Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve everything Vermillion Limited has a total of 200,000 common shares issued. On October 3, 2020, CT inc purchased a bleck of thete shares

Please solve everything

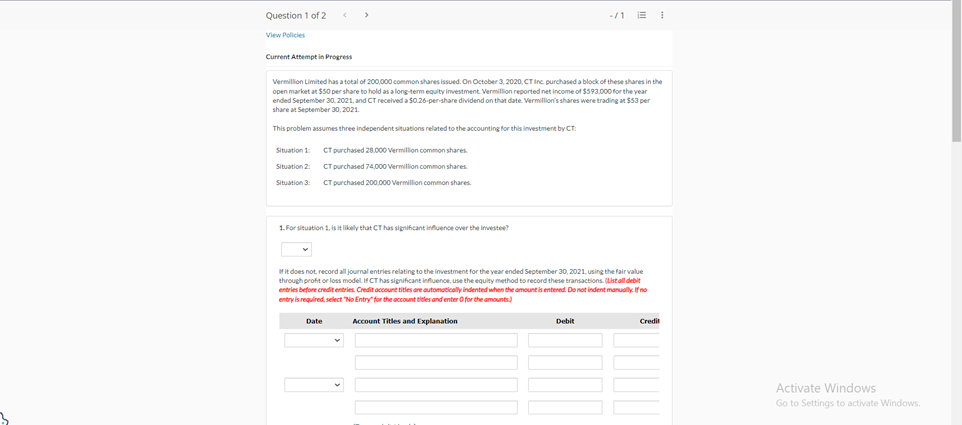

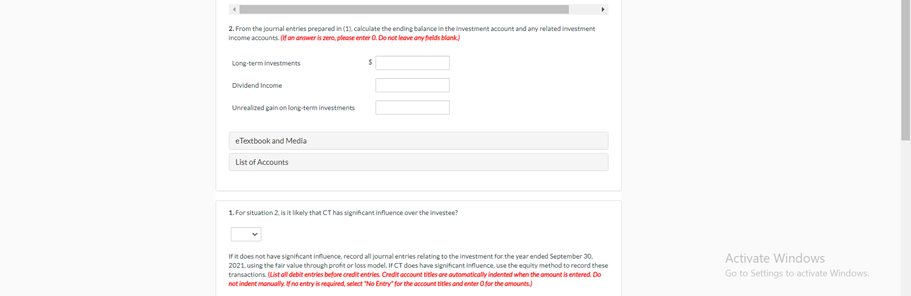

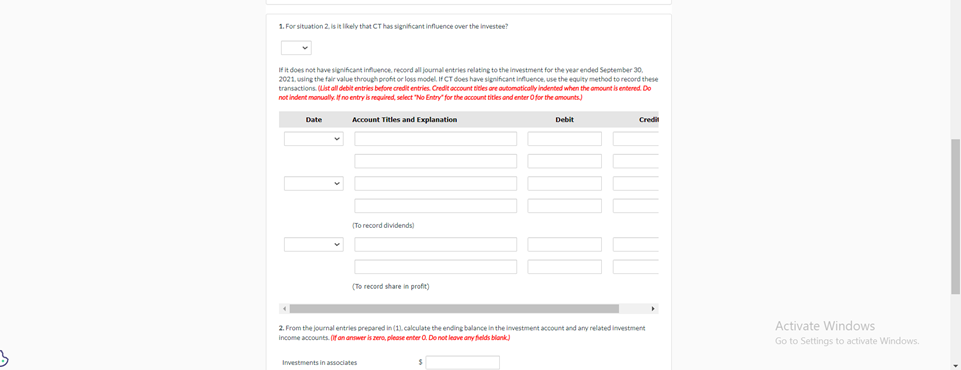

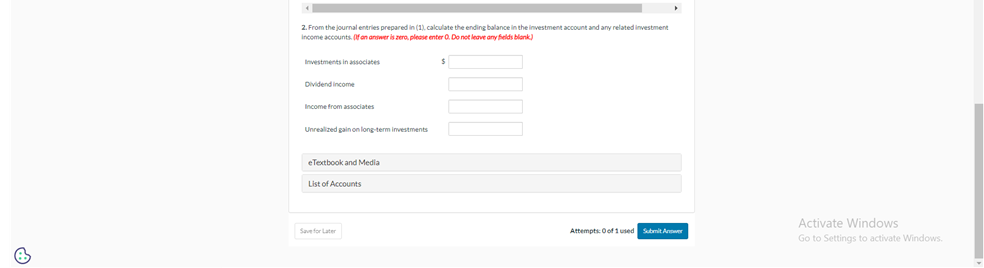

Vermillion Limited has a total of 200,000 common shares issued. On October 3, 2020, CT inc purchased a bleck of thete shares in the open market at 550 per share to hold as a long-term equity investment. Vermillion reported net income of 5593,000 kor the year ended September 30,2021 , and CT recehed a 50.26 -perighare dividend on that dote. Vermillion's shares were trading at $53 per share at September 30,2021 . This problem assumes three independent situations related to the accounting for this investmenk byCT: Situation 1: CT perchased 28,000 Vermillion common shares Situation 2. CT purchaded 74 , 000 Vermillion common shares. 5ituation 3: CT purchated 200.000 Vermillion common shares. 1. For 1ituation 1 , is it likely that CT has significant influence over the imvertet? w it does not, record all journal entries relating to the investment for the year ended Sepeember 30, 2021, using the fair value through probt or loss model if CT has significant influence, use the equity method to record the-te transactions. (lat all debit entries befort credit entries. Credit account bites are outomoticaly indented when the amount is enterted. Do not indent manudly. If no entry is required, select "Wo Entry" for the occount eleles ond enter O for the mounts) 2. From the journal entries pregared in (1) calculate the ending bulance in the investment account and any related investment 1. For situation 2 , is it liely that CT has ilignificant influence ower the investee? If it does not have significant infuence, recond all journal entries relating to the investment for the year ended september a0. 2021. using the fair value through protit or loss model. If CT does have significant influence, use the equity method to record these trandactions. (list all debit entries before aredit entries. Credit account biles ore outomotically indented when the amount is entered. Do not indent monually. H no entry is kequired, select "No Entry' for the acceune titles and enter Ofor the amounts) 1. For aituation 2 is it ikely that CT has significant influence over the investee? If it does noe have ignificant infloence, record all joumal entries relating to the investment for the year ended September 30 . 2021. wing the far value through profit or loss model. If CT does have significant influence. uje the equity method to record theie transactions. Wat all debit entries before credit entries Crediteccount bibes are asbomatically indented when the amount is entered Do not indent monually. If no entry is requlred, select 'No Entry' for the ocoount billes end enter 0 for the amounts.) 1 2. From the joumal entries prepared in (11. calculate the ending balance in the investment account and ary related investment income wecounts. (if as anner is aere, plesue enter Q. De not leave any felds blank) 2. From the journal entries prepared in (1) calculate the ending bolance in the investment account and any related investment

Vermillion Limited has a total of 200,000 common shares issued. On October 3, 2020, CT inc purchased a bleck of thete shares in the open market at 550 per share to hold as a long-term equity investment. Vermillion reported net income of 5593,000 kor the year ended September 30,2021 , and CT recehed a 50.26 -perighare dividend on that dote. Vermillion's shares were trading at $53 per share at September 30,2021 . This problem assumes three independent situations related to the accounting for this investmenk byCT: Situation 1: CT perchased 28,000 Vermillion common shares Situation 2. CT purchaded 74 , 000 Vermillion common shares. 5ituation 3: CT purchated 200.000 Vermillion common shares. 1. For 1ituation 1 , is it likely that CT has significant influence over the imvertet? w it does not, record all journal entries relating to the investment for the year ended Sepeember 30, 2021, using the fair value through probt or loss model if CT has significant influence, use the equity method to record the-te transactions. (lat all debit entries befort credit entries. Credit account bites are outomoticaly indented when the amount is enterted. Do not indent manudly. If no entry is required, select "Wo Entry" for the occount eleles ond enter O for the mounts) 2. From the journal entries pregared in (1) calculate the ending bulance in the investment account and any related investment 1. For situation 2 , is it liely that CT has ilignificant influence ower the investee? If it does not have significant infuence, recond all journal entries relating to the investment for the year ended september a0. 2021. using the fair value through protit or loss model. If CT does have significant influence, use the equity method to record these trandactions. (list all debit entries before aredit entries. Credit account biles ore outomotically indented when the amount is entered. Do not indent monually. H no entry is kequired, select "No Entry' for the acceune titles and enter Ofor the amounts) 1. For aituation 2 is it ikely that CT has significant influence over the investee? If it does noe have ignificant infloence, record all joumal entries relating to the investment for the year ended September 30 . 2021. wing the far value through profit or loss model. If CT does have significant influence. uje the equity method to record theie transactions. Wat all debit entries before credit entries Crediteccount bibes are asbomatically indented when the amount is entered Do not indent monually. If no entry is requlred, select 'No Entry' for the ocoount billes end enter 0 for the amounts.) 1 2. From the joumal entries prepared in (11. calculate the ending balance in the investment account and ary related investment income wecounts. (if as anner is aere, plesue enter Q. De not leave any felds blank) 2. From the journal entries prepared in (1) calculate the ending bolance in the investment account and any related investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started