Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve completely and correctly all questions thanks HCorp receny ied eftrey Hs mmediate mandate was to analyre the company He hs to s.bmts repert

please solve completely and correctly all questions thanks

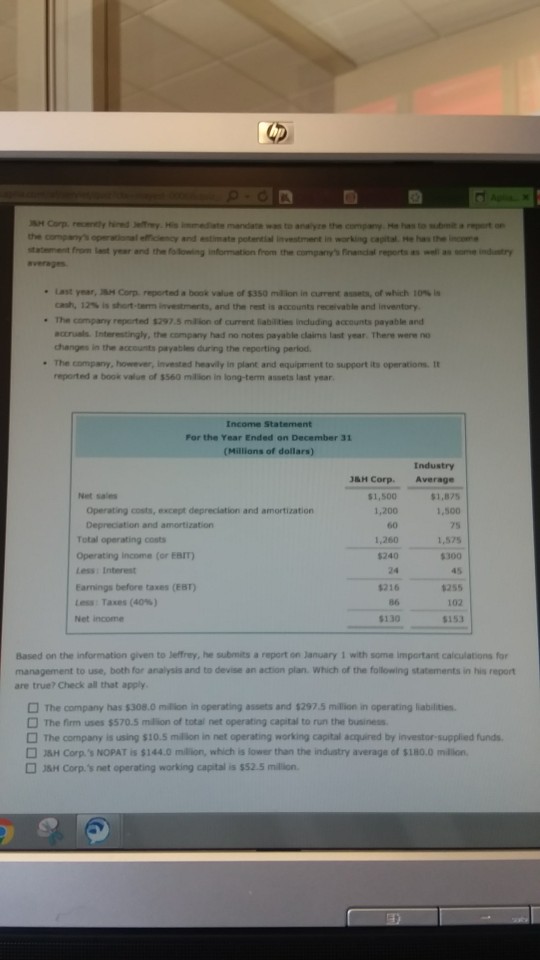

HCorp receny ied eftrey Hs mmediate mandate was to analyre the company He hs to s.bmts repert on tatement from lest year and the folowing information from the company's nanial reports as wel as some indstry r, aH Corp. r_ed a book-of$350 mlkr, in carret assets, at which 10% Last cet, 12% is start-terminvestments, and thn * is aaounts receivable and inventory " The campany reperted $297.5 milion of current liabilities induding accounts payable and accruals. Interestingly, the company had no notes payable claims last year There were no changes in the accounits payables during the reperting perlod. The company, however, invested heavily in plant and equipment to support its operations. It reported a book valus of $560 milion in long-term assets last year Income Statement For the Year Ended on December 31 (Millions of dollars) Industry &H Corp. Average Net sales $1,500 1,200 60 1,260 $240 24 $216 86 $130 $1.875 1,500 75 1,575 $300 45 $255 102 $153 Operating costs, except depreciation and amortizatiorn Total operating costs Operating income (or EBIT) Less: Interest Earnings before taxes (EBT) Lmis Taxes (40%) Net income Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply The crpany has S308.0 mlin it operating assets and $297.5 malon in operating iabilites. The firm uses S570.5 mlin of tot= net operating capital to run the business. The company is using $10.5 millon in net operating working capital amred by investor-supplied funds J&H Corp.'s NOPAT is $144.0 milion, which is lower than the industry average of $110.0 milion. J&H Corp.'s net operating working capital is $52.5 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started