please solve and show calculations

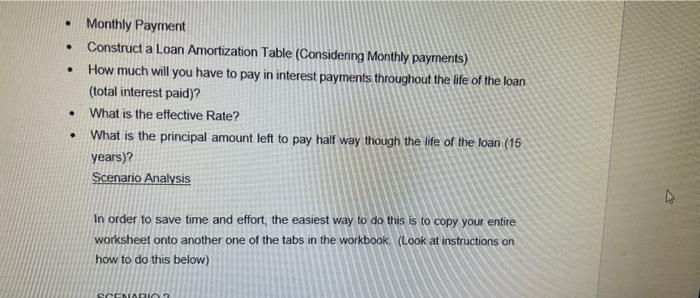

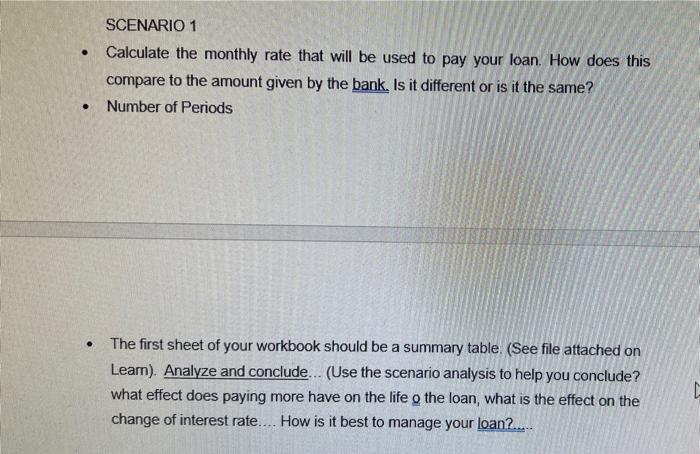

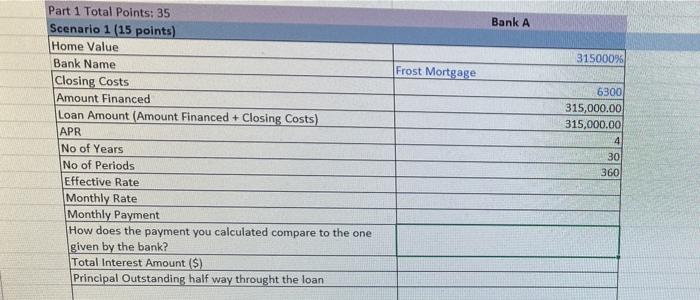

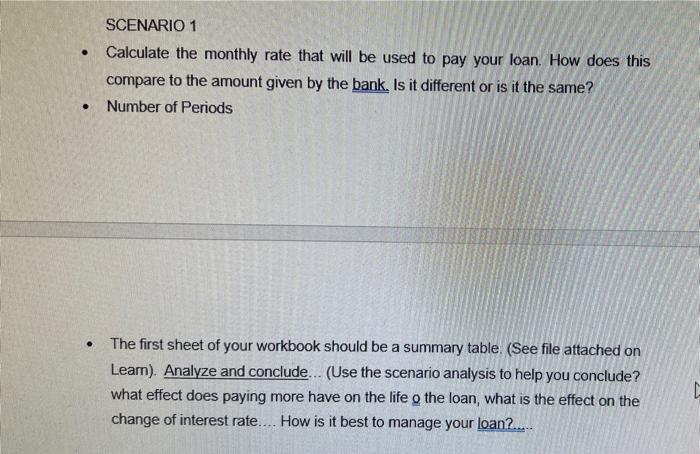

Bank A 315000% Frost Mortgage Part 1 Total Points: 35 Scenario 1 (15 points) Home Value Bank Name Closing Costs Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods Effective Rate Monthly Rate Monthly Payment How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loan 6300 315,000.00 315,000.00 4 30 360 . SCENARIO 1 Calculate the monthly rate that will be used to pay your loan. How does this compare to the amount given by the bank. Is it different or is it the same? Number of Periods . . The first sheet of your workbook should be a summary table. (See file attached on Learn). Analyze and conclude... (Use the scenario analysis to help you conclude? what effect does paying more have on the life o the loan, what is the effect on the O change of interest rate.... How is it best to manage your loan?... C . . Monthly Payment Construct a Loan Amortization Table (Considering Monthly payments) How much will you have to pay in interest payments throughout the life of the loan (total interest paid)? What is the effective Rate? What is the principal amount left to pay half way though the life of the loan (15 years)? Scenario Analysis . . In order to save time and effort, the easiest way to do this is to copy your entire worksheet onto another one of the tabs in the workbook (Look at instructions on how to do this below) SCENARIO Bank A 315000% Frost Mortgage Part 1 Total Points: 35 Scenario 1 (15 points) Home Value Bank Name Closing Costs Amount Financed Loan Amount (Amount Financed + Closing Costs) APR No of Years No of Periods Effective Rate Monthly Rate Monthly Payment How does the payment you calculated compare to the one given by the bank? Total Interest Amount ($) Principal Outstanding half way throught the loan 6300 315,000.00 315,000.00 4 30 360 . SCENARIO 1 Calculate the monthly rate that will be used to pay your loan. How does this compare to the amount given by the bank. Is it different or is it the same? Number of Periods . . The first sheet of your workbook should be a summary table. (See file attached on Learn). Analyze and conclude... (Use the scenario analysis to help you conclude? what effect does paying more have on the life o the loan, what is the effect on the O change of interest rate.... How is it best to manage your loan?... C . . Monthly Payment Construct a Loan Amortization Table (Considering Monthly payments) How much will you have to pay in interest payments throughout the life of the loan (total interest paid)? What is the effective Rate? What is the principal amount left to pay half way though the life of the loan (15 years)? Scenario Analysis . . In order to save time and effort, the easiest way to do this is to copy your entire worksheet onto another one of the tabs in the workbook (Look at instructions on how to do this below) SCENARIO

please solve and show calculations

please solve and show calculations