Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve for me. 1. EXPANSION DECISION Boudreaux Chemical Corp. (BCC) is considering building a new plant to market a new product, GaseXtension. This new

please solve for me.

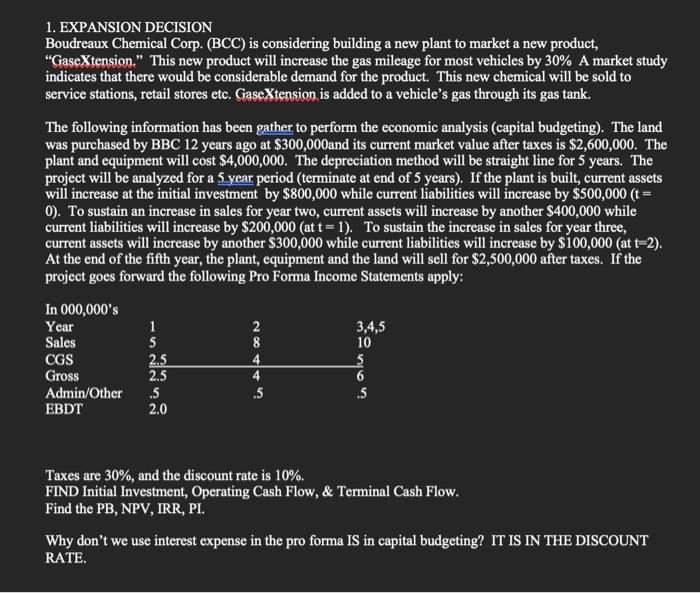

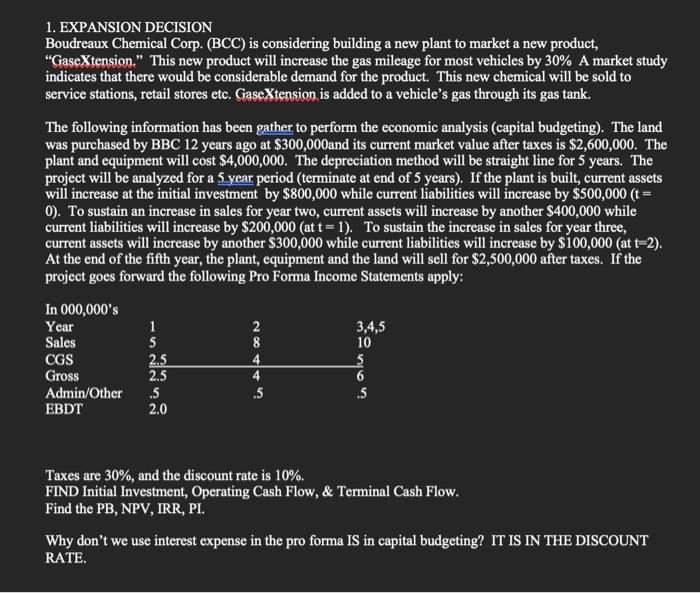

1. EXPANSION DECISION Boudreaux Chemical Corp. (BCC) is considering building a new plant to market a new product, "GaseXtension." This new product will increase the gas mileage for most vehicles by 30% A market study indicates that there would be considerable demand for the product. This new chemical will be sold to service stations, retail stores etc. GaseXtension is added to a vehicle's gas through its gas tank. The following information has been gather to perform the economic analysis (capital budgeting). The land was purchased by BBC 12 years ago at $300,000and its current market value after taxes is $2,600,000. The plant and equipment will cost $4,000,000. The depreciation method will be straight line for 5 years. The project will be analyzed for a 5 year period (terminate at end of 5 years). If the plant is built, current assets will increase at the initial investment by $800,000 while current liabilities will increase by $500,000 (t = 0). To sustain an increase in sales for year two, current assets will increase by another $400,000 while current liabilities will increase by $200,000 (at t= 1). To sustain the increase in sales for year three, current assets will increase by another $300,000 while current liabilities will increase by $100,000 (at t=2). At the end of the fifth year, the plant, equipment and the land will sell for $2,500,000 after taxes. If the project goes forward the following Pro Forma Income Statements apply: In 000,000's Year 1 3,4,5 Sales 5 10 CGS 2.5 Gross 2.5 6 .5 .5 Admin/Other .5 EBDT 2.0 Taxes are 30%, and the discount rate is 10%. FIND Initial Investment, Operating Cash Flow, & Terminal Cash Flow. Find the PB, NPV, IRR, PI. Why don't we use interest expense in the pro forma IS in capital budgeting? IT IS IN THE DISCOUNT RATE. 24444 8 1. EXPANSION DECISION Boudreaux Chemical Corp. (BCC) is considering building a new plant to market a new product, "GaseXtension." This new product will increase the gas mileage for most vehicles by 30% A market study indicates that there would be considerable demand for the product. This new chemical will be sold to service stations, retail stores etc. GaseXtension is added to a vehicle's gas through its gas tank. The following information has been gather to perform the economic analysis (capital budgeting). The land was purchased by BBC 12 years ago at $300,000and its current market value after taxes is $2,600,000. The plant and equipment will cost $4,000,000. The depreciation method will be straight line for 5 years. The project will be analyzed for a 5 year period (terminate at end of 5 years). If the plant is built, current assets will increase at the initial investment by $800,000 while current liabilities will increase by $500,000 (t = 0). To sustain an increase in sales for year two, current assets will increase by another $400,000 while current liabilities will increase by $200,000 (at t= 1). To sustain the increase in sales for year three, current assets will increase by another $300,000 while current liabilities will increase by $100,000 (at t=2). At the end of the fifth year, the plant, equipment and the land will sell for $2,500,000 after taxes. If the project goes forward the following Pro Forma Income Statements apply: In 000,000's Year 1 3,4,5 Sales 5 10 CGS 2.5 Gross 2.5 6 .5 .5 Admin/Other .5 EBDT 2.0 Taxes are 30%, and the discount rate is 10%. FIND Initial Investment, Operating Cash Flow, & Terminal Cash Flow. Find the PB, NPV, IRR, PI. Why don't we use interest expense in the pro forma IS in capital budgeting? IT IS IN THE DISCOUNT RATE. 24444 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started