Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve both FIFO and Moving wieghted average with steps and proper explanation for all four boxes. Thanks Exercise 6-5 Alternative cost flow assumptions-perpetual inventory

Please solve both FIFO and Moving wieghted average with steps and proper explanation for all four boxes. Thanks

Please solve both FIFO and Moving wieghted average with steps and proper explanation for all four boxes. Thanks

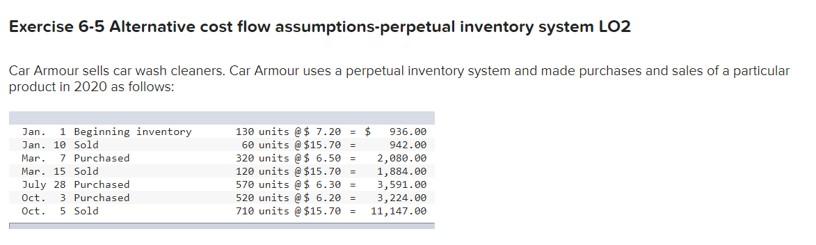

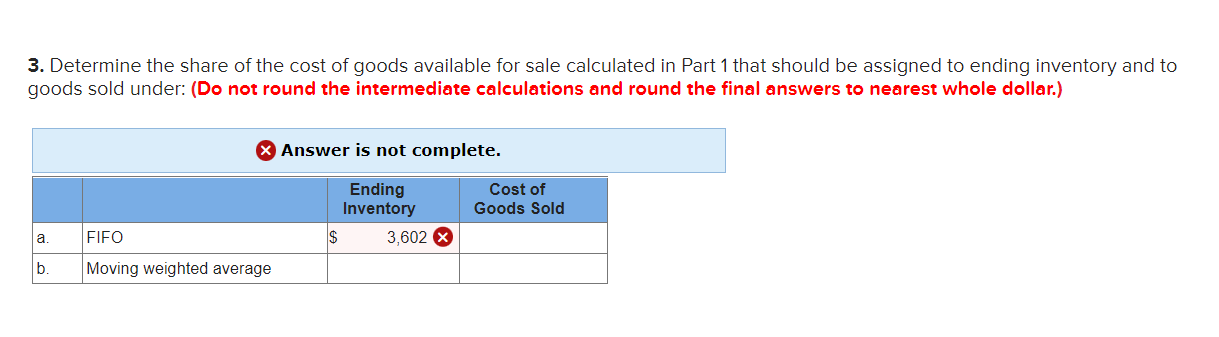

Exercise 6-5 Alternative cost flow assumptions-perpetual inventory system LO2 Car Armour sells car wash cleaners. Car Armour uses a perpetual inventory system and made purchases and sales of a particular product in 2020 as follows: Jan. 1 Beginning inventory Jan. 10 Sold Mar. 7 Purchased Mar. 15 Sold July 28 Purchased Oct. 3 Purchased Oct. 5 Sold 130 units $ 7.20 = $ 936.00 60 units @ $15.70 942.00 320 units @$ 6.50 = 2,080.00 120 units @ $15.70 = 1,884.00 570 units @$ 6.30 = 3,591.00 520 units @ $ 6.20 = 3,224.00 710 units @ $15.70 = 11,147.00 3. Determine the share of the cost of goods available for sale calculated in Part 1 that should be assigned to ending inventory and to goods sold under: (Do not round the intermediate calculations and round the final answers to nearest whole dollar.) Answer is not complete. Ending Inventory 3,602 X Cost of Goods Sold a. FIFO $ b Moving weighted average

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started