Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all the required questions. Thanks. Alpine Transportation Inc. (Alpine) is a small transportation company that carries merchandise between centres in eastern Canada and

Please solve all the required questions. Thanks.

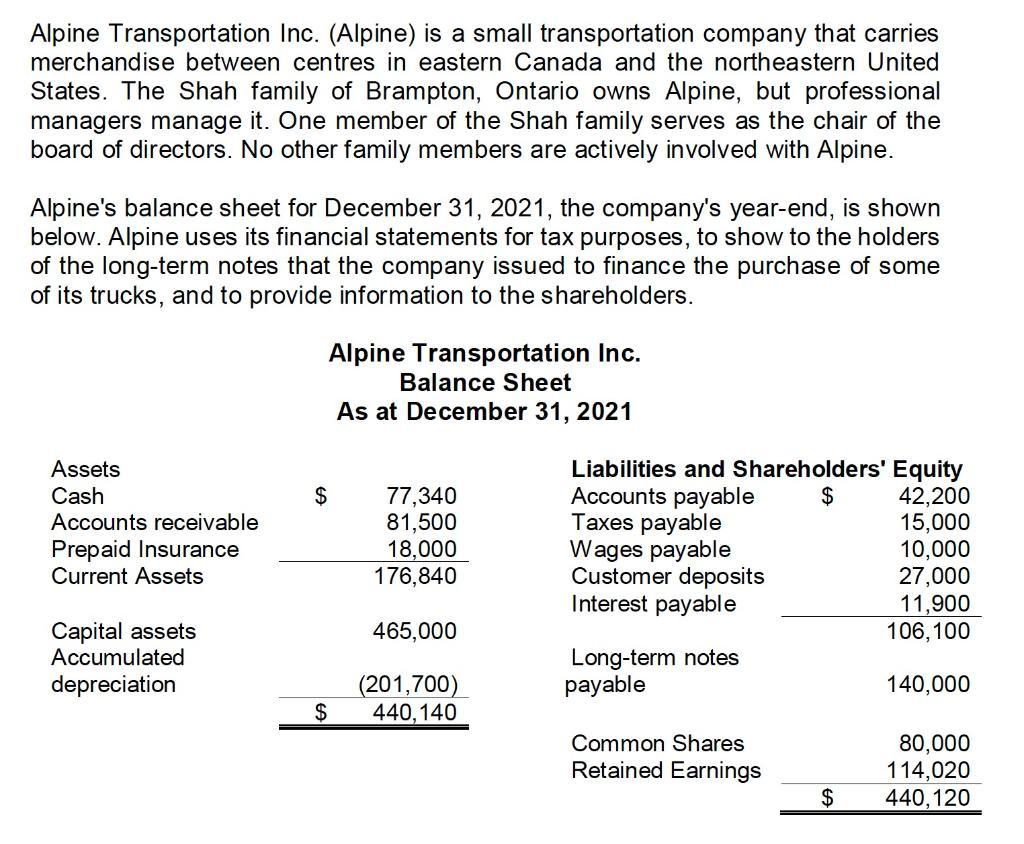

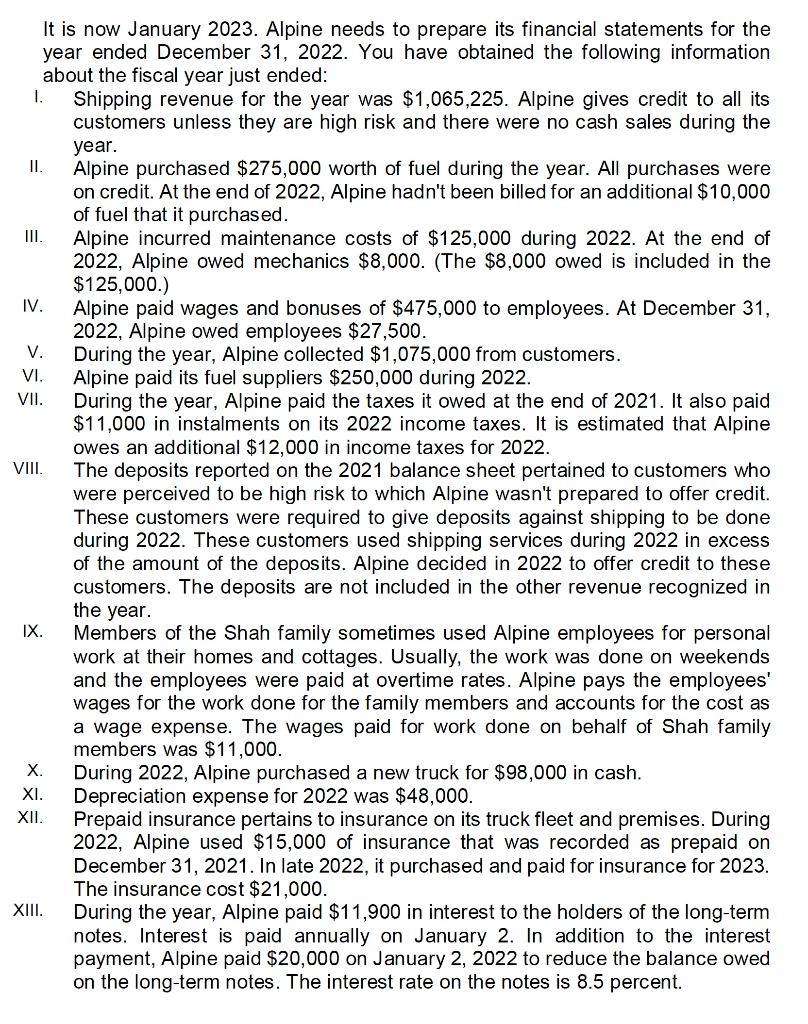

Alpine Transportation Inc. (Alpine) is a small transportation company that carries merchandise between centres in eastern Canada and the northeastern United States. The Shah family of Brampton, Ontario owns Alpine, but professional managers manage it. One member of the Shah family serves as the chair of the board of directors. No other family members are actively involved with Alpine. Alpine's balance sheet for December 31, 2021, the company's year-end, is shown below. Alpine uses its financial statements for tax purposes, to show to the holders of the long-term notes that the company issued to finance the purchase of some of its trucks, and to provide information to the shareholders. It is now January 2023. Alpine needs to prepare its financial statements for the year ended December 31, 2022. You have obtained the following information about the fiscal year just ended: I. Shipping revenue for the year was $1,065,225. Alpine gives credit to all its customers unless they are high risk and there were no cash sales during the year. II. Alpine purchased $275,000 worth of fuel during the year. All purchases were on credit. At the end of 2022, Alpine hadn't been billed for an additional $10,000 of fuel that it purchased. III. Alpine incurred maintenance costs of $125,000 during 2022. At the end of 2022 , Alpine owed mechanics $8,000. (The $8,000 owed is included in the $125,000.) IV. Alpine paid wages and bonuses of $475,000 to employees. At December 31, 2022 , Alpine owed employees $27,500. V. During the year, Alpine collected $1,075,000 from customers. VI. Alpine paid its fuel suppliers $250,000 during 2022. VII. During the year, Alpine paid the taxes it owed at the end of 2021. It also paid $11,000 in instalments on its 2022 income taxes. It is estimated that Alpine owes an additional $12,000 in income taxes for 2022. VIII. The deposits reported on the 2021 balance sheet pertained to customers who were perceived to be high risk to which Alpine wasn't prepared to offer credit. These customers were required to give deposits against shipping to be done during 2022. These customers used shipping services during 2022 in excess of the amount of the deposits. Alpine decided in 2022 to offer credit to these customers. The deposits are not included in the other revenue recognized in the year. IX. Members of the Shah family sometimes used Alpine employees for personal work at their homes and cottages. Usually, the work was done on weekends and the employees were paid at overtime rates. Alpine pays the employees' wages for the work done for the family members and accounts for the cost as a wage expense. The wages paid for work done on behalf of Shah family members was $11,000. X. During 2022, Alpine purchased a new truck for $98,000 in cash. XI. Depreciation expense for 2022 was $48,000. XII. Prepaid insurance pertains to insurance on its truck fleet and premises. During 2022 . Alpine used $15,000 of insurance that was recorded as prepaid on December 31, 2021. In late 2022, it purchased and paid for insurance for 2023. The insurance cost $21,000. XIII. During the year, Alpine paid $11,900 in interest to the holders of the long-term notes. Interest is paid annually on January 2 . In addition to the interest payment, Alpine paid $20,000 on January 2, 2022 to reduce the balance owed on the long-term notes. The interest rate on the notes is 8.5 percent. XIV. Alpine paid $75,000 in cash for other expenses related to operating the business in fiscal 2022. XV. Alpine paid dividends of $55,000 to shareholders. Required: Use the information about Alpine Transportation Inc. (Alpine) provided above to do the following: 1. Prepare all necessary transactional journal entries for the year ended December 31, 2022. Do not provide an explanation for each journal entry. 2. Prepare T-accounts and post each journal entry to the appropriate T-accounts. 3. Prepare and post adjusting journal entries to the appropriate T-accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started