Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve and slightly explain your solution to help me learn it. The financial manager of Confused Inc. is deciding to take on an investment

Please solve and slightly explain your solution to help me learn it.

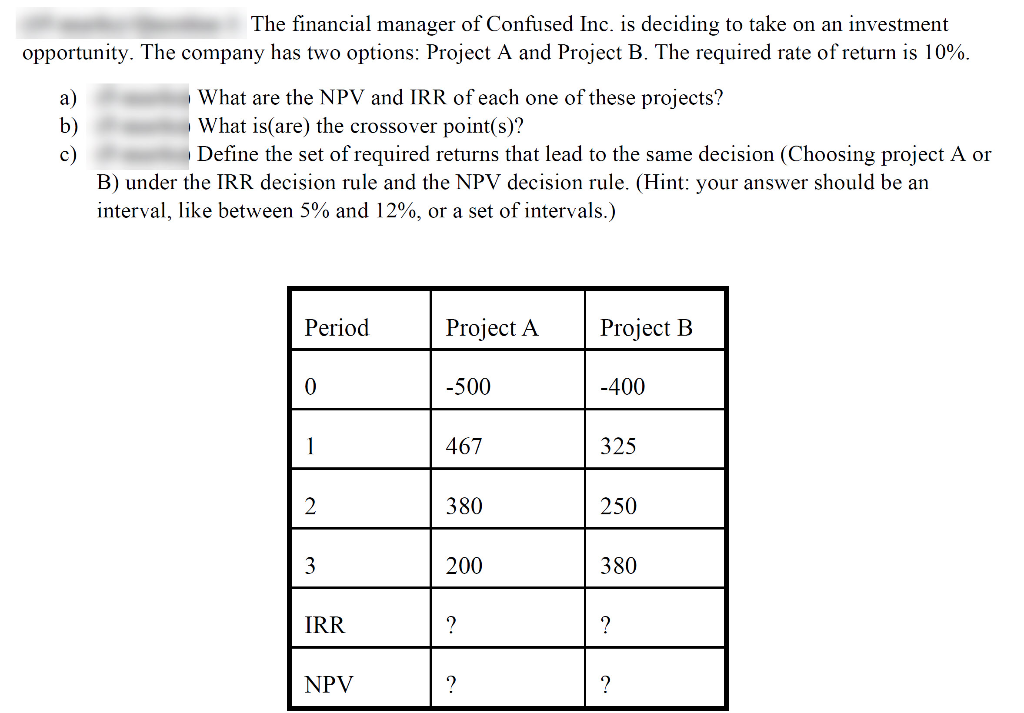

The financial manager of Confused Inc. is deciding to take on an investment opportunity. The company has two options: Project A and Project B. The required rate of return is 10%. c) What are the NPV and IRR of each one of these projects? What is(are) the crossover point(s)? Define the set of required returns that lead to the same decision (Choosing project A or B) under the IRR decision rule and the NPV decision rule. (Hint: your answer should be an interval, like between 5% and 12%, or a set of intervals.) Period Project A Project B 0 -500 -400 467 325 2. 380 250 3 200 380 IRR ? ? NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started