Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve both of these, i want to check my answers! Thanks! QUESTION 3 Annual Depreciation First, we will start with annual depreciation. We will

Please solve both of these, i want to check my answers! Thanks!

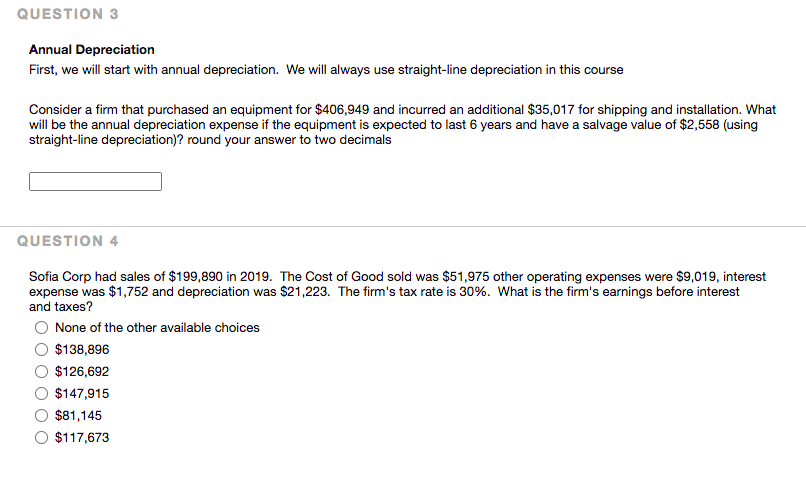

QUESTION 3 Annual Depreciation First, we will start with annual depreciation. We will always use straight-line depreciation in this course Consider a firm that purchased an equipment for $406,949 and incurred an additional $35,017 for shipping and installation. What will be the annual depreciation expense if the equipment is expected to last 6 years and have a salvage value of $2,558 (using straight-line depreciation)? round your answer to two decimals QUESTION 4 Sofia Corp had sales of $199,890 in 2019. The Cost of Good sold was $51,975 other operating expenses were $9,019, interest expense was $1,752 and depreciation was $21,223. The firm's tax rate is 30%. What is the firm's earnings before interest and taxes? None of the other available choices $138,896 $126,692 $147,915 $81,145 $117,673Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started