Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve all three questions step by step and by canadian standards Carry at least 6 decimals on interest calculations. 1. At the beginning of

Please solve all three questions step by step and by canadian standards

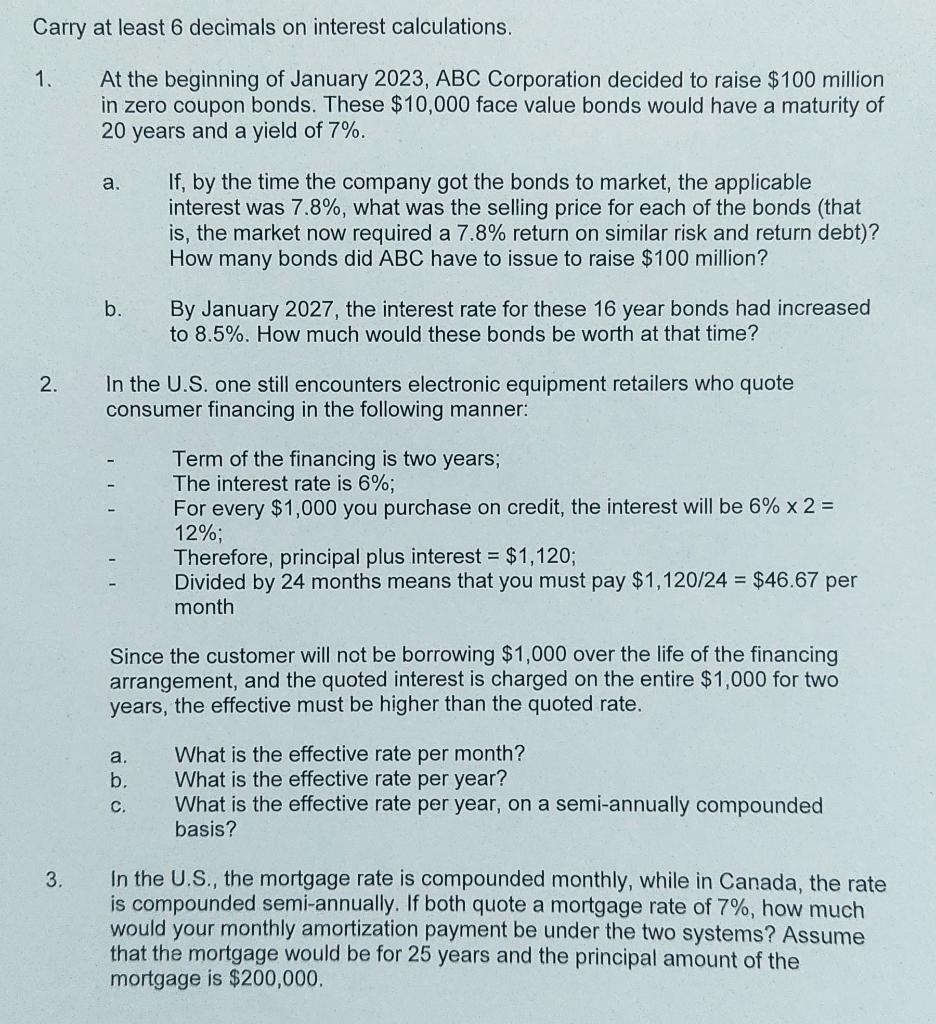

Carry at least 6 decimals on interest calculations. 1. At the beginning of January 2023,ABC Corporation decided to raise $100 million in zero coupon bonds. These $10,000 face value bonds would have a maturity of 20 years and a yield of 7%. a. If, by the time the company got the bonds to market, the applicable interest was 7.8%, what was the selling price for each of the bonds (that is, the market now required a 7.8% return on similar risk and return debt)? How many bonds did ABC have to issue to raise $100 million? b. By January 2027 , the interest rate for these 16 year bonds had increased to 8.5%. How much would these bonds be worth at that time? 2. In the U.S. one still encounters electronic equipment retailers who quote consumer financing in the following manner: - Term of the financing is two years; - The interest rate is 6%; - For every $1,000 you purchase on credit, the interest will be 6%2= 12% - Therefore, principal plus interest =$1,120; Divided by 24 months means that you must pay $1,120/24=$46.67 per month Since the customer will not be borrowing $1,000 over the life of the financing arrangement, and the quoted interest is charged on the entire $1,000 for two years, the effective must be higher than the quoted rate. a. What is the effective rate per month? b. What is the effective rate per year? c. What is the effective rate per year, on a semi-annually compounded basis? 3. In the U.S., the mortgage rate is compounded monthly, while in Canada, the rate is compounded semi-annually. If both quote a mortgage rate of 7%, how much would your monthly amortization payment be under the two systems? Assume that the mortgage would be for 25 years and the principal amount of the mortgage is $200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started