Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve!!! :)) And for the second pic please answer a)-d) thank you :)) lon't submit your Dropbox can be found under COURSE WORK ASSIGNMENTS

please solve!!! :)) And for the second pic please answer a)-d) thank you :))

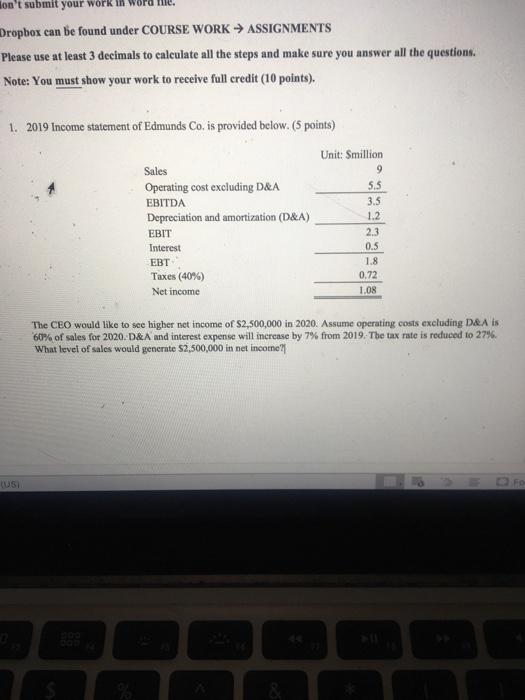

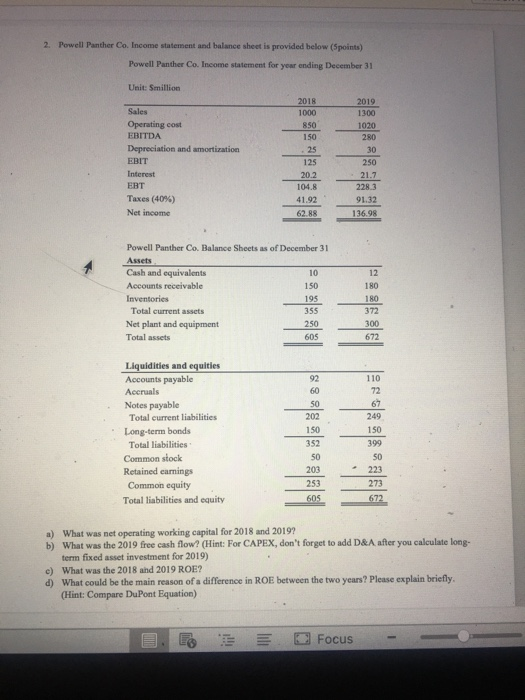

lon't submit your Dropbox can be found under COURSE WORK ASSIGNMENTS Please use at least 3 decimals to calculate all the steps and make sure you answer all the questions. Note: You must show your work to receive full credit (10 points). 1. 2019 Income statement of Edmunds Co. is provided below. (5 points) Sales Operating cost excluding D&A EBITDA Depreciation and amortization (D&A) EBIT Interest EBT Taxes (40%) Net income Unit: Smillion 9 5.5 3.5 1.2 2.3 0.5 1.8 0.72 1.08 The CEO would like to see higher net income of $2,500,000 in 2020. Assume operating costs excluding D&A is 60% of sales for 2020. D&A and interest expense will increase by 7% from 2019. The tax rate is reduced to 27% What level of sales would generate $2,500,000 in net income? (US) 2. Powell Panther Co. Income statement and balance sheet is provided below (5points) Powell Panther Co. Income statement for your ending December 31 Unit: Smillion Sales Operating cost EBITDA Depreciation and amortization EBIT Interest EBT Taxes (40%) Net income 2018 1000 850 150 25 125 20.2 104.8 41.92 62.88 2019 1300 1020 280 30 250 21.7 228.3 91.32 136.98 150 Powell Panther Co. Balance Sheets as of December 31 Assets Cash and equivalents 10 Accounts receivable Inventories Total current assets 355 Net plant and equipment 250 Total assets 605 195 12 180 180 372 300 672 Liquidities and equities Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Common equity Total liabilities and equity 92 60 SO 202 150 352 50 203 253 605 110 72 67 249 150 399 50 223 273 672 a) What was net operating working capital for 2018 and 2019? b) What was the 2019 free cash flow? (Hint: For CAPEX, don't forget to add D&A after you calculate long- term fixed asset investment for 2019) c) What was the 2018 and 2019 ROE? d) What could be the main reason of a difference in ROE between the two years? Please explain briefly. (Hint: Compare DuPont Equation) Focus Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started