \\ Property Name \end{tabular} & Broadmore Apartments \\ \hline Purchase Price & $19,500,000 & \\ \hline & & \\ \hline Unit Mix & & \\ \hline Unit Type & 50 & $1,950 \\ \hline 1BR/1BA & 45 & $1,995 \\ \hline 2BR/1.5BA & 30 & $2,200 \\ \hline 3BR/2BA & 125 & $253,275 \\ \hline Total & & $3,039,300 \\ \hline Annual Rent (PGI) & & \\ \hline Operating Information & & \\ \hline Monthly Other Income Per Unit & $25 & \\ \hline Annual Other Income & $31,500 & \\ \hline Annual Rent/Income Increase \% & 4.00% & \\ \hline Vacancy and Collection Loss \% & 1.00% & \\ \hline OPEX\% of EGI & 40% & \\ \hline \end{tabular} Unlevered Before Tax Cash Flow Potential Gross Income (PG) Less Vacancy and Collection Loss Other income Operating fapenses (OPDX) Net Operating income (NOI) Purchane Price Wot Procedofrohisite Fotyl Property Metrics Unlevered NDV Ontereredilit OAR atAcqubition: Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4\%) \begin{tabular}{r} \hline \\ \hline 9.00% \\ \hline$0 \\ \hline \end{tabular} Net Proceeds from Sale