Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve as soon as solve quickly i get you thumbs up directly Thank you for your help The plant of Omer manufacturing company uses

please solve as soon as solve quickly i get you thumbs up directly Thank you for your help

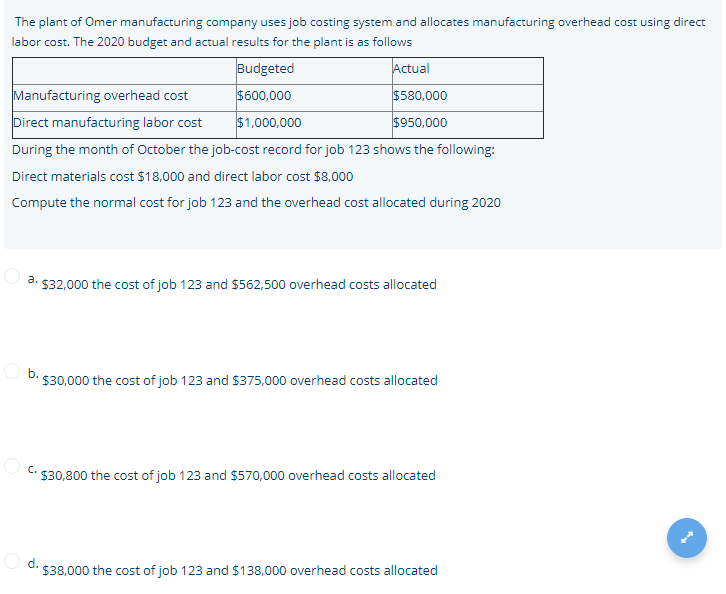

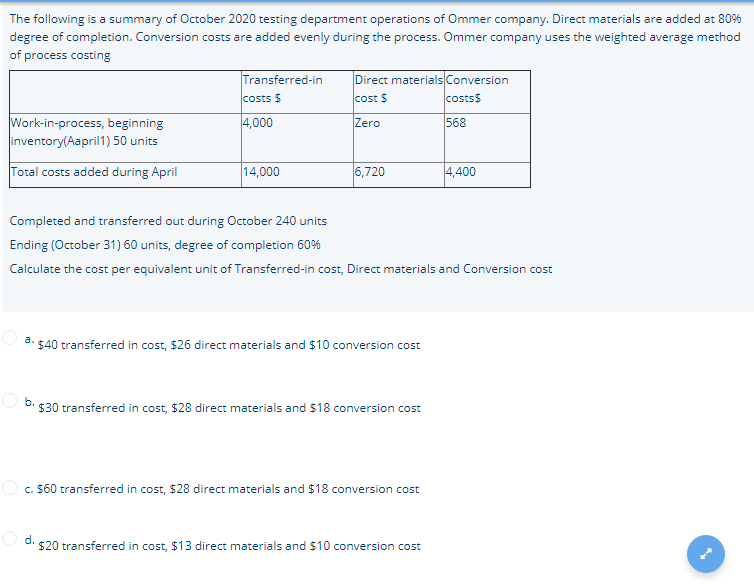

The plant of Omer manufacturing company uses job costing system and allocates manufacturing overhead cost using direct labor cost. The 2020 budget and actual results for the plant is as follows Budgeted Actual Manufacturing overhead cost $600,000 $580,000 Direct manufacturing labor cost $1,000,000 $950,000 During the month of October the job-cost record for job 123 shows the following: Direct materials cost $18,000 and direct labor cost $8,000 Compute the normal cost for job 123 and the overhead cost allocated during 2020 a. $32,000 the cost of job 123 and $562,500 overhead costs allocated b. $30,000 the cost of job 123 and $375,000 overhead costs allocated $30,800 the cost of job 123 and $570,000 overhead costs allocated d. $38,000 the cost of job 123 and $138,000 overhead costs allocated The following is a summary of October 2020 testing department operations of Ommer company. Direct materials are added at 80% degree of completion. Conversion costs are added evenly during the process. Ommer company uses the weighted average method of process costing Transferred-in Direct materials Conversion cost $ Work-in-process, beginning 4,000 Zero 568 inventory(Aaprill) 50 units costs $ costs $ Total costs added during April 14,000 6,720 4,400 Completed and transferred out during October 240 units Ending (October 31) 60 units, degree of completion 60% Calculate the cost per equivalent unit of Transferred-in cost, Direct materials and Conversion cost a. $40 transferred in cost, $26 direct materials and $10 conversion cost b. $30 transferred in cost, $28 direct materials and $18 conversion cost c. 560 transferred in cost, $28 direct materials and $18 conversion cost O de $20 transferred in cost, $13 direct materials and $10 conversion costStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started