please solve C part as soon as possible

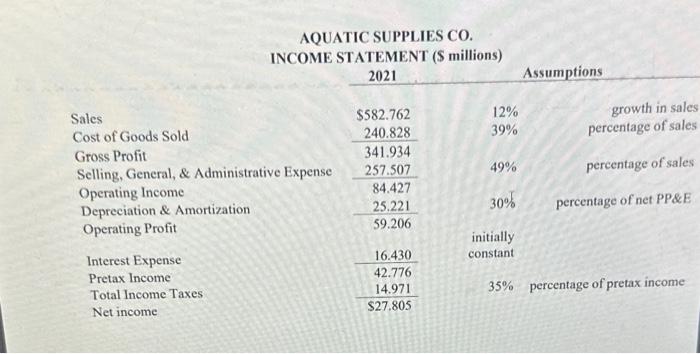

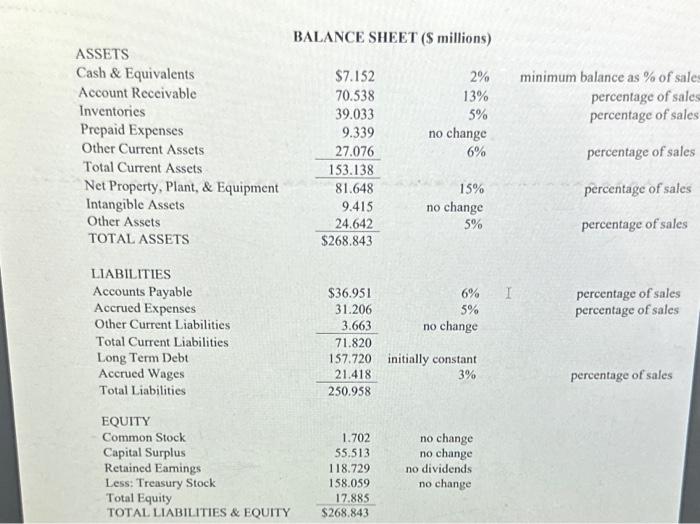

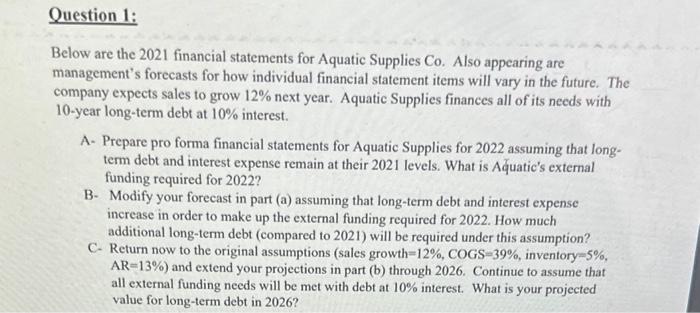

Below are the 2021 financial statements for Aquatic Supplies Co. Also appearing are management's forecasts for how individual financial statement items will vary in the future. The company expects sales to grow 12% next year. Aquatic Supplies finances all of its needs with 10-year long-term debt at 10% interest. A- Prepare pro forma financial statements for Aquatic Supplies for 2022 assuming that longterm debt and interest expense remain at their 2021 levels. What is Aquatic's external funding required for 2022 ? B- Modify your forecast in part (a) assuming that long-term debt and interest expense increase in order to make up the external funding required for 2022. How much additional long-term debt (compared to 2021) will be required under this assumption? C- Return now to the original assumptions (sales growth =12%,COGS=39%, inventory =5%, AR=13% ) and extend your projections in part (b) through 2026. Continue to assume that all external funding needs will be met with debt at 10% interest. What is your projected value for long-term debt in 2026? AQUATIC SUPPLIES CO. INCOME STATEMENT (\$ millions) 2021 Assumptions Sales growth in sales Cost of Goods Sold Gross Profit $582.762240.828341.934 percentage of sales Selling, General, \& Administrative Expense Operating Income Depreciation \& Amortization percentage of net PP\&E Operating Profit 257.50784.42725.22159.206 percentage of sales Interest Expense 16.430 constant Pretax Income Total Income Taxes 35% percentage of pretax income Net income BALANCE SHEET (S millions) ASSETS Cash \& Equivalents Account Receivable percentage of sales Inventories $7.15270.53839.0332%13%5% minimum balance as % of sale: percentage of sales Prepaid Expenses no change Other Current Assets percentage of sales Total Current Assets Net Property, Plant, \& Equipment percentage of sales Intangible Assets Other Assets TOTAL ASSETS LIABILITIES Accounts Payable percentage of sales Accrued Expenses percentage of sales Other Current Liabilitics Total Current Liabilities Long Term Debt Accrued Wages Total Liabilities \begin{tabular}{rr} $36.951 & 6% \\ 31.206 & 5% \\ 3.663 & no change \\ \hline 71.820 & \\ 157.720 & initially constant \\ 21.418 & 3% \\ \hline 250.958 & \end{tabular} percentage of sales EQUITY Common Stock Capital Surplus Retained Eamings Less: Treasury Stock Total Equity TOTAL LIABILITIES \& EQUITY $268.84317.885 Below are the 2021 financial statements for Aquatic Supplies Co. Also appearing are management's forecasts for how individual financial statement items will vary in the future. The company expects sales to grow 12% next year. Aquatic Supplies finances all of its needs with 10-year long-term debt at 10% interest. A- Prepare pro forma financial statements for Aquatic Supplies for 2022 assuming that longterm debt and interest expense remain at their 2021 levels. What is Aquatic's external funding required for 2022 ? B- Modify your forecast in part (a) assuming that long-term debt and interest expense increase in order to make up the external funding required for 2022. How much additional long-term debt (compared to 2021) will be required under this assumption? C- Return now to the original assumptions (sales growth =12%,COGS=39%, inventory =5%, AR=13% ) and extend your projections in part (b) through 2026. Continue to assume that all external funding needs will be met with debt at 10% interest. What is your projected value for long-term debt in 2026? AQUATIC SUPPLIES CO. INCOME STATEMENT (\$ millions) 2021 Assumptions Sales growth in sales Cost of Goods Sold Gross Profit $582.762240.828341.934 percentage of sales Selling, General, \& Administrative Expense Operating Income Depreciation \& Amortization percentage of net PP\&E Operating Profit 257.50784.42725.22159.206 percentage of sales Interest Expense 16.430 constant Pretax Income Total Income Taxes 35% percentage of pretax income Net income BALANCE SHEET (S millions) ASSETS Cash \& Equivalents Account Receivable percentage of sales Inventories $7.15270.53839.0332%13%5% minimum balance as % of sale: percentage of sales Prepaid Expenses no change Other Current Assets percentage of sales Total Current Assets Net Property, Plant, \& Equipment percentage of sales Intangible Assets Other Assets TOTAL ASSETS LIABILITIES Accounts Payable percentage of sales Accrued Expenses percentage of sales Other Current Liabilitics Total Current Liabilities Long Term Debt Accrued Wages Total Liabilities \begin{tabular}{rr} $36.951 & 6% \\ 31.206 & 5% \\ 3.663 & no change \\ \hline 71.820 & \\ 157.720 & initially constant \\ 21.418 & 3% \\ \hline 250.958 & \end{tabular} percentage of sales EQUITY Common Stock Capital Surplus Retained Eamings Less: Treasury Stock Total Equity TOTAL LIABILITIES \& EQUITY $268.84317.885