Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve and show all steps Q.4. Imagine that you face two career choices. You could decide to invest your life savings in a entrepreneurial

please solve and show all steps

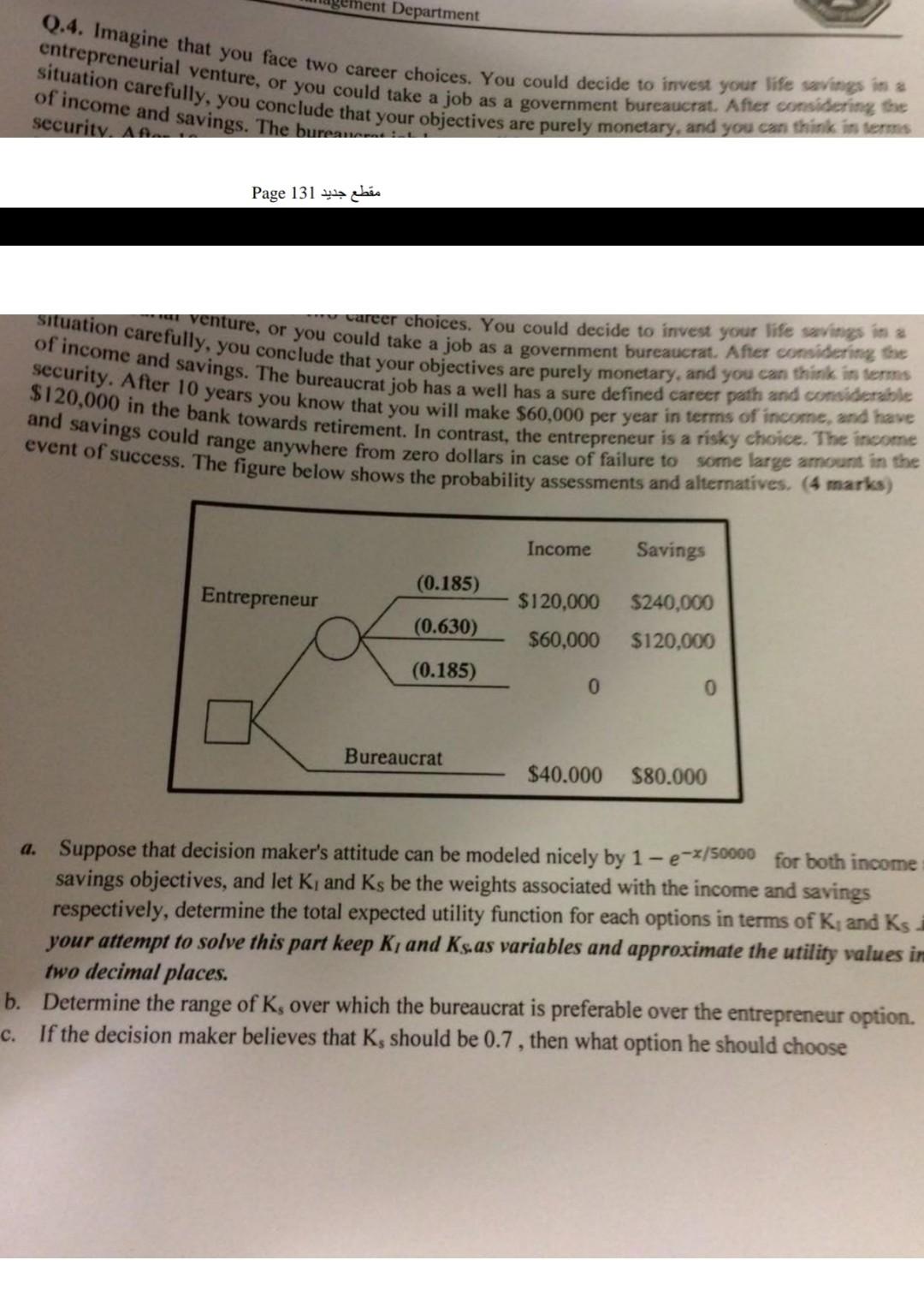

Q.4. Imagine that you face two career choices. You could decide to invest your life savings in a entrepreneurial venture, or you could take a job as a government bureaucrat. After considering the situation carefully, you conclude that your objectives are purely monetary, and you can think in terms venture, or you could take a job as a government bureaucrat. After considering the of income and savings. The bureaucrat job has a well has a sure defined career path and considerable security. After 10 years you know that you will make $60,000 per year in terms of income, and have $120,000 in the bank towards retirement. In contrast, the entrepreneur is a risky choice. The income and savings could range anywhere from zero dollars in case of failure to some large amount in the situation carefully, you conclude that your objectives are purely monetary, and you can think its terms hent Department of income and savings. The bureau security. A 131 Page vareer choices. You could decide to invest your life savings in a Income Savings (0.185) Entrepreneur $120,000 $240,000 (0.630) $60,000 $120,000 (0.185) 0 0 Bureaucrat $40.000 $80.000 a. Suppose that decision maker's attitude can be modeled nicely by 1 - e-x/50000 for both income savings objectives, and let K, and Ks be the weights associated with the income and savings respectively, determine the total expected utility function for each options in terms of K, and Ks your attempt to solve this part keep Ki and Ks.as variables and approximate the utility values in two decimal places. b. Determine the range of K, over which the bureaucrat is preferable over the entrepreneur option. c. If the decision maker believes that Ks should be 0.7, then what option he should choose Q.4. Imagine that you face two career choices. You could decide to invest your life savings in a entrepreneurial venture, or you could take a job as a government bureaucrat. After considering the situation carefully, you conclude that your objectives are purely monetary, and you can think in terms venture, or you could take a job as a government bureaucrat. After considering the of income and savings. The bureaucrat job has a well has a sure defined career path and considerable security. After 10 years you know that you will make $60,000 per year in terms of income, and have $120,000 in the bank towards retirement. In contrast, the entrepreneur is a risky choice. The income and savings could range anywhere from zero dollars in case of failure to some large amount in the situation carefully, you conclude that your objectives are purely monetary, and you can think its terms hent Department of income and savings. The bureau security. A 131 Page vareer choices. You could decide to invest your life savings in a Income Savings (0.185) Entrepreneur $120,000 $240,000 (0.630) $60,000 $120,000 (0.185) 0 0 Bureaucrat $40.000 $80.000 a. Suppose that decision maker's attitude can be modeled nicely by 1 - e-x/50000 for both income savings objectives, and let K, and Ks be the weights associated with the income and savings respectively, determine the total expected utility function for each options in terms of K, and Ks your attempt to solve this part keep Ki and Ks.as variables and approximate the utility values in two decimal places. b. Determine the range of K, over which the bureaucrat is preferable over the entrepreneur option. c. If the decision maker believes that Ks should be 0.7, then what option he should chooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started