Answered step by step

Verified Expert Solution

Question

1 Approved Answer

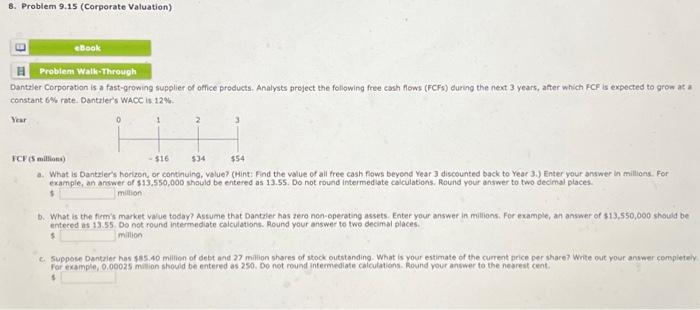

Please solve asap!! antaler Corporation is a fast-growing supplier of office products. Analysts project the following free cosh flows (FCFs) during the next 3 years,

Please solve asap!!

antaler Corporation is a fast-growing supplier of office products. Analysts project the following free cosh flows (FCFs) during the next 3 years, after which FCF is expected to grow at a onstant 6% rate. Dantrier's WACC is: 12%. CV (5 millians) a. What is Dantzier's horizon, or continuing, value? (Hint: Find the walue of all free cash fows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For examale. an answer of $13,550,000 shoisld be entered as 13.55 . Do not round intermediate calculations. Round your answer to two decimal places. 1 milion b. What is the firms market vave today? Aswume that Dantiler has zero non-operating assets. Enter your answer in milions. For example, an answer of $13,550,000 should be entered at 13.55. Do not round intermediate calculations. Round your answer to two decimal places. s milition C. Suppose Dantzier has $85.40 milion of debt and 27 milion shores of stock outstonding. What is your estimate of the current price cer share? Write out your anumer completeh 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started