Answered step by step

Verified Expert Solution

Question

1 Approved Answer

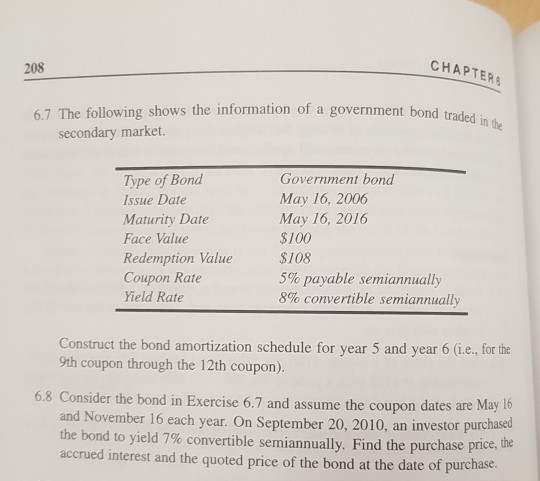

Please solve Exercise 6.8 by hand, without using a finance calculator or Excel. Thank you. 6.7 The following shows the information of a government bond

Please solve Exercise 6.8 by hand, without using a finance calculator or Excel. Thank you.

6.7 The following shows the information of a government bond traded in the 208 secondary market. CHAPTERS Type of Bond Issue Date Maturity Date Face Value Redemption Value Coupon Rate Yield Rate Government bond May 16, 2006 May 16, 2016 $100 $108 5% payable semiannually 8% convertible semiannually Construct the bond amortization schedule for year 5 and year 6 (i.e., for the 9th coupon through the 12th coupon). 6.8 Consider the bond in Exercise 6.7 and assume the coupon dates are May 16 and November 16 each year. On September 20, 2010, an investor purchased the bond to yield 7% convertible semiannually. Find the purchase price, the accrued interest and the quoted price of the bond at the date of purchaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started