Answered step by step

Verified Expert Solution

Question

1 Approved Answer

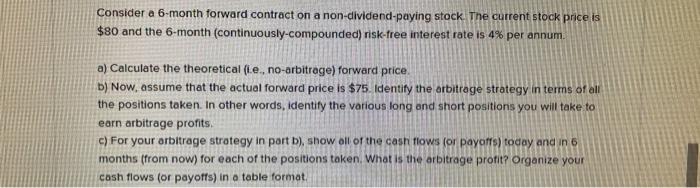

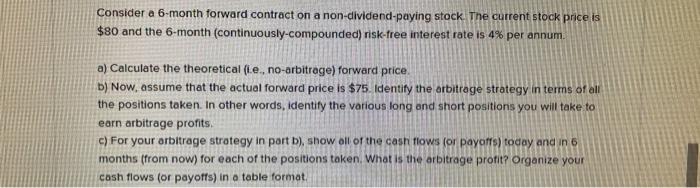

Please solve for A, B, and C. Please explain your reasoning. Please show your work. Consider a 6-month forward contract on a non-dividend-paying stock. The

Please solve for A, B, and C.

Consider a 6-month forward contract on a non-dividend-paying stock. The current stock price is $80 and the 6-month (continuously-compounded) risk-free interest rate is 4% per annum. a) Calculate the theoretical fi.e., no-arbitrage) forward price. b) Now, assume that the actual forward price is $75. Identify the arbitrage strategy in terms of all the positions taken. In other words, identify the various long and short positions you will take to earn arbitrage profits. c)For your arbitrage strategy in portb), show all of the cash flows for payoffs) today and in 6 months (from now) for each of the positions taken. What is the arbitrage profit? Organize your cash flows (or payoffs) in a table format Please explain your reasoning.

Please show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started