Answered step by step

Verified Expert Solution

Question

1 Approved Answer

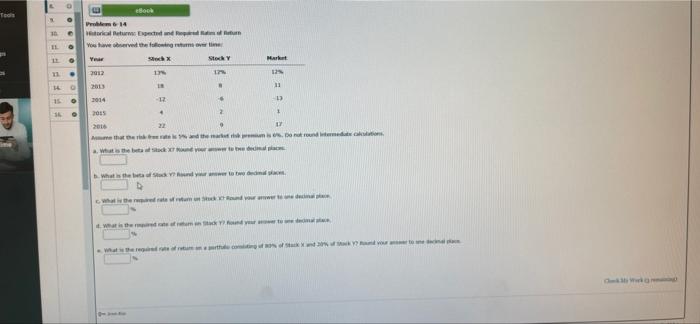

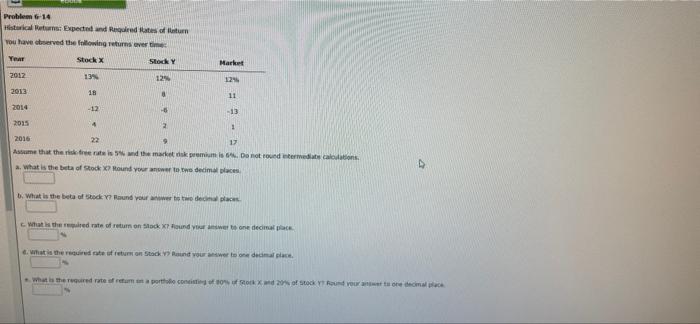

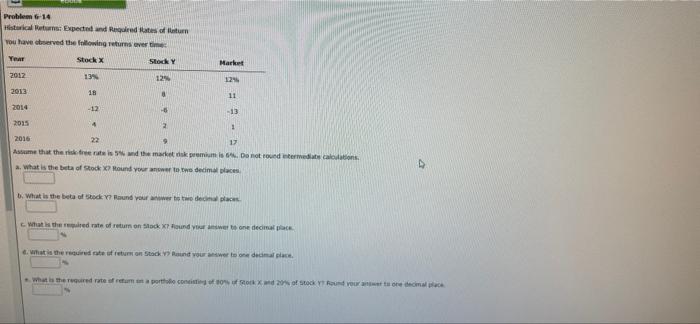

please solve? does this work? clearer image! Tools N 0 100 IL 11. 9 11. . 14 O 15 O 16 eBook Problem 6-14 Historical

please solve?

does this work?

clearer image!

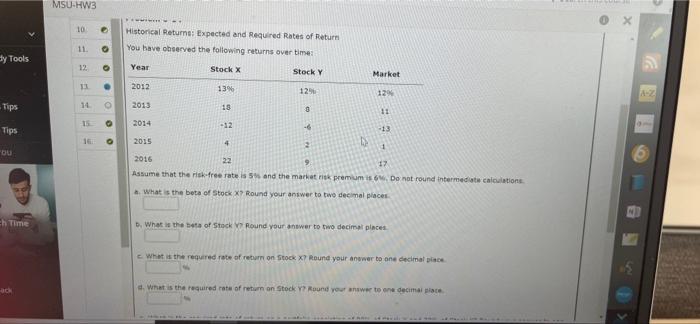

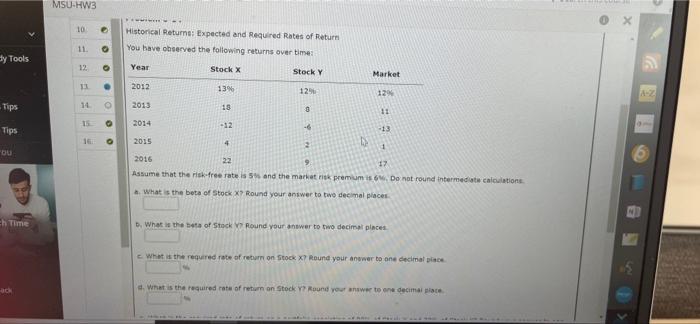

Tools N 0 100 IL 11. 9 11. . 14 O 15 O 16 eBook Problem 6-14 Historical Returns: Expected and Repaal of You have observed the following return overline Year Stock X Stock Y 2012 17% 17% 2013 18 . 2014 -12 * 13 2015 4 1 2016 22 17 Asume that the risk rate is 1% and the market risk premium is . Do not round intermedate calculations e beta af stack X7 Round your answer to the decimal places What is the beta of Stock Round your answer to two decimal pla decal What is I rate of retum un Stock Round your awer to de Stack Yound your ar to What thule contin 80% of Stack and 20% of Stack Y? required rate of retur Market 12% 11 al CM Wik Problem 6-14 Historical Returns: Expected and Required Rates of Return You have observed the following returns over time: Year Stock X Stock Y Market 2012 13% 12% 12% 2013 18 11 -13 2014 -12 2015 4 1 2016 22 17 Assume that the risk-free rate is 5% and the market disk premium is 6. Do not round intermediate calculations. a. what is the beta of Stock X? Round your answer to two decimal places b. What is the beta of Stock Y7 Round your answer to two decimal places c. What is the required rate of return on Stock X7 Round your answer to one decimal place 4. What is the required rate of return on Stock 17 Round your answer to one decimal place. What is the required rate of retum on a portfolo consisting of 80% of Stock x and 20% of stock Y7 Round your answer to ore decimal place dy Tools - Tips Tips "Du Ch Time ack MSU-HW3 1-4 10 Historical Returns: Expected and Required Rates of Return 11. O You have observed the following returns over time: 12 Year Stock X Stock Y Market 13 2012 13% 12% 12% 14. O 2013 18 8 11 15 2014 -12 -6 -13 16 2015 4 2 D 4 2016 22 17 Assume that the risk-free rate is 5% and the market risk premium is 6%. Do not round intermediate calculations a. What is the beta of Stock X? Round your answer to two decimal places. b. What is the beta of Stock V7 Round your answer to two decimal places c. What is the required rate of return on Stock x? Round your answer to one decimal place d. What is the required rate of return on Stock Y? Round your answer to one decimal place O . 0 O A-Z

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started