Answered step by step

Verified Expert Solution

Question

1 Approved Answer

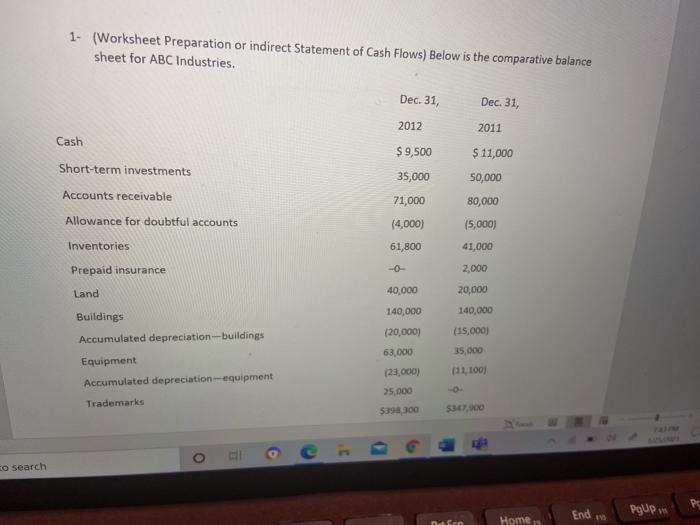

please solve both this is all the information i was given 1- (Worksheet Preparation or indirect Statement of Cash Flows) Below is the comparative balance

please solve both

this is all the information i was given

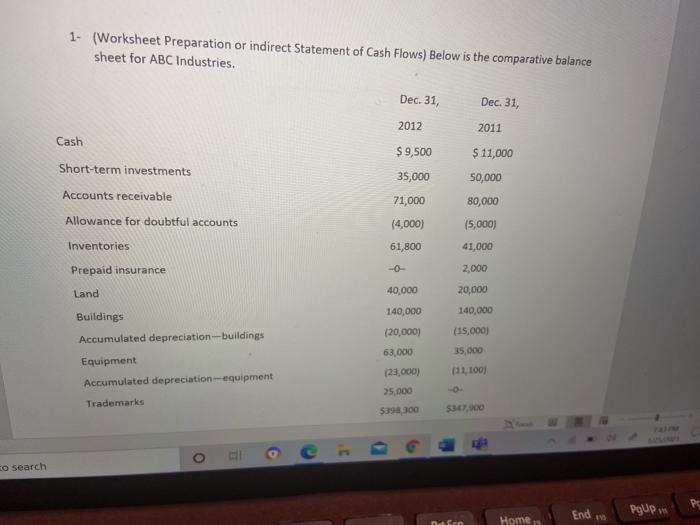

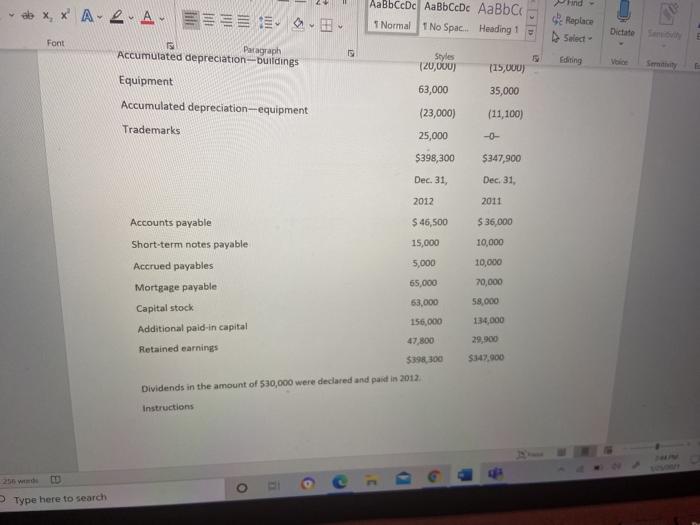

1- (Worksheet Preparation or indirect Statement of Cash Flows) Below is the comparative balance sheet for ABC Industries. Dec. 31, Dec. 31, 2012 2011 Cash $ 11,000 Short-term investments $ 9,500 35,000 50,000 80,000 71,000 (4,000) (5,000) Accounts receivable Allowance for doubtful accounts Inventories Prepaid insurance 61,800 41,000 2,000 Land 40,000 20,000 140,000 140,000 (20,000) (15,000) 35,000 63,000 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Trademarks (23,000) (11 100) 25,000 $398300 $347.900 2 co search nd PyUp Sen Homes Find do x * A-LA- AalbCcDc AaBbCcDc AaBb C 1 Normal 1 No Spac Heading 1 2 Replace Select Dictate Font s Paragraph Accumulated depreciation-buildings Styles 120,000) (15,000) Equipment Accumulated depreciation--equipment 63,000 35,000 (11,100) (23,000) Trademarks 25,000 $398,300 $347,900 Dec 31, Dec. 31, 2011 $ 35,000 10,000 10,000 70,000 2012 Accounts payable $ 46,500 Short-term notes payable 15,000 Accrued payables 5,000 Mortgage payable 65,000 Capital stock 63.000 Additional paid-in capital 156,000 Retained earnings 47,800 $398,300 Dividends in the amount of 530,000 were declared and paid in 2012 58.000 134,000 29,900 $347.900 Instructions o 2 O Type here to search Font No Spac. Heading 1 > Dictate Paragraph Select 2 Styles Instructions From this information, prepare a worksheet for a statement of cash flows. Make reasonable assumptions as appropriate. The short-term investments are considered available-for-sale, and no unrealized gains or losses have occurred on these securities. 2- (Basic Pension Worksheet) The following facts apply to the pension plan of I-Pass Corporation for the year 2012 Plan assets, January 1, 2012 $950,000 Projected benefit obligation, January 1, 2012 950,000 Settlement rate 6% Service cost 75,000 Contributions (funding) 10,000 Actual and expected return on plan assets 40,600 Benefits paid to retirees 42,200 Instructions Using the preceding data, compute pension expense for the year 2012. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2012 and the year-end balances in the related pension accounts, 8 le 3 O Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started