Answered step by step

Verified Expert Solution

Question

1 Approved Answer

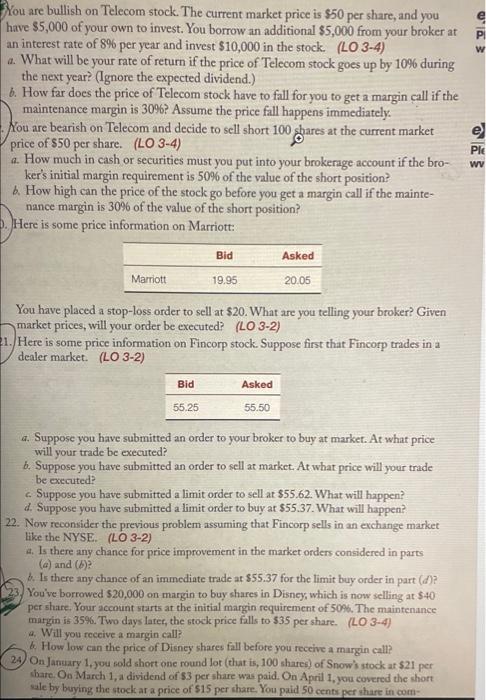

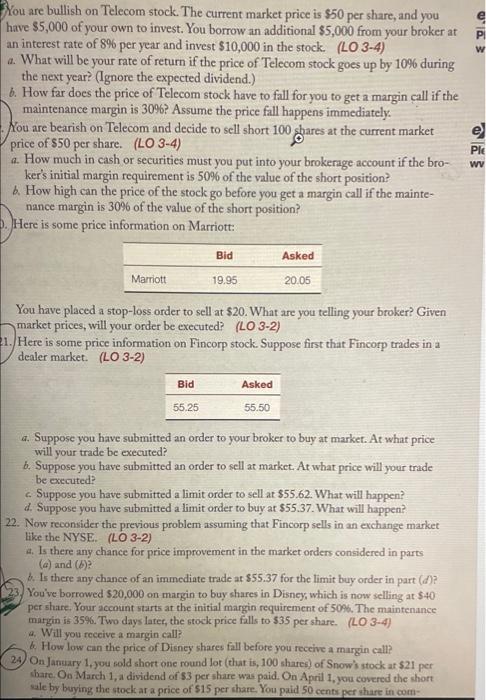

please solve first 2 problema and #23. will upvote show work. thank you. 103 w You are bullish on Telecom stock. The current market price

please solve first 2 problema and #23. will upvote show work. thank you.

103 w You are bullish on Telecom stock. The current market price is $50 per share, and you have $5,000 of your own to invest. You borrow an additional $5,000 from your broker at an interest rate of 8% per year and invest $10,000 in the stock. (LO 3-4) a. What will be your rate of return if the price of Telecom stock goes up by 10% during the next year? (Ignore the expected dividend.) 6. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 3096? Assume the price fall happens immediately. You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. (LO 3-4) a. How much in cash or securities must you put into your brokerage account if the bro- ker's initial margin requirement is 50% of the value of the short position? How high can the price of the stock go before you get a margin call if the mainte- nance margin is 30% of the value of the short position? . Here is some price information on Marriott: Ple wy Bid Asked 19.95 Marriott 20.05 You have placed a stop-loss order to sell at $20. What are you telling your broker? Given market prices, will your order be executed? (LO 3-2) 21. Here is some price information on Fincorp stock. Suppose first that Fincorp trades in a dealer market. (LO 3-2) Bid Asked 55.25 55.50 4. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed Suppose you have submitted a limit order to sell at $55.62. What will happen? d. Suppose you have submitted a limit order to buy at $55.37. What will happen? 22. Now reconsider the previous problem assuming that Fincorp sells in an exchange market like the NYSE. (LO 3-2) 4. Is there any chance for price improvement in the market orders considered in parts (a) and (5) . Is there any chance of an immediate trade at $55.37 for the limit buy order in part (d)? You've borrowed $20,000 on margin to buy shares in Disney, which is now selling at $40 per share. Your account starts at the initial margin requirement of 50%. The maintenance margin is 35%. Two days later, the stock price falls to $35 per share. (LO 3-4) 4. Will you receive a margin call? & How low can the price of Disney shares fall before you receive a margin call? 24 On January 1, you sold short one round lot (that is, 100 shares) of Snow's stock at $21 per share. On March 1, a dividend of $3 per share was paid. On April 1, you covered the short sale by buying the stock at a price of $15 per share. You paid 50 cents per share in com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started