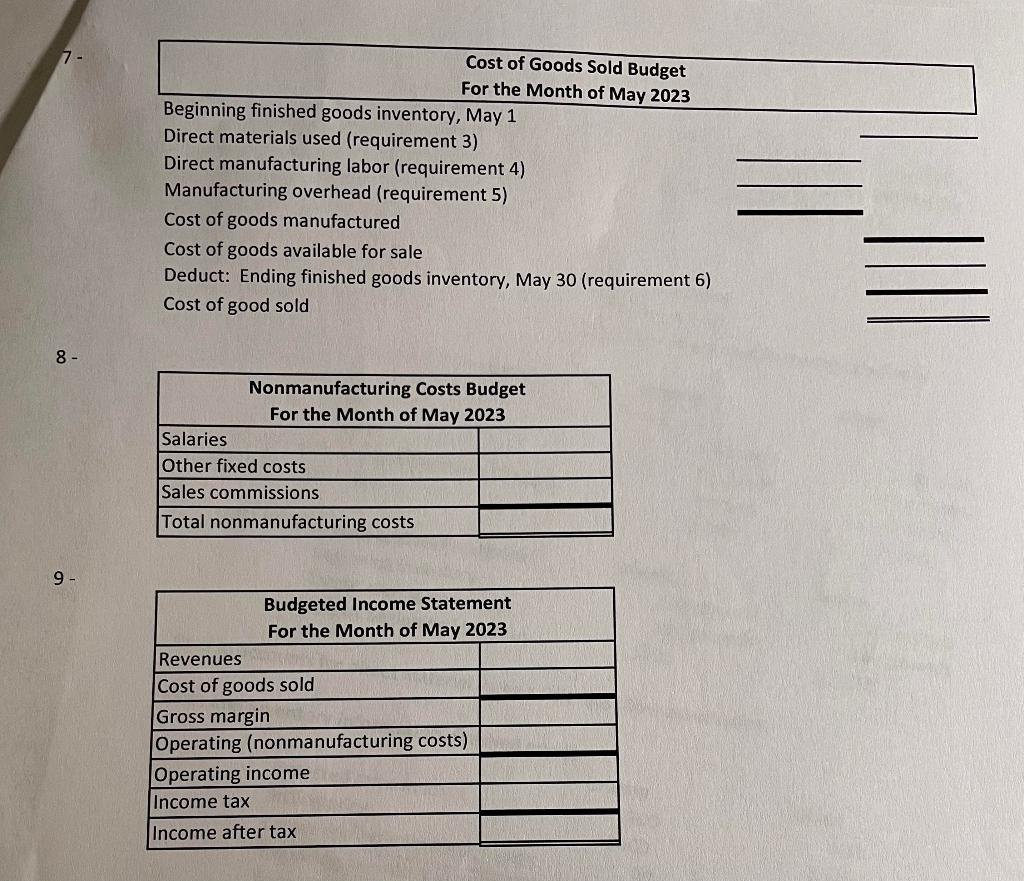

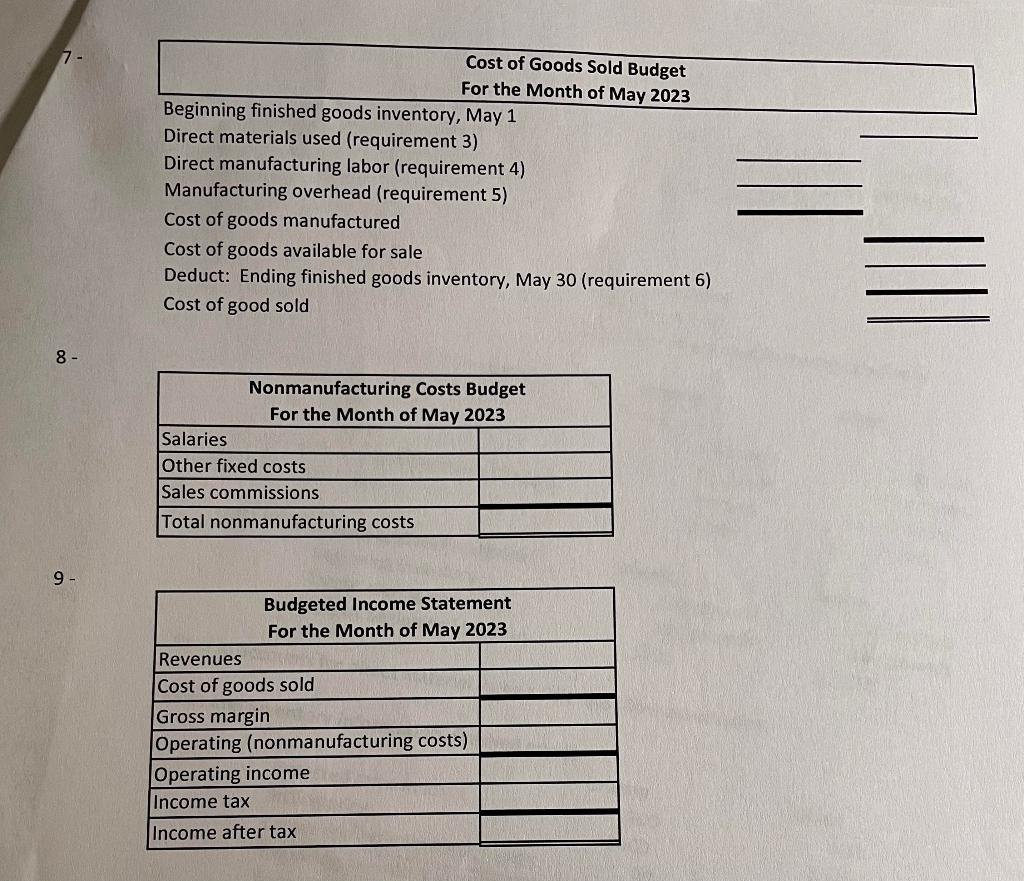

Please solve for numbers 7, 8, & 9 (the first image) the second two images are the information needed to solve. Thank you.

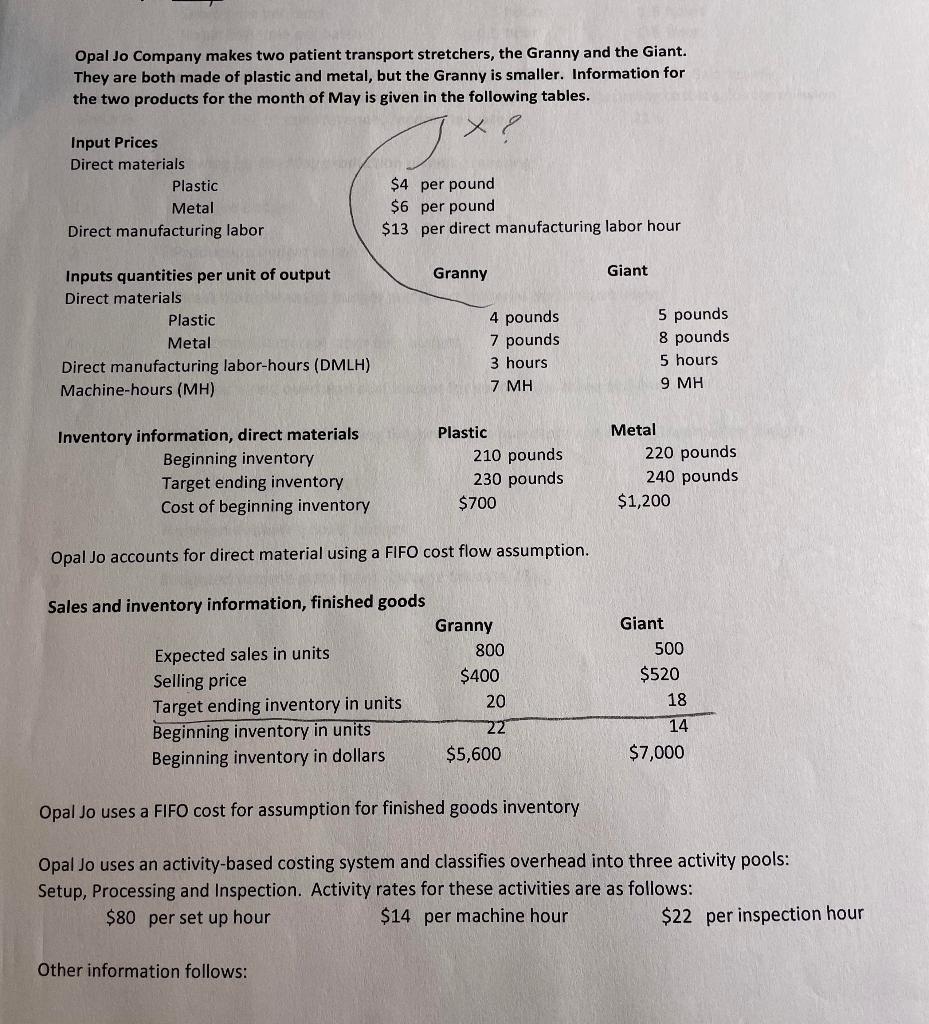

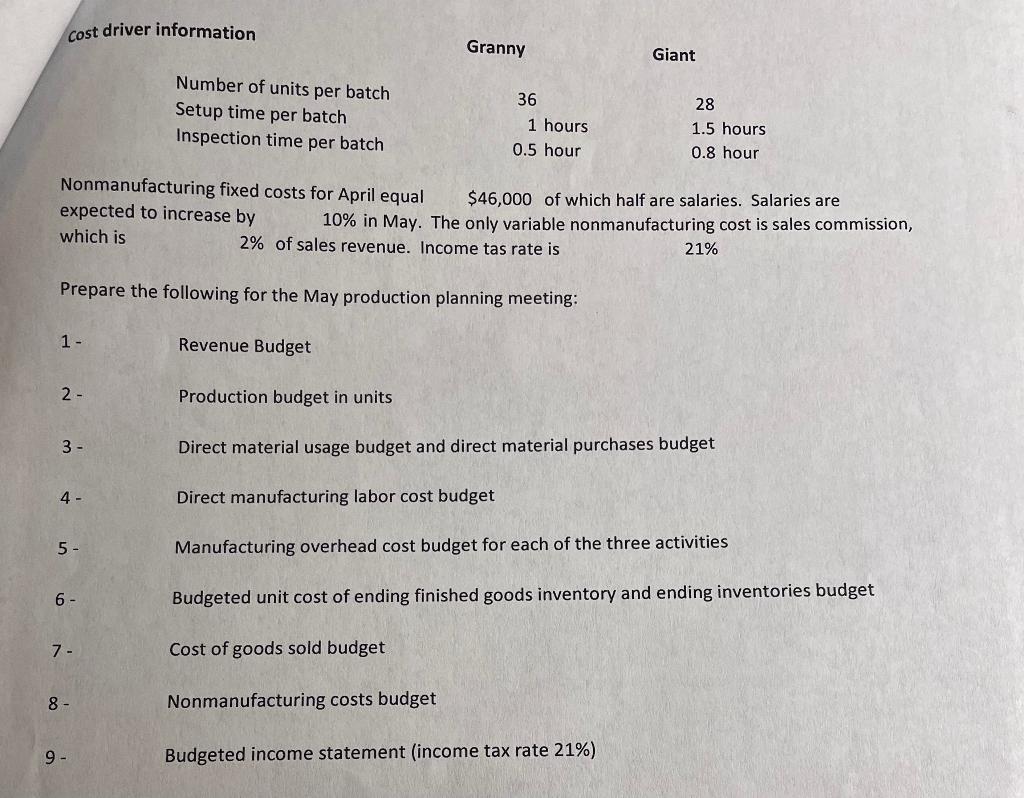

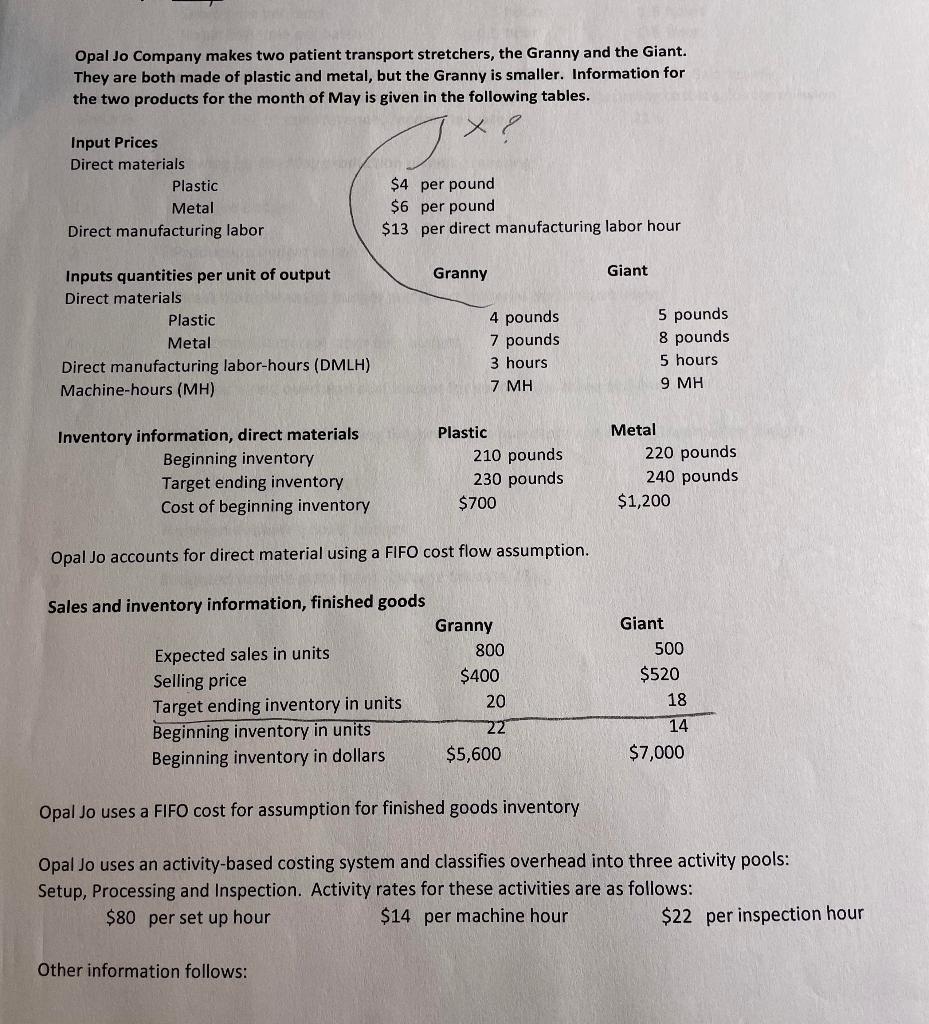

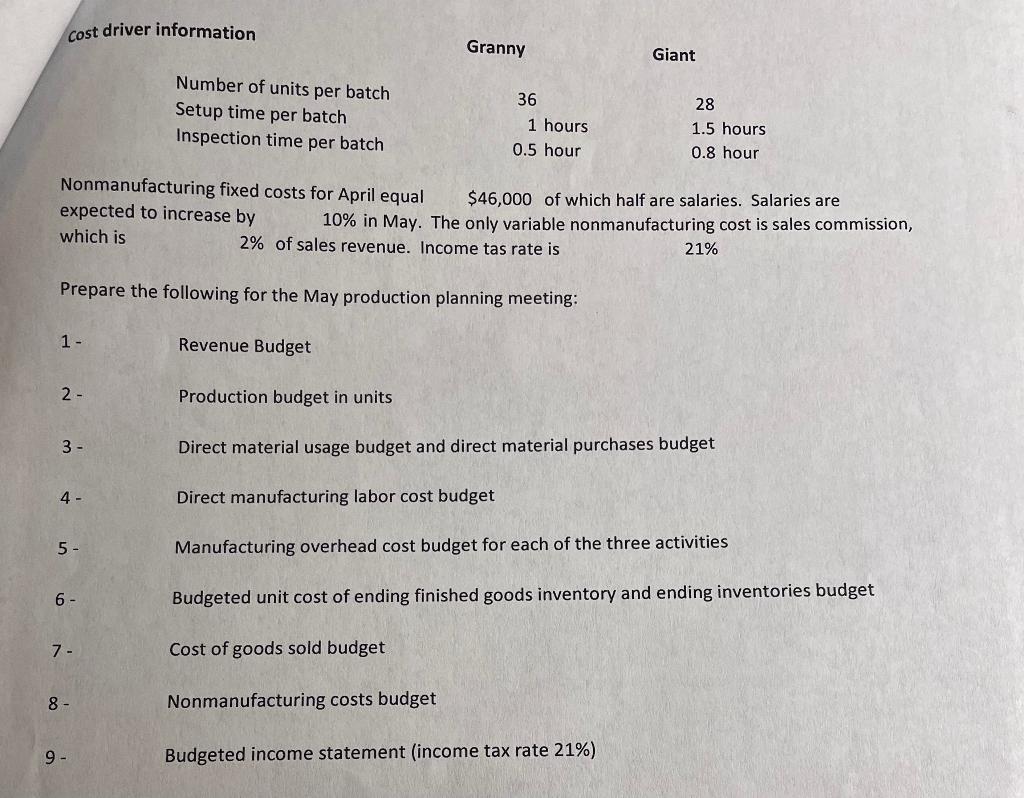

7 Cost of Goods Sold Budget For the Month of May 2023 Beginning finished goods inventory, May 1 Direct materials used (requirement 3) Direct manufacturing labor (requirement 4) Manufacturing overhead (requirement 5) Cost of goods manufactured Cost of goods available for sale Deduct: Ending finished goods inventory, May 30 (requirement 6) Cost of good sold 8 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{\begin{tabular}{|} Nonmanufacturing Costs Budget \\ For the Month of May 2023 \end{tabular}} \\ \hline Salaries & \\ \hline Other fixed costs & \\ \hline Sales commissions & \\ \hline Total nonmanufacturing costs & \\ \hline \end{tabular} 9 \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{\begin{tabular}{|} Budgeted Income Statement \\ For the Month of May 2023 \end{tabular}} \\ \hline Revenues & \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Operating (nonmanufacturing costs) & \\ \hline Operating income & \\ \hline Income tax & \\ \hline Income after tax & \\ \hline \end{tabular} Opal Jo Company makes two patient transport stretchers, the Granny and the Giant. They are both made of plastic and metal, but the Granny is smaller. Information for the two products for the month of May is given in the following tables. Inventory Opal Jo accounts for direct material using a FIFO cost flow assumption. Sales and in mantam infarmation finished goods Opal Jo uses a FIFO cost for assumption for finished goods inventory Opal Jo uses an activity-based costing system and classifies overhead into three activity pools: Setup, Processing and Inspection. Activity rates for these activities are as follows: $80 per set up hour $14 per machine hour $22 per inspection hour Other information follows: Nonmanufacturing fixed costs for April equal $46,000 of which half are salaries. Salaries are expected to increase by 10% in May. The only variable nonmanufacturing cost is sales commission, which is 2% of sales revenue. Income tas rate is 21% Prepare the following for the May production planning meeting: 1 Revenue Budget 2 Production budget in units 3 Direct material usage budget and direct material purchases budget 4 Direct manufacturing labor cost budget 5 Manufacturing overhead cost budget for each of the three activities 6 Budgeted unit cost of ending finished goods inventory and ending inventories budget 7. Cost of goods sold budget 8 Nonmanufacturing costs budget 9 Budgeted income statement (income tax rate 21% ) 7 Cost of Goods Sold Budget For the Month of May 2023 Beginning finished goods inventory, May 1 Direct materials used (requirement 3) Direct manufacturing labor (requirement 4) Manufacturing overhead (requirement 5) Cost of goods manufactured Cost of goods available for sale Deduct: Ending finished goods inventory, May 30 (requirement 6) Cost of good sold 8 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{\begin{tabular}{|} Nonmanufacturing Costs Budget \\ For the Month of May 2023 \end{tabular}} \\ \hline Salaries & \\ \hline Other fixed costs & \\ \hline Sales commissions & \\ \hline Total nonmanufacturing costs & \\ \hline \end{tabular} 9 \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{\begin{tabular}{|} Budgeted Income Statement \\ For the Month of May 2023 \end{tabular}} \\ \hline Revenues & \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Operating (nonmanufacturing costs) & \\ \hline Operating income & \\ \hline Income tax & \\ \hline Income after tax & \\ \hline \end{tabular} Opal Jo Company makes two patient transport stretchers, the Granny and the Giant. They are both made of plastic and metal, but the Granny is smaller. Information for the two products for the month of May is given in the following tables. Inventory Opal Jo accounts for direct material using a FIFO cost flow assumption. Sales and in mantam infarmation finished goods Opal Jo uses a FIFO cost for assumption for finished goods inventory Opal Jo uses an activity-based costing system and classifies overhead into three activity pools: Setup, Processing and Inspection. Activity rates for these activities are as follows: $80 per set up hour $14 per machine hour $22 per inspection hour Other information follows: Nonmanufacturing fixed costs for April equal $46,000 of which half are salaries. Salaries are expected to increase by 10% in May. The only variable nonmanufacturing cost is sales commission, which is 2% of sales revenue. Income tas rate is 21% Prepare the following for the May production planning meeting: 1 Revenue Budget 2 Production budget in units 3 Direct material usage budget and direct material purchases budget 4 Direct manufacturing labor cost budget 5 Manufacturing overhead cost budget for each of the three activities 6 Budgeted unit cost of ending finished goods inventory and ending inventories budget 7. Cost of goods sold budget 8 Nonmanufacturing costs budget 9 Budgeted income statement (income tax rate 21% )